Read this article to learn about – 1. Time wage system 2. Piece wage system 3. Advantages of Time wage system 3. Disadvantages of Time wage system 4. Advantages of Piece wage system 5. Disadvantages of Piece wage system 6. Formula for the calculations of Earnings.

7. Pros and cons and field of application of the various methods of wages 8. Incentive Schemes 9. The formula for calculating wages under Incentive Schemes 10. Suitability of Time Rate System 11. Types of Incentive Plans: i. Taylor’s differential piece rate system (1985) ii. Merrick’s differential piece rate system iii. Emerson’s efficiency plan iv. Halsey plan (time+ piece=50% bonus plan) v. Rowan plan (similar to Halsey plan) 12. Factors to be Considered before Introducing an Incentive Scheme

Everything you need to know about the Methods of Wage Payment as studied in Cost Accounting: Time Wage System, Piece Wage System, Incentive Schemes, Payment by Results and More…

Top 2 Methods of Wage Payment as used in Cost Accounting – Time Wage System and Piece Wage System (with Advantages and Disadvantages)

There are two methods of wage payment, namely:

1. Time wage system, and

ADVERTISEMENTS:

2. Piece wage system

Method # 1. Time Wage System:

Under this system wages are paid on the basis of time without considering the output produced by workers. The rate is pre-determined for a particular time unit spent in the organization. The wages are paid on the basis of attendance.

The wages are calculated by multiplying the time spent by the predetermined rate. Payment may be made on an hourly, daily, weekly or monthly basis. No consideration is given for the quantity or quality of work done.

ADVERTISEMENTS:

Earnings = Time Taken x Rate per hour.

Suitability:

This method is suitable where:

a. Quality of work is more important than quantity.

ADVERTISEMENTS:

b. Worker is a learner or a beginner.

c. Output is beyond the control of workers.

Advantages:

The following are the main advantages of the Time Wage System:

ADVERTISEMENTS:

a. This system is very simple to understand. It does not involve much calculation.

b. If quality is very important, this method should be used, because workers work slowly and carefully.

c. This system is generally preferred by Trade unions because uniform rate is given to all workers.

d. Under this method workers are sure of getting a fixed amount at the expiry of a certain period; thus they get mental relief.

ADVERTISEMENTS:

e. When the worker is a beginner, this method is preferred.

Disadvantages:

The following are the disadvantages of time wage system:

a. No distinction is made between efficient and inefficient workers. The payment is made according to time spent and not according to the output produced by the workers.

ADVERTISEMENTS:

b. Efficient workers will become inefficient as both efficient and inefficient workers get the same amount of wages.

c. Strict supervision is required to get the work done by workers.

d. Workers tend to be slow in work leading to low production.

e. Workers waste a lot of time resulting in increase of idle time.

Method # 2. Piece Wage System:

Under this system wages are paid on the basis of the output of workers, without considering the time taken in performing the work. Thus the workers are paid on the basis of quantity of output. For calculating total earnings of workers, piece rate is multiplied by the total number of units produced.

Earnings = Units Produced x Rate per unit.

Suitability:

This method is more suitable where:

a. Quality of work is not important.

b. Work is of repetitive nature and can be measured in units.

c. Piece rate can be satisfactorily fixed.

Advantages:

The following are the advantages of piece wage system:

a. This system works as an incentive to workers to produce more. Under this system the efficiency increases. Thus it maximises output and minimises the per unit cost.

b. The quantum of idle time is minimised

c. It is also simple to operate.

d. It is easily understood by workers.

e. The workers try to discover new techniques for efficient production, resulting in more production and more wages for them.

Disadvantages:

The following are the disadvantages of piece wage system:

a. Workers give utmost importance on quantity and not on quality. Thus the quality of the product diminishes.

b. The workers may be tempted to have more on quantity even at the cost of his health.

c. This system will frustrate the less efficient workers.

d. There is possibility of more wastage of materials and defective work.

Various Methods of Wage Payment (With Pros and Cons and Field of Application)

The method of wage payment differs from firm to firm and industry to industry depending upon the nature of work and circumstances prevailing within the firm or industry.

The pros and cons and field of application of the various methods of wages are considered below:

1. Time Wage System:

The system under which the payment is made to the workers according to the time for which they work is known as Time-wage System. The time-rate is fixed beforehand and workers are remunerated for the hours of work done by them.

For example, an employee has to work for 8 hours daily in a factory, and the rate per hour fixed by the management is Rs. 2; the total remuneration per day shall be Rs. 8 x 2 = Rs. 16. The payment can be made according to the rate per hour, day, week, fortnight or month.

There is a guarantee given to the worker that he will get a fixed minimum for a specified period of time. Since the method depends on time worked, no account is taken of the quality and quantity of work done. The straight time-wage system, though is a very old system, holds its merit even today.

Application:

This method is suitable in the following cases:

(i) Where strict supervision is possible;

(ii) Where production passes through different operations and delays and disturbances cannot be avoided.

(iii) The time-basis of making wage payment can best be applied to those industries where efficiency of a worker does not have an important role to play in the speed of production.

(iv) Where services are not capable of being directly or tangibly measured, e.g., services of cleaners, time-keepers, supervisor or clerical staff.

