Marginal Costing is a management technique of dealing with cost data. It is based primarily on the behavioural study of cost. Marginal costing provides this vital information to management and it helps in the discharge of its functions like c6st control, profit planning, performance evaluation and decision-making.

Marginal costing plays its key role in decision making. It is a technique which provides presentation of cost data in such a way that true cost-volume-profit relationship is revealed. Under this technique, it is presumed that costs can be divided in two categories, i.e. fixed cost and variable cost. Fixed cost is charged to contribution of the period in which it is incurred and is considered period cost.

Marginal Costing is “a principle whereby marginal cost of cost units are ascertained. Only variable costs are charged to cost units, the fixed costs attributable to a relevant period being written off in full against the contribution for that period.” (CIMA definition).

Learn about:-

ADVERTISEMENTS:

1. Introduction to Marginal Costing 2. Definitions of Marginal Costing 3. Features 4. Process 5. Determination of Marginal Cost 6. Marginal Costing and Decision-Making 7. Advantages 8. Limitations.

Marginal Costing: Introduction, Definitions, Features, Applications, Process, Advantages, Determination and Limitations

Contents:

- Introduction to Marginal Costing

- Definitions of Marginal Costing

- Features of Marginal Costing

- Process of Marginal Costing

- Determination of Marginal Cost

- Marginal Costing and Decision-Making

- Advantages of Marginal Costing

- Limitations of Marginal Costing

Marginal Costing – Introduction

Even a school-going student knows that profit is a balancing figure of sales over costs, i.e., Sales – Cost = Profit. This knowledge is not sufficient for management for discharging the functions of planning and control, etc. The cost is further divided according to its behaviour, i.e., fixed cost and variable cost.

The age-old equation can be written as:

ADVERTISEMENTS:

Sales – Cost = Profit or

Sales – (Fixed cost + Variable Cost) = Profit.

The relevance of segregating costs according to variability can be understood by a very simple example of a shoe-maker, whose cost data for a particular period is given below:

(a) Rent of shop is Rs.1200 for the period under consideration,

ADVERTISEMENTS:

(b) Selling price per pair is Rs.55.

(c) Input material required for making one pair is Rs.50.

(d) He is producing 1000 pairs during period under consideration.

In this data, only two types of costs are mentioned — rent of shop and cost of input materials. The rent of shop will not change, if he produces more than 1,000 pairs or less than 1,000 pairs. This cost is, therefore, referred to as fixed cost. The cost of input material will change according to the number of pairs produced. This is variable cost. Thus, both the costs do not have the same behaviour.

ADVERTISEMENTS:

This knowledge about the changes in behaviour of costs can yield wonderful results for the shoe-maker in decision-making. Based on these changes in behaviour of costs, a very effective cost accounting technique emerges. It is known as marginal costing. Marginal Costing is a management technique of dealing with cost data. It is based primarily on the behavioural study of cost.

Absorption costing i.e., the costing technique, which does not recognise the difference between fixed costs and variable costs does not adequately cater to the needs of management. The statements prepared under absorption costing do elaborately explain past profit, past losses and the costs incurred in past, but these statements do not help when it comes to predict about tomorrow’s result. A conventional income statement cannot tell what the profit or loss will be, if the volume is increased or decreased.

These days, there is a cut-throat competition in market and management has got to know its cost structure thoroughly. Marginal costing provides this vital information to management and it helps in the discharge of its functions like c6st control, profit planning, performance evaluation and decision-making. Marginal costing plays its key role in decision making.

Marginal Costing – Definitions: Given by CIMA

CIMA defines marginal costing as “the cost of one unit of product or service which would be avoided if that unit were not produced or provided”.

ADVERTISEMENTS:

CIMA defines marginal costing as “the accounting system in which variable cost arc charged to the cost units and fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision-making.” Marginal costing is not a distinct method of costing like job costing or process costing.

It is a technique which provides presentation of cost data in such a way that true cost-volume-profit relationship is revealed. Under this technique, it is presumed that costs can be divided in two categories, i.e. fixed cost and variable cost. Fixed cost is charged to contribution of the period in which it is incurred and is considered period cost.

Certain readers vainly try to find out difference between marginal costing and direct costing. In accounting literature marginal costing and direct costing are basically one and the same thing. Actually, what has been called direct costing in the United States has been referred to as marginal costing in Great Britain.