(v) Jobs are highly skilled e.g. those of inspection, testing etc. Here the quality of output has a greater role to play than the quantity.

(vi) When pace of output is independent of the employee e.g. fully electronic/automatic system of production.

Advantages:

(1) Simplicity

The labour as well employer can easily understand this system, and amount of wages to be paid can be calculated without any tedious mathematical calculations.

(2) Stability in wages and sense of security to workers

Wages are not related to the quantity and quality of the work done. Monthly, daily and hourly rates are fixed and labourers are assured of a certain amount of wages to be received after definite period. In case work is interrupted due to failure of power or technical defect in machine, the labourers need not worry. Thus, they feel a sense of security also.

(3) Quality production

Since wages are fixed the worker is not in haste and he uses the best of his talents to give qualitative production. Thus, quality is not sacrificed for quantity.

(4) Unity in labour

No hard line of distinction is drawn between an efficient and inefficient worker on the basis of production. This promotes a feeling of unity among the workers. That is why most of trade unions favour this system of wage payment.

(5) Economy

This method is economical also. Detailed records regarding the work done by the labour are not required. This results in economy of administrative overheads. Moreover, the workers do not try to be hasty in doing their work. This means that they use material and plants very carefully to produce goods of the highest quality. Care in use of material and plants affects considerable economy.

Disadvantages:

(1) No distinction is made between efficient and inefficient workers. They are treated alike and thus there is no inducement for hard work.

(2) The workers become lazy and dull and try to avoid work, and thus production suffers.

(3) “Soldiering” is the common practice followed by workers when the time-wage system is followed in a firm. The workers try to make the work last as long possible so that earnings may be greater. Thus, labour cost per unit is increased.

(4) There is discontentment among the efficient workers for their efforts are not properly rewarded. Moreover, the system may also lead to employer-employee trouble since the interests of the two conflict. Employer is interested in maximum production while the workers are interested in maximum earnings.

F. W. Taylor has rightly remarked – “This method of wage payment leaves a bad moral influence on the labour because all workers receive the same wages.”

(5) Idle time is considerably increased, Mr. F. W. Taylor has also stated – “The waste of time is increased when a group of labourers is employed on the identical wage.”

(6) A close supervision is needed. Appointment of additional supervisors increases cost of manufacture.

Some variants of time wage system are used sometimes to overcome the shortcomings of straight time wage system.

These are as follows:

(i) High wage plan

Under this plan a worker is paid a rate ordinarily higher than the prevailing in the area or in the industry. It ensures higher level of performance from him.

(ii) Measured Day Work Rate

Under this plan a portion of wages depends on the merit rating of the worker and cost of living index.

(iii) Differential Time Rate

In case of this plan different hourly rates are determined for different levels of efficiency. This, in fact, turns out to be differential piece rate system.

2. Piece Wage System:

The payment under this system is made in proportion to the work done, no regard being given to time taken in performing the work. The rate is fixed per unit of output, per article, per commodity etc. The worker is paid for the total units produced or manufactured.

The system is thus result or output oriented. For example, if the rate per unit is Rs. 10 and the worker completes 10 units in a week, his week’s wages shall be 10 x 10 = Rs. 100.

It may be expressed in the form of the following formula:

Total earnings = Rate per unit x Units completed

This system takes into account the quantity of work done. However, to ensure quality units not completed up to the mark may be rejected. Payment is made for those units only which are accepted.

The rate per unit must be fixed bearing in mind the factors such as physical labour required, the normal time which a worker would take in completing one unit etc. Piece wages system may be for individual workers or for a group of workers.

(a) Individual Piece Work:

When the wages are paid to each worker according to the rate per unit of output or rate for each job or operation performed, the piece work system is known as individual piece work system.

(b) Group Piece Work:

Group or collective piece work system is that where the workers are paid remuneration on a group basis because they perform a particular job or operation after making collective effort. The workmen of a particular group can, afterwards, divide the earnings in any proportion. The basis of distribution is generally their basic time earnings. (Hrs. spent on the operation x Hourly basic rate of wages).

Advantages:

(1) The system recognises the merit and efficiency of workers and, therefore, can be regarded as more equitable than the time wage system.

(2) The workers are induced to work hard with the result that production is enhanced. This reduces the fixed overhead expenses per unit and, finally the total cost of production.

(3) The total labour cost per unit or job is accurately ascertained if this system is employed.

(4) The workers too are benefited since they get more wages. They can finish the work in less time and in the time saved they can make additional earnings.

(5) Improvement in the methods of production takes place because the workers take care to remove the deficiency of material and plant.

Disadvantages:

(1) Since the workers are paid for the quantity of units produced irrespective of the time they have spent, they take no precaution to improve the quality of products. Sometimes, in a hurry to finish the job earlier, they deteriorate the quality of the goods.

(2) Occasionally, the employees handle the tools and equipments very roughly and carelessly to achieve a high output, causing thereby losses to the firm or industry.

(3) The workers suffer loss if due to certain reasons, they fail to work efficiently for a particular period. No guarantee is given for the day’s wages.

(4) Speedy and excessive work, in a bid to earn more, proves injurious to the health of workers.