Still certain authors hold the view that there is a difference between these two terms. Contributing costing and variable costing are other synonyms of marginal costing. The terms differential costing and incremental costing are somewhat like marginal costing. These have been taken up in detail separately in the discussion ahead.

ADVERTISEMENTS:

Marginal Costing is “a principle whereby marginal cost of cost units are ascertained. Only variable costs are charged to cost units, the fixed costs attributable to a relevant period being written off in full against the contribution for that period.” (CIMA definition).

Fixed cost is also called time cost and period cost. It is a fixed amount irrespective of the level of capacity achieved. In the marginal costing technique, profit is measured by contribution less fixed overheads which include the fixed portion of semi-variable overheads also.

Semi-variable overheads are segregated and the variable portion is added to the variable overheads and fixed amount is added to the fixed overheads. Variable costs vary directly with output and cost per unit is the same. This is a linear relationship. Fixed costs remain the same regardless of the level of output and vary only with time.

Marginal Costing – 17 Main Features

1. Costs are divided into two categories, i.e., fixed costs and variable costs.

2. Fixed cost is considered period cost and remains out of consideration for determination of product cost and value of inventories.

3. Prices are determined with reference to marginal cost and contribution margin.

4. Profitability of departments and products is determined with reference to their contribution margin.

5. In presentation of cost data, display of contribution assumes dominant role.

6. Closing stock is valued on marginal cost.

7. Segregation of costs on the basis of behaviour, i.e., fixed and variable elements.

8. Segregation semi-variable overheads into variable portion and fixed amount.

9. Valuation of closing stock of finished goods and closing WIP at marginal cost. Generally, variable selling and distribution costs are excluded.

10. Fixed costs are not considered for valuation of closing stock of finished goods and closing WIP.

11. Prices are based on marginal costs and marginal contribution.

12. Cost-volume-profit relationship. A special form of cost sheet is used.

13. Facilitates decision-making in regard to product mix, sales mix, make or buy, machine or manual, etc.

14. Break-even technique is employed.

15. Sales revenue less marginal cost is termed contribution. It may be gross or net. If only the variable production expenses are deducted from sales revenue, the difference is termed gross contribution. If variable administration and S and D overheads are deducted from the gross contribution, the balance is the Net contribution.

16. Price fixation for exports.

17. The unit cost of a product means the average variable cost of manufacturing the product.

Marginal Costing – Process

Under marginal costing, the difference between sales and marginal cost of sales is found out. This difference is technically called contribution. Contribution provides for fixed cost and profit. Excess of contribution over fixed cost is profit or net margin. Emphasis remains here on increasing total contribution.

Variable Cost:

Variable cost is that part of total cost, which changes directly in proportion with volume. Total variable cost changes with change in volume of output. Increase in output will lead to increase in total variable cost and decrease in output will lead to reduction in total variable cost. However, variable cost per unit of production remains the same irrespective of increase or decrease in volume of production.

Variable cost includes cost of direct material, direct labour, direct expenses, etc. Variable cost per unit is arrived at by dividing total variable cost by units produced. Variable cost per unit has also been referred to as variable cost ratio. Variable cost can be arrived at by dividing change in cost by change in activity.

Variable costs are very sensitive in nature and are influenced by a variety of factors.

Main aim of ‘marginal costing’ is to help management in controlling variable cost because this is an area of cost which lends itself to control by management.

Fixed Cost:

It represents the cost which is incurred for a period, and which, within certain output and turnover limits tends to be unaffected by fluctuations in the levels of activity (output or turnover). Examples are rent, rates, insurance and executive salaries.

Break-Even Point:

Break-even point is the point of sale at which company makes neither profit nor loss. The marginal costing technique is based on the idea that difference of sales and variable cost of sales provides for a fund, which is referred to as contribution. Contribution provides for fixed cost and profit.

At break-even point, the contribution is just enough to provide for fixed cost. If actual sales level is above break-even point, the company will make profit. If actual sales is below break-even point the company will incur loss. When cost-volume-profit .relationship is presented graphically, the point, at which total cost line and total sales line intersect each other will be the break-even point.

Contribution:

Marginal costing analysis depends a lot on the idea of contribution. In this technique, efforts are directed to increase total contribution only. Contribution is the difference between sales and variable cost, i.e., marginal cost.

It can be expressed as follows:

Contribution = Sales – Variable cost of sales.

Suppose sales is Rs.1000 and variable cost of sales is Rs.800. The contribution will be Rs.200, i.e., Rs.1000 – Rs.800.

Key Factor or Limiting Factor:

There are always factors that do not lend themselves to managerial control. For example, if at a particular point of time there is a Government restriction on the import of a material, which forms the principal ingredient of company’s product, company cannot produce, as it wishes. It has to plan production taking into consideration this limiting factor. However, its efforts will be directed for maximum utilization of available sources. Thus, limiting factor is a factor which influences the volume of output of an organisation at a given point of time.

Key factor is the factor whose influence must be first ascertained to ensure that there is maximum utilization of resources. Gearing the production process in the light of-key factor’s influences will lead to maximisation of profit. Key factor constrains managerial action and limits output of company. Generally sales is the limiting factor, but any of the following factors can be a limiting factor – (a) Material (b) Labour (c) Plant capacity (d) Power (e) Government action.

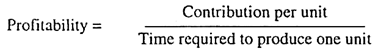

When a limiting factor is in operation and a decision is to be taken regarding relative profitability of different products, contribution for each product is divided by key factor to select the most profitable alternative.

The choice of management rests with the products or projects, which show more contribution per unit of key factor. Thus, if sale is the key factor, contribution to sales ratio should be considered. If management is facing labour shortage, contribution per labour hour should be considered. Suppose sales of products A and B are Rs.100 and Rs.110 and variable cost of sales are Rs.30 and Rs.23 respectively. The labour hours (key factor) required for these products are 2 hours and 3 hours respectively.

The contribution will be – Product A, Rs.100 – Rs.30 = 70 per unit or Rs.35 per hour; Product—B, Rs.110 – Rs.23 = Rs.87 per unit or Rs.29 per hour. In this situation P/V ratio of product B (79%) is better than P/V ratio of products (70%) and normal conclusion should be to produce product B. Thus, time is the key factor. Contribution per hour is better in product A than in B. Therefore, during labour shortage product A is more profitable than product B.

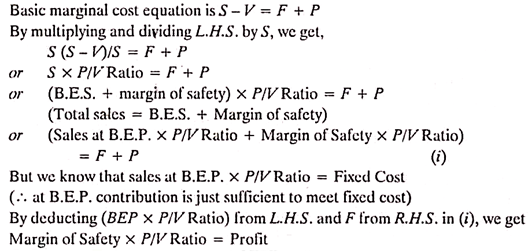

Basic Marginal Cost Equation:

We know that – Sales – Cost = Profit

or Sales – (Fixed costs + Variable costs) = Profit

or Sales – Variable costs = Fixed costs + Profit

This is known as marginal equation and it is also expressed as follows:

S – V = F + P,

Where,

S = Sales,

V – Variable costs of sales

F = Fixed costs and

P = Profit.

The reader is advised to discourage the use of formulae. All problems on marginal costing should be attempted by use of this basic relationship, as far as possible.

Profit/Volume Ratio:

When the contribution from sales is expressed as a percentage of sales value, it is known as profit/volume ratio (or P/V ratio). It expresses relationship between contribution and sales. Better P/V ratio is an index of sound ‘financial health’ of a company’s product. This ratio reflects change in profit due to change in volume. Broadly speaking, it shows how large the contribution will appear, if it is expressed on equal footing with sales.

The statement that P/V ratio is 40% means that contribution is Rs.40, if size of the sale is Rs.100. One important characteristic of P/V ratio is that it remains the same at all levels of output. P/V ratio is particularly useful, when it is considered in conjunction with margin of safety. The other terms being used to refer to P/V ratio are – (a) Marginal income ratio, (b) Contribution to sales ratio, and (c) Variable profit ratio.

P/V ratio may be expressed as:

P/V ratio = (Sales – Marginal cost of sales)/Sales

or = Contribution/Sales

or = Change in contribution/Change in sales

or = Change in profit/Change in sales

Suppose sales price and marginal cost of product are Rs.20 and Rs.12 respectively. The P/V ratio will be (Rs.20 – Rs.12)/20 = (8 ÷ 20) x 100 = 40%

P/V ratio remains constant at different levels of operations. A change in fixed cost does not result in change in P/V ratio since P/V ratio expresses relationship between contribution and sales.