(5) There may be dissatisfaction among workers who work slowly and gradually. They may resent against the increased earnings of their fellow workers.

(6) When the workers start doing the work more efficiently and the wages start rising up, the employers have a tendency to exploit workers.

(7) Fixing the equitable piece rate is a task of considerable difficulty.

The system requires a vigorous system of inspection of the quality of the output. A strict vigilance should be kept to see that the workers make a proper use of materials given to them, handle the machines properly.

The system is normally followed in coal mining, textile industries, shoe factories etc. Where the work is of a repetitive nature and the change in the conditions of job is not frequent, the system is best suited.

Balance of Debt System:

According to this system, the worker is paid on the basis of rate per unit of output but if on some occasions, the earnings by piece rate fall short of the earnings by time rate, the worker is paid according to the time rate. In future this extra payment to him can be recovered if his piece-rate earnings exceed the time-rate earnings.

This makes the operation of piece wage system effective. It helps a worker to earn money even when he finishes the work in a longer duration due to certain unavoidable reasons. Thus, in times of need, lie can get enough wages and later on, the recoupment in times of his extra earnings will not be felt by him.

Methods of Wage Payment – Time Rate System, Piece Rate System and Incentive Schemes (with Formulas, Advantages and Disadvantages)

The methods of wage payment are:

1. Time Rate System;

2. Piece Rate System; and

3. Incentive Schemes.

1. Time Rate System:

This is the oldest of the wage payment systems. In this system, time is made on the basis of payment. Labour is paid for the time worked irrespective of the volume of production during that time.

The formula for calculating wages under this system is:

Wages = Hours worked x Rate per hour

or

= Days worked x Rate per day

Payment may be based upon the hour, the day or the week, or it may be at the fixed salary rate.

Suitability of Time Rate System:

Time wage system is suitable for the following type of situations:

(a) Where quality of work is more important than quantity, e.g., high class tailoring.

(b) Where output cannot be measured in quantitative terms, e.g., in the case of indirect workers like watchmen, cleaners and sweepers, etc.

(c) Where output is beyond the control of worker, e.g in process industries the flow of work is regulated by the speed of conveyor belt or where the work of a worker is dependent on the work of oilier workers.

(d) Where work is being done on a small-scale so that close supervision is possible,

(e) Where the worker is a learner or an apprentice.

Advantages of Time Rate System:

The main advantages of time rate system are:

1. Simplicity

The system is simple and calculation of wages is easily understood by the workers.

2. Security to workers

Workers are assured of a certain amount of wages payable even if there is a stoppage of work due to power failure, machine breakdown, etc. This gives security of wages to workers.

3. Quality of work

As this method does not consider quantity of work done, workers can concentrate on the quality of goods produced. Thus the quality of work under this method is better.

4. Accepted by trade unions

Trade unions generally favour this method because it treats all workers alike and does not make any distinction between efficient and inefficient workers.

5. Economical method

This method does not require detailed records to be maintained of work done by workers. This results saving in clerical costs. Moreover, workers avoid over- speeding and cause less damage to plant and machinery and also materials. This also results in economy.

Disadvantages of Time Rate System:

The main disadvantages of this system are:

1. No Incentive

It does not offer any inducement to workers to improve performance because it does not make a distinction between efficient and inefficient workers.

2. Low quantity

When workers are paid on time basis, they tend to be slow in work. This results in lower production quantity.

3. Extra supervision costs

Under this method extra supervision is needed so that workers do not waste time. Appointment of additional supervisors increases cost.

4. Costing difficulties

From costing point of view, it creates difficulties in the calculation of labour cost per unit because the output is quite fluctuating.

5. Idle time

Workers waste a lot of time resulting in increase in idle time.

2. Piece Rate System:

Wages under this system are paid according to the quantity of work done.

A rate is fixed per unit of production and wages are calculated by the following formula:

Wages = Rate per unit x No. of units produced

For instance, if rate per unit is Rs. 17 and during a day a worker has completed 10 units, then his wages will be Rs. 17 x 10 units = Rs.170.

This method does not give any consideration to the time taken by the worker in completing the work. Only quantity of work is taken into account for calculating wages.

Suitability of Piece Rate System:

Conditions under which piece rates may be usefully employed are:

(a) Where production is standardized and repetitive in nature

(b) Where the aim is continuous maximum production

(c) Where the output of workers can be measured

(d) Where workers continue at the same job for long periods

(e) Where the standard time required to complete a job can be measured accurately

Advantages:

Piece rate system has the following advantages:

1. Incentive to efficient workers

As remuneration is in proportion to the worker’s effort, the method provides a strong incentive to work more.

2. Increase in production

Each worker tries his best to produce more to earn more wages. This results in increase in production.

3. Lower cost

On account of increase in production, fixed cost per unit is decreased because of higher production.

4. Equitable

This system is more equitable than time rate system because wages are paid according to the efficiency of each worker.

5. Decrease in supervision

Strict supervision is not necessary because the workers are themselves interested in maximizing their earnings through the maximization of output.

6. Simplifies costing

As wages are paid at a rate per unit, this method simplifies cost ascertainment because labour cost per unit is known in advance.