Advantages of P/V Ratio:

1. It helps in determining the break-even point.

2. It helps in determining profit at various sales levels.

3. It helps to find out the sales volume to earn a desired quantum of profit.

4. It helps to determine relative profitability of different products, processes and departments.

Improvement of P/V Ratio:

P/V ratio can be improved, if contribution is improved.

Contribution can be improved by any of the following steps:

1. Increase in sale price,

2. Reducing marginal cost by efficient utilization of men, material and machines.

3. Concentrating on the sale of products with relatively better P/V ratio. This will help to improve overall P/V ratio.

Limitations of P/V Ratio:

There is a growing trend among companies to use the profit-volume-ratio in deciding the product-worthy additional sale efforts and productive capacity and host of other managerial exercises.

Following are the limitations of the use of P/V Ratio:

1. P/V ratio heavily leans on excess of revenues over variable cost.

2. The P/V ratio fails to take into consideration the capital outlays required by the additional productive capacity and the additional fixed costs that are added.

3. Inspection of P/V ratio of products can suggest profitable product lines that might be emphasized and unprofitable lines that may be re-evaluated or eliminated. Mere inspection of P/V ratio will not help to take final decision. For this purpose, analysis has to be broadened to take into consideration differential cost of the decision and opportunity costs, etc. Thus, it indicates only the area to be probed.

4. The P/V ratios has been referred to as the questionable device for decision-making because it only gives an indication of the relative profitability of the products/product lines, that too, if other things are equal P/V ratio is good for forming impression and not for making decision.

The above points highlight that P/V ratio should not be used inconsiderately. Its limitations should be alive in the mind of user.

Margin of Safety:

Margin of safety represents the difference between sales at a given activity and sales at break-even point. (B.E.P. is the point of sales where company makes neither profit nor loss). Consequently, it indicates the extent to which a fall in demand could be absorbed, before company begins to sustain losses.

The margin of safety is expressed as percentage of sale. The validity of safety always depends on the accuracy of cost estimates. The wide margin of safety is advantageous for the company. Margin of safety depends on level of fixed cost, rate of contribution and level of sales.

The relationship of margin of safety with sales can be expressed as follows:

Sales – Sales at B.E.P = Margin of safety.

Thus, soundness of a business can be measured by margin of safety. This knowledge is very useful in taking policy decision like reduction in price to race the competitors. Margin of safety indicates how much present sales are able to keep business away from the crucial point, where business will earn neither profit not loss.

Its relationship with V/P ratio and profit can be expressed as follows:

Improvement in the Margin of Safety:

The margin of safety can be improved by adopting the following steps:

1. Increase in sales volume – It widens the difference between sales at activity level and sales at break-even point.

2. Increase in selling price – If it is not possible to increase sales volume, selling price is increased to improve the margin of safety.

3. Change in product mix thereby increasing contribution – This will lead to improvement in margin of safety, because it widens the gap of sales at specified activity level and sales at break-even point.

4. Lowering fixed cost – It increases margin of a safety, because break-even sales go down by lowering fixed cost.

5. Lowering fixed variable overhead – It increase margin of safety by improvement in P/V ratio.

The angle which the sales line makes with the total cost lines, is known as the angle of incidence. This angle gives the pictorial relationship between profit and sales. This angle indicates the profit earning capacity of a company over the break-even point. A large angle of incidence will indicate earning of high margin of profit. Small angle of incidence will indicate earning of low margin of profit. Low angle of incidence indicates that variable costs form a major part of cost of sales.

Normally, margin of safety and angle of incidence are considered together. For example, a high margin of safety with a large angle of incidence will indicate the most favourable conditions of a company. Under such situation, the company is monopolising in the market. On the other hand, low margin of safety with low angle of incidence indicates bad financial shape of the company.