7. Simple and easy

This method is simple and is easily understood by the workers.

Limitations:

Piece rate system suffers from the following limitations:

1. Poor quality of work

This method lays too much emphasis on quantity of production and ignores quality of work. In order to maximize their wages, workers try to produce more and more without caring for the quality of production.

2. No security of wages

This system does not guarantee a minimum wage to a worker. If a worker is not able to complete his day’s work, for any reason, he is paid less wages. Thus, earnings of workers are uncertain.

3. Misuse of materials and equipment

In the greed to produce more, workers cause extra wastage of materials and damage plant and machinery.

4. Injurious to health of workers

In an effort to earn more wages, workers try to work excessively with speed. This proves injurious to the health of workers.

5. Opposed by trade unions

Piece rate system is generally opposed by trade unions because it creates inequality in the wages of workers. Slow and inefficient workers feel jealous of the higher wages of their fellow workers.

6. Difficulties in fixing piece rate

Fixing equitable piece rates is quite a difficult task and may require a considerable amount of work in the form of time studies.

7. Unsuitable in certain cases

This method does not suit where work is of artistic and refined nature.

3. Incentive Schemes:

Both time rate and piece rate systems have their own strong points and drawbacks. Incentive schemes or bonus system is a compromise between the two, combining the good points of each system. Under incentive schemes, time rate and piece rate systems are combined in such a way that workers are induced to increase their productivity.

The gains arising from the efficiency of a worker are shared between the worker and the employer in agreed proportion. In this way, both the employers and the employees benefit from these incentive plans. Incentive plans are, however, used in various forms and with different names.

In these systems, standard time for each work is predetermined and bonus is given to those workers who finish (licit work within or less than the time specified.

Some of the principal incentive plans are described below:

Any plan which induces a worker to produce more and to earn more is called incentive priors.

Types of Incentive Plans:

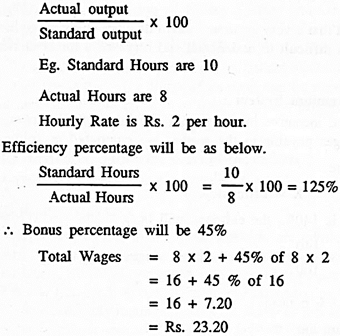

i. Taylor’s differential piece rate system (1985)

ii. Merrick’s differential piece rate system

iii. Emerson’s efficiency plan

iv. Halsey plan (time+ piece=50% bonus plan)

v. Rowan plan (similar to Halsey plan)

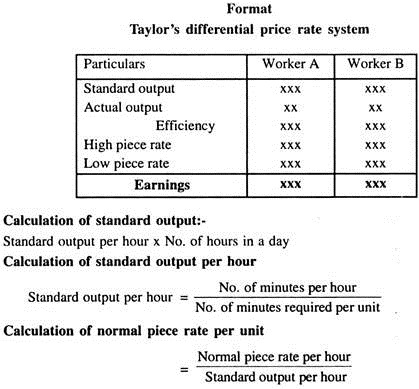

i. Taylor’s Differential Piece Rate System:

This scheme was introduced by Fredric Winslow Taylor in the year 1985 he is a founder of scientific management under this system there are 2 piece rates that is-

a) High piece rate

b) Low piece rate.

Low piece rate is applicable to the workers who are below the efficiency, high piece rate is applicable to the workers who are at the standard and above the standard.

Differential Piece Rate:

1) 80% of normal piece rate

If employees per hour below standard.

2) 120% of normal piece rate per hour

If the employees are at or above the standard.

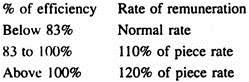

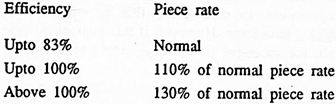

ii. Merrick’s Differential Piece Rate System or Sliding Scale System:

This is also a differential rate plan at the time of payment of wages to workers which have been propounded by Merrick’s.

Under this plan he has prescribed 3 rates based on % of efficiency as follows.

Low piece rate = Beginner

Middle piece rate = Developing workers

High piece rate = Highly efficient workers

The rate of remuneration accordingly to Merrick’s plan is as follows:

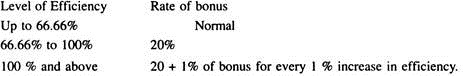

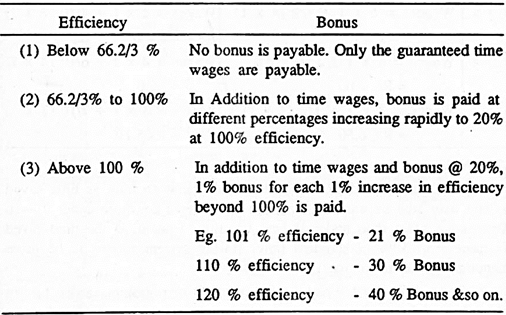

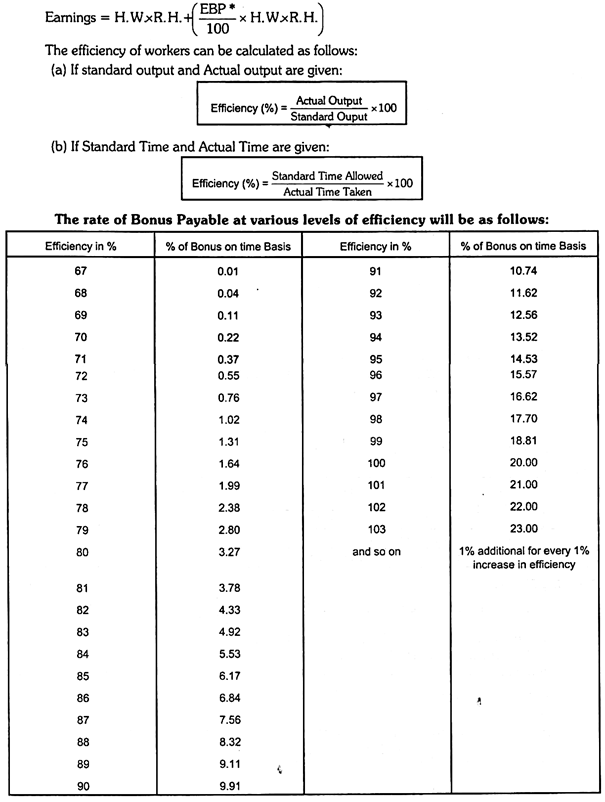

iii. Emerson’s Efficiency Plan:

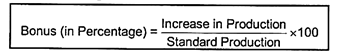

Under plan wages are guaranteed even to those workers whose output is below the standard but bonus is paid in addition to wages to those workers who prove to be efficient.

Bonus is paid to a worker whose efficiency exceeds 66.66%. As efficiency increases step by step, bonus also should increase gradually.

Bonus rate of Emerson’s efficiency plan is as follows:

Advantages of Emerson’s Plan:

1) This plan guarantees minimum wage to workers

2) This plan is more beneficial to employers.

3) It rewards efficient employees in matter of bonus.

4) It protects the setting of rates.

5) Incentive to workers

Disadvantages of Emerson’s Plan:

1) It is difficult to understand to laymen

2) This plan discourage in efficient workers

3) Complex and expensive

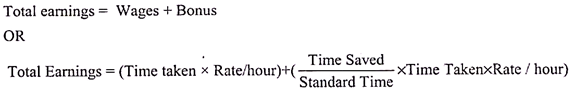

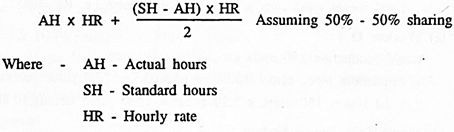

iv. Halsey Plan:

It is a plan under which workers are paid guaranteed hourly rate + % age of wage for time saved.

The standard time required for the job is determined in advance on the basis of time and performance.

This plan also considered to be 50% bonus plan.

Formula:

Earnings = Time taken x Rate per hour + ½ of (time saved x Rate per hour)

Advantages of Halsey Plan:

1. It is simple to understand

2. It encourages efficient employers

3. Minimum wages are guaranteed

4. There are 50% benefits for time saved

Disadvantages of Halsey Plan:

1. Trade unions are opposing this system

2. In consistency in standard

3. It is costly

4. Over supervision is required

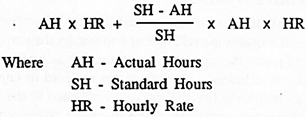

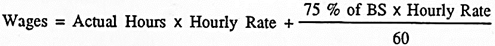

v. Rowan Plan:

This is a plan of payment of wages guaranteed + bonus rate. It is a slightly modified method to the Halsey plan.

Under this system bonus are provided to workers who prove to be efficient proportionate to their saving in time.

Formula:

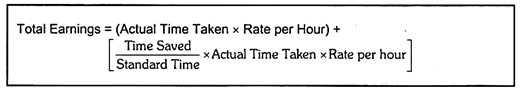

Earnings = Time take x Rate per hour + time saved/Std Time x (time taken x rate per hour)

Advantages of Rowan Plan:

1) There is a guarantee for minimum wages.

2) It is a reward to efficient workers

3) Incentive to learners.

4) It is based on employers’ benefits.

Disadvantages of Rowan Plan:

1) It is quite difficult to understand.

2) It de motivates very efficient employers

3) It is very expensive

Methods of Wage Payment:Time Rate System and Payment by Results (with Methods of Remuneration)

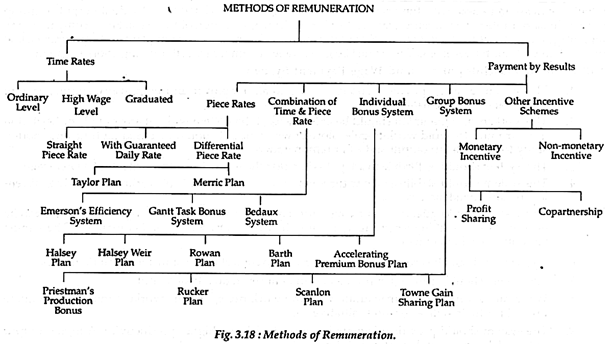

The systems of wages can be classified as follows:

(a) Time Rate System and

(b) Payment by Results.