Marginal Costing – Determination of Marginal Cost

Determination of marginal cost is first practical step in the introduction of ‘Marginal Costing’. It is not a simple problem. Studying the trend of data relating to cost and dividing it two categories, i.e., fixed and variable, requires a lot of labour, skill and experience. Methods frequently used for analysis cost according to variability are – (1) Comparison of level of activity (2) Range or high and low method, (3) Analytical method, (4) Scatter Graph Method, and (5) Least Square Method.

Measurement of Volume:

Marginal costing is primarily used to analyse the cost behaviour in relation to volume. This presents a difficulty of selecting a base for measuring volume. A number of bases can be used for expressing volume such as – (i) Physical units manufactured or sold, (ii) Volume of goods produced or sold, or (iii) Productive or actual hours, which maybe either machine hours or labour hours. Selecting a unit to express volume is a complex exercise requiring a lot of experience.

In different situations, different bases will be selected for expressing volume. Unless everything that is sold in a given period comes from the production of that period, sales do not measure production. Nor does production provide a measure of sales activity. Similarly, labour hours are a measure of time and not of output. They are affected by efficiency. The idea is that different bases can be used for measuring volume and selection has to be with reference to a particular situation.

Importance of selecting proper measure of volume should not be ignored. Tests should be applied to ensure that there is a correlation between the basis of volume and cost. Points that merit attention in the selection of a measure for volume or activity are – (a) the base should be representative of the activity, (b) it should be easily understood, (c) base should be capable of being used unaltered to facilitate adequate control, and (d) where it is possible to express production in terms of common physical units like tonnes, kg. litres, cubic feet and barrels, the volume should be expressed in terms of these units only.

Selling at or below Marginal Cost:

Conditions in business are always changing. Sometimes it is seller’s market, while at other times it may be difficult to sell the goods even at cost. These situations may justify to sell the goods at or even below marginal cost for a short while. Selling the goods at or even below marginal cost cannot be resorted to as a matter of routine.

But this step may help the organisation to overcome the situations under which recovery of even full cost appears a difficult proposition. This step cannot continue for a long time and should be resorted to after very careful consideration.

Selling the goods at or even below marginal cost may be necessary for the following reasons:

1. To keep machinery and factory in running condition so that it remains in readiness to go ‘full steam ahead’, when the temporary difficult period is over.

2. To keep the employees occupied.

3. To dispose of the perishable goods.

4. To drive the weak competitors out of market.

5. To popularise the new products – This step may be temporarily resorted to so that the new product may gain recognition in the market.

6. To prevent loss of trade – If new products are likely to eliminate the company’s product and there exists a possibility of loss of trade, it may be necessary to temporarily reduce the price to marginal cost or even below that.

7. To overcome the period of depressing prices – Sometimes a trend of depressing prices sets in and company finds no alternative but to follow suit in order to remain in business.

8. To maintain the sale of joint products – There are situations in which production on one product is necessarily associated with the production of other product. For example, A and B may be the joint products. A may find a very poor response in market, while B may continue to sell very well in the market.

In this situation, the company may have to sell the product A at marginal cost or even below that, to maintain the production of B. In this situation, losses in one product may be offset by the profit of other product. Sometimes, this step is used to maintain the level of production of joint products only.

Selling the product at marginal cost or even below that is a very difficult decision. This step should be taken for a short while to overcome a temporary difficult situation, where recovery of even full cost may not be possible. This step may lead to a landslide in price, which may permanently damage the market position of the product.

For this reason, this step should be taken exceptionally after very careful consideration. It should be kept in mind that the subject of pricing is exceedingly complex and cost price relationship represents only a part of the problem.

A cost accountant should ensure the following two points:

(i) Selling price equal to marginal cost or even below it has not been through ignorance.

(ii) There is cost consciousness in the organisation and cost offers resistance point to the lowering of prices. This cannot be done, if cost is not known or ignored.

Marginal Costing – Decision-Making and Marginal Costing: Ascertaining Relative Profitability of Products, Determining Profitability of Alternative Product-Mix and a Few Others

The effort of the management in an enterprise is to optimise profits or minimise losses. In their efforts to do so they have to review the existing production, pricing and marketing policies from time to time and make necessary adjustments, if needed.

The following points provides objective basis and facilitates the task of decision-making:

1. Determining relative profitability of products.

2. Determining profitability of alternative product-mix.

3. Make or Buy decisions.

4. Pricing in home and foreign markets.

5. Production with limiting factor.

6. Profit planning.

1. Ascertaining Relative Profitability of Products:

A manufacturing concern engaged in the production of various products is interested in the study of the relative profitability of its products so that it may suitably change its production and sales policies in case of those products which it considers less profitable or unproductive. The concept of P/V Ratio provided by the marginal costing technique is much helpful in understanding the relative profit/ability of products. It is always profitable to encourage the production of that product which shows a higher P/V ratio.

Sometimes, the management is confronted with a problem of loss and it has to decide whether to continue or abandon the production of a particular product which has resulted in a net loss. Marginal costing technique properly guides the management in such a situation. If a product or department shows loss, the Absorption Costing method would hastily conclude that it is of no use of produce and run the department and it should be close down.

Sometimes this type of conclusion will mislead the management. The marginal costing technique would suggest that it would be profitable to continue the production of a product if it is able to recover the full marginal cost and a part of the fixed cost.

2. Determining Profitability of Alternative Product-Mix:

Since the objective of an enterprise to maximise profits, the management would prefer that product-mix which is ideal one in the sense that it yields maximum profits. Products-mix means combination of products which is intended for production and sales. A firm producing more than one product has to ascertain the profitability of alternative combinations of units or values of products and select the one which maximises profits.

3. Make or Buy Decision (When Plant is not Fully Utilised):

If the similar product or component is available outside, then a manufacturing firm compares its unit cost of manufacture with the price at which it can be purchased from the market. The marginal cost analysis suggests that it is profitable to the total manufacturing cost. In other words the firm should prefer to buy if the marginal cost is more than the Bought-out price and Make when the marginal cost is lesser than the purchase price. However, the available plant capacity will exert its own influence in such a decision-making.

Firm should buy when PP+FC is lesser than total cost of manufacture

Firm should manufacture when PP+FC is greater than total cost of manufacture

In case unused capacity is limited or does not exist, then an alternative to buying is to make by purchasing additional plant and other equipment. The firm should evaluate the capital expenditure proposal resulting out of expansion programme in terms of cash flows and cost of capital. If the installed capacity of the existing plant is partially being used, then it can be utilised by producing more internally. The additional production may necessitate purchase of some specialised equipment and thus involve interest and depreciation cost. It is advisable to expand and produce if the enterprise is able to save some costs by doing so.

4. Pricing in Home and Foreign Markets:

Pricing of a product is governed primarily by its cost of production and the nature of competition being faced by the production unit. Once a price is fixed by market forces, it remains stable at least in the short period. During short period when selling period, marginal cost and fixed costs remain the same, an entrepreneur is in a position to establish relationship between them.

On the basis of such a relationship, it is very easy to fix the volume of sales and selling price during normal and abnormal times in the home market. How far the prices can be cut in case of foreign buyer to effect additional sales is a problem which is realistically answered by the marginal costing technique.

Price under Recession/Depression:

Recession is an economic condition under which demand is declining. During depression the demand is at its lowest ebb, and the firms are confronted with the problem of price reduction and closure of production. Under such conditions, the marginal costing technique suggests that prices can be reduced to a level of marginal cost. In that case, the firm will lose profits and also suffer loss to the extent of fixed costs. This loss will also be borne even if the production is suspended altogether. Selling below marginal cost is advisable only under very special circumstances.

Pricing in Foreign Markets:

A foreign market can be kept separate from the domestic market due to many legal and other restrictions imposed on imports and exports and as such a different price can be charged from foreign buyers. Any company which enjoys surplus production capacity can increase its production to sell in the foreign market at lower price if its full fixed cost already stands recovered from the production from home market.

5. Production with Limiting Factor:

Sometimes, production has to be carried with certain limiting factor. A limiting factor is the factor the supply of which is not unlimited or freely available to the manufacturing enterprise. In case of labour shortages, the labour becomes limiting factor. Raw material or plant capacity may be a limiting factor during budget period.

The consideration of limiting factors is essential for the success of any production plan because the manufacturing firm cannot increase the production to the level it desire when a limiting factor is combined with other factors of production. The limiting factor is also called by the name of ‘scarce factor’ or ‘key factor,’ ‘principal budget factor’ or ‘governing factor.’