The different systems of remuneration and their subdivisions are shown in Fig. 3.18.

1. Time Rate System:

(a) Time Rate at Ordinary Level:

Under this system of wage payment, the unit of measurement for remunerating workers is ‘time’. It disregards the output of the worker. The wage rate of the workers may be calculated on hourly, daily, weekly or monthly basis.

The time rate may be fixed with reference to time rate prevailing in similar industry but it should not be less than the minimum wages specified under the Minimum Wages Act. Normal wages are computed by multiplying “hours worked” with “hourly rate of wages”. Overtime work is paid extra.

Earnings = Hours worked x Rate per hour

Or, E = HW x RH

Time rate system may be applied under the following circumstances:

i. Where units of output or services are not distinguishable or measurable e.g., clerical and supervisory staff, general helper, watchman, sweepers, cleaners, etc.

ii. Where the work requires high degree of skill and the quality of output is more important than quantity.

iii. Where machine do job and the worker has very little control on the quantity of output and there is no clear-cut relationship between output and effort, e.g., process industries.

iv. Where work is not of repetitive nature, e.g., repair and maintenance, etc.

v. Where the worker is a learner or an apprentice.

vi. Where the unit is small and the work needs close supervision.

Advantages of this system are as follows:

i. It is very simple and easy to understand.

ii. It is easy to calculate and hence involves less clerical work. Even an ordinary worker can compute wages of his own.

iii. It helps to maintain better industrial relations as the system is readily acceptable to trade unions.

iv. It assures a guaranteed wages to every worker and hence workers have a feeling of security.

v. Workers concentrate on quality and need not work at high speed.

Disadvantages of this system are as follows:

i. Efficient workers are penalised as this system does not provide incentives to produce more.

ii. No distinction is made between slow, fast, inefficient and efficient workers.

iii. Since ii encourages the inefficient workers, productivity will decrease thereby increasing cost per unit.

iv. It becomes difficult to complete a job within the scheduled time as the progress of work is usually very slow.

v. Supervision costs go up as the workers have a tendency to go slow during normal working hours in the hope of getting overtime.

vi. Cost per unit cannot be assessed in advance.

vii. Standards of labour cannot be set.

viii.It fails to attract efficient workers.

(b) Time Rate at High Wages Level:

In this method, the time rates are fixed at a higher level than the rates prevailing in the industry. Overtime is not usually paid. The object is to attract efficient workers and retain them, achieve higher level of productivity and reduce cost per unit in respect of labour and overheads.

This method is suitable when the work can be easily measured and a high task is fixed by time and motion study.

Advantages of this method are as follows:

i. It reduces labour turnover.

ii. Less supervision is needed.

iii. It attracts highly skilled workers.

iv. The system is easy to operate and understand.

v. The earnings of workers increase.

vi. Labour cost per unit reduces due to high productivity.

Disadvantages of this method are as follows:

i. It is difficult to maintain higher productivity over a long period unless there is strict supervision over the performance of each worker.

ii. There is no guarantee that high day rate will act as an incentive. Only fixed hourly rate is not enough to extract more output from them.

(c) Graduated Time Rate:

In this method, time rate has two elements-

(a) a fixed basic rate which depends on the nature of the job; and

(b) a variable element i.e., dearness allowance which varies for each worker depending on merit rating and cost of living index. Though the scheme is favourable to both employer and employees, a suitable wage index cannot be determined easily.

Calculation of wages becomes complicated and the workers cannot understand it easily. It is difficult to operate multiple rates for each class of workers and estimate labour cost.

2. Payment by Results:

In this method, effort is linked with the payment for the output of the worker. The workers are given an incentive to increase their outputs. The benefits of increased production are shared both by employer and employee, i.e., workers can earn more and the employer gets lower unit cost.

All the methods of remuneration shown under the heading ‘Payment by Results’ are incentive wage payment schemes. Incentive means “the stimulation of effort and effectiveness by offering monetary inducement or enhanced facilities”.

General Principles of an Incentive Scheme:

i. The reward should be linked with the effort involved in the job and the scheme should be just and fair to both the employer and the employees.

ii. The standards of performance should be carefully set based on time and motion study as these cannot be changed unless there is a change in the method of production or facilities provided.

iii. No limit should be imposed on the earnings of the worker.

iv. The scheme should cover direct as well as indirect workers.

v. The scheme should be stable and not be modified frequently without consulting the workers.

vi. The earnings of an employee should not be affected for reasons beyond their control.

vii. The scheme should be simple and easy to understand so that a worker can calculate his own wage easily. The standards set should be achievable even by average workers. While setting the standards, the workers concerned and the union should be consulted.

viii.There should be a clear system for inspecting, counting and recording the good pieces produced by each worker and results should be updated daily so that the workers know what they have produced.

This enables the workers to compute their earnings which again increases the incentive effect.

ix. The operation of the scheme should not entail excessive clerical costs i.e., its operational cost should be minimum

x. The scheme should be able to improve the morale of the workers.

xi. The scheme should provide for adequate supervision and production control. The management should ensure that workers are not idle for want of tools or materials.

xii. The scheme should be in strict conformity with relevant national or local trade agreements.

xiii. The scheme should guarantee the minimum day wages.

xiv. The scheme should minimise labour turnover and absenteeism.

xv. The scheme should be conducive to the setting up of standard costs and budgetary control.