The commodity which contributes maximum contribution per unit or which yields maximum P/V ratio is the most profitable commodity. This is true when there is no limitation or production. In case different products are manufactured with a particular limiting factor, it is not the contribution per unit or P/V ratio which rightly guides in fixing production priorities but the profitability per unit of limiting factor is the proper guiding star.

Supposing labour is the limiting factor, the relative profitability will be calculated as under:

A Case of Two Limiting Factors:

It is possible that the production is limited by two or more limiting factors Labour and raw material may be in short supply. The amount of availability of one factor affects the utilization of other factor. Under such a condition the best product mix is one which optimise over-all profits but is achievable under the given constraints.

6. Profits Planning:

The process of profit planning involves the calculation of expected costs and revenues arising out of operations at different levels of plant capacity for the production of different types of goods during a given period of time. The cost and revenues at different level of operating are different and a concern has to choose one level at which its profits are maximum.

Marginal costing technique helps the management by suggesting a suitable product-mix or plant capacity which optimise profits. It also guides the management in selecting the best product mix for attaining a specified level of profit.

Marginal Costing – Top 5 Advantages: Avoids Allocation of Fixed Overheads, Values Inventory Uniformly, Simplifies Decision-Making and a Few Others

Main advantages are as under:

Advantage # 1. Avoids Allocation of Fixed Overheads:

The allocation of fixed overheads over various products/departments has been a problem with the firms following absorption costing method. None of the methods employed for allocation of overheads is scientific and accurate and as such an arbitrary value of overheads is placed on different products due to which cost and price decisions become unrealistic. The difficulty in the allocation of fixed overheads is avoided by following the marginal costing which separates the fixed and variable costs. Fixed cost is recovered from the contribution of all the products / deptts. If pre-determined overhead costs are used, it is most likely that pre-determined cost does not coincide with the actual cost and give rise to the problem of over-recovery or under-recovery of overheads. Marginal costing also avoids the problem of under or over recovery of overheads.

Advantage # 2. Values Inventory Uniformly:

The unsold stock and work-in-progress are valued at marginal cost which remains unchanged, at least in the short period. Valuation of inventory at marginal cost ensures homogeneity of profits as the reported income is not affected by the amount of production and the differences in the opening and closing inventories.

Advantage # 3. Simplifies Decision-Making:

Under marginal costing ‘Contribution’ forms the basis for marginal costing ‘Contribution’ forms the basis for managerial decision-making. The management can easily fix selling price, determine production priorities and plan for profits by analysing cost data on marginal costing principles.

Advantage # 4. Facilitates Cost Control:

It is possible to control cost more effectively when it is classified into fixed and variable components. Generally fixed costs are the result of policy decisions and these can be controlled by the management by appropriate changes in policies. For example, rent would become payable only when the management takes a decision to acquire a leasehold property instead of freehold property.

Variable costs are also the result of managerial decision regarding volume of output and technique of production but here are incurred by all levels of management and operators. J. Batty has rightly observed “the responsibility of variable costs can be traced with substantial degree of certainty and this allows the necessary control to be exercised.”

Advantage # 5. Recognises Importance of Selling:

Production is meaningless without its disposition at remunerative prices. Marginal costing duly recognises the importance of selling as it prescribe the calculation of profit on the basis of sales without recognising the opening and closing stocks. The reports for consideration of management are prepared on the basis of sales instead of total production.

Marginal Costing – 6 Major Limitations

In recent years, there has been a widespread interest in marginal costing. Still very few have adopted it as method of accounting for cost.

Main points of limitations are as follows:

1. It is not proper to disregard fixed cost for product cost determination and inventory valuation.

2. Marginal costing is specially useful in short-run profit planning and decision-making. For decision of far-reaching importance, one is interested in special purpose cost rather than variability of costs.

3. Marginal costing technique disregards the use of recovering fixed cost through product pricing. For long-run continuity of business it is not good. Assets have to be recovered in the long run.

4. Establishing variability of costs is not an easy task. In real life situations, variable costs are rarely completely variable and fixed costs are rarely completely fixed.

5. Exclusion of fixed cost from inventory valuation does not conform to accepted accounting practice.

6. The income-tax authorities do not recognize the marginal cost for inventory valuation. This necessitates keeping of separate books for separate purposes.