Advantages of the Incentive Schemes:

i. It increases production and reduces cost per unit.

ii. There is less labour turnover.

iii. Employers, employees and consumers are benefited from more economical production cost.

iv. Management always makes an attempt to improve the efficiency in working level.

Disadvantages of the Incentive Schemes:

i. The wage incentive scheme can work only when workers have confidence in company’s management and procedures.

ii. If the scheme is not accepted by the trade-unions, it may lead to friction resulting in strikes, lockouts, etc.

iii. It is difficult to withdraw a scheme once introduced even if it is found uneconomical at a later date.

iv. Workers may have the impression that standards have been set unfairly at a high level which may not be attainable by average workers.

v. It is difficult to cover indirect workers under the scheme. A separate scheme may be devised for indirect workers.

vi. Workers feel that the wage incentive schemes have been designed in a complicated way by the management to take advantage of them.

Factors to be Considered before Introducing an Incentive Scheme:

i. The impact of the scheme on production should be considered, i.e., how much the production increases without lowering its quality.

ii. The incentive scheme prevailing in that locality or industry.

iii. The net savings in cost of production per unit due to increase in production.

iv. The practicability of measuring the performance of each worker.

v. The capacity of the market to absorb the increased production without reducing the selling price.

vi. The future impact of trade unions and workers towards the scheme.

vii. The extent to which the workers will appreciate the scheme. Whether the scheme will motivate the workers to attain the standards.

viii.Whether the quantity of production for the nature of work is within the control of the workers.

Piece Rates:

(a) Straight Piece Rate:

Under this method, a fixed amount per unit of output is paid irrespective of time taken. The earnings of a worker can be calculated as follows-

Under the standard hour method, piece rate is fixed on the basis of standard time required to produce one unit and expressed as rate per standard hour.

For example, if two units are produced in one standard hour, and straight piece rate is Rs.3 per unit, then standard hour piece rate will be fixed at Rs.6. Thus, if a worker produces 12 pieces, it will be equivalent to 6 standard hours and his earnings will be Rs6 x 6 = Rs.36.

Sufficient care and judgment are needed while fixing piece rate, a loose standard will increase labour cost and a too high standard may lead to labour unrest. Moreover, once a low standard is set, it is not easy to change it.

Hence, piece rate should be fixed after time and motion study and trial runs. This method can be applied where the jobs are repetitive, measurable and standard type and there are plenty of jobs to feed the workers continuously. If piece rate is less than time-rate, their daily rate as per the Minimum Wages Act may have to be paid.

Advantages of this method are as follows:

i. The method is simple and easy to operate and understand.

ii. It provides strong incentive as the remuneration is in direct proportion to the worker’s effort and the employer also gains by saving on overhead costs.

iii. It reduces supervision costs and cost per unit.

iv. Labour cost per unit being constant, it can be computed in advance. This helps in price fixation and to submit quotations accurately.

v. It provides a sound basis for production control and standard costing since piece rates are fixed after a careful time and motion study.

vi. Workers continue to improve and earn more. Efficient workers are encouraged.

Disadvantages of this method are as follows:

i. The quality of output suffers, i.e., the method is not suitable where quality is of prime concern.

ii. It involves more clerical work as detailed statistics as regards production of individual workers are to be maintained.

iii. In the anxiety to maximise output, workers may cause excessive wastage of materials, defective units, damage tools and machinery and may even damage their own health.

iv. The setting of piece rates based on time and motion studies involves lot of work at the outset as well as during the operation of the scheme.

Any looseness or mistake in fixing standards preceding the determination of piece rates may lead to wage loss in the form of low productivity, under recovery of fixed costs, high labour costs etc. It is difficult to correct a wrong rate afterwards as it will create dissatisfaction among the workers.

v. A piece rate without proper quality control system may result in high rates of rejection by customers involving loss of goodwill besides financial loss to the concern.

vi. Maintenance of discipline regarding arrival and departure of workers may be a problem. It may cause frequent absenteeism.

vii. The system is generally opposed by trade unions as it creates unhealthy rivalries among the workers.

viii.It is not patronised by inefficient workers. The worker’s remuneration may fall considerably due to the fault of worker or employer or co-workers.

ix. It is not possible to reward workers for seniority or merit.

x. Plants and machinery are not maintained properly.

(b) Piece Rate with Guaranteed Day Rate:

In this method the wages of a worker are computed at the piece rate provided the amount exceeds his earnings on the time basis. When piece rate earnings are less than his time-rate earnings, his time-rate earnings are paid.

An alternative plan is the guaranteed time-rate earnings, plus a piece-rate payment for output over and above the prescribed minimum. The advantage of this system is that the workers are not unduly penalised when his piece-rate wages fall below his time-rate wages. The disadvantage is that it removes the incentive for improving comparatively low rate of output.

(c) Differential Piece Rate:

Under this scheme earnings vary at various stages of output, sometimes proportionally more, sometimes less or sometimes in proportion to output. It is designed to reward efficient workers and encourage the less efficient workers or a trainee.

The aim of the scheme is to increase the production on one hand and to increase the earnings of the workers on the other hand. Several piece rates are fixed on a slab scale for a job or operation. A standard of efficiency is fixed for each job or operation put on piece work. For various levels of output below and above the standard various piece rates are applicable.

It can be successfully applied under the following circumstances:

(i) Work is of repetitive type;

(ii) Production methods are standardised;

(iii) Output can be identified easily with individual worker;

(iv) Standard time needed to complete a Job can be easily and accurately measured;

(v) Overheads and fixed expenses are relatively high in comparison to direct wages.

The differential piece work system may be classified as:

a. Taylor System, and

b. Merrick System.

a. Taylor Differential Piece-Rate System:

This scheme was first introduced in U.S.A. by F.W. Taylor, the father of scientific management, and was modified afterwards by Merrick.

Essential features of the scheme are as follows:

i. Day wages are not guaranteed.

ii. Piece rates are fixed by time and motion study.

iii. Two rates are fixed –

a very low piece rate for those who failed to achieve the standard and a high piece rate for those who achieved or exceeded the performance standard. The difference between the two rates is so wide that efficient workers are amply rewarded and below average workers are punished.

This system is criticized as unfair as minimum wages of the worker are not guaranteed.

Advantages of this system are given below:

i. It is simple to understand and calculate.

ii. It attracts efficient workers for high incentive.

iii. When overheads are very high, the scheme is more useful since reduction of overheads cost per unit more than compensates increased labour cost.

iv. It provides more inducement to the workers to increase output and earn more wages.

Disadvantages of this system are as follows:

i. It punishes very severely below average workers as a slight fall in production will considerably affect their earnings.

ii. It creates rivalry and unrest among the workers as it makes wide discrimination between inefficient and efficient workers.

iii. It affects the morale of the workers as minimum day wages are not guaranteed.

iv. Labour cost of a job will be different for the two levels of performance because of two different rates.

v. An error in the fixation of the lower and higher piece rate differential, may adversely affect the morale and productivity of the workers.

b. Merrick Differential Piece-Rate System:

It is a modification of the Taylor system. It uses three piece rates instead of two, recognising the difference between beginners, average workers and superior workers. In fact, none of the rates is below normal rate.

The rates are as follows:

This scheme rewards the efficient workers and encourages inefficient workers to increase their output. There is no punitive lower rate for performances lower than 83%. It also does not guarantee day wages.

Top 3 Most Popular Methods of Wage Payment: Time rate system, Piece rate systems and Incentive Schemes (with Formulas)

Main methods of wage payment are:

1. Time rate system

2. Piece rate systems and

3. Incentive Schemes

Method # 1. Time Rate System:

This system is the oldest system of wage payment. This is also termed as “Day Wage System” or “Flat Rate System.” Under this system, wages are paid to the workers on the basis of time spent on the job irrespective of the quantity of work produced by the workers. Payment can be made at a rate per day or a week, a fortnight or a month.

The formula for calculation of payment of time rate is as follows:

Wages = Number of hours worked x Hourly rate

Example:

Hours worked = 50 hours,

Rate per Hour = Rs.200

Thus wages = Rs.200 x 50 hours = Rs.10,000

Suitability of Time Rate System:

Time wage system is suitable under the following conditions:

(1) Where the units of output are difficult to measure (watchman)

(2) Where the quality of work is more important, (artistic goods [furniture], fine jewellery, carving)

(3) Where machinery and materials used are very sophisticated and expensive.

(4) Where supervision is effective and close supervision is possible.

(5) Where the workers are new and learning the job.

(6) Where the work is of a highly varied nature and standard of performance cannot be established.

Advantages:

(1) It is simple and easy to calculate.

(2) Wastages of materials can be reduced.

(3) Inefficient handling of materials and machinery can be avoided.

(4) Quality of the work is not affected.

(5) Better utilization of resources is possible.

(6) To some extent accidents can be reduced or avoided.

(7) Minimum wages can be assured to employees.

(8) The personal development of employees can be identified and improved.

(9) Equality can be maintained between the efficient and inefficient workers.

(10) This method is accepted by the trade unions.

Disadvantages:

(1) As the assured wages are paid, laziness of employee and idle time can be increased.

(2) Management cannot reach output of production easily.

(3) There is a chance of increase in unit cost.

(4) No difference between efficient and inefficient workers. (Both will get the same wages).

(5) Possibility of under utilisation of plant capacity.

(6) Supervision costs may be increased, because workers paid on time basis need greater supervision.

(7) No incentive is given to efficient workers. It will depress the efficient workers.

(8) There are no specific standards for evaluating the merit of different employees for promotions.

Method # 2. Piece Rate System (Payment by Result):

Under this system workers are paid the fixed amount per unit produced by them. Thus under this system the wages of workers depend upon their output or work and not on their attendance time in the factory.

Piece rate system can be divided into following two types:

i. Straight piece rate system

Under this method payment is made on the basis of the fixed amount per unit produced without due regard to the time taken.

Symbolically-

Total Wages = Number of units produced x Rate per unit

ii. Differential piece rate system

Under this system workers are paid wages at different piece rate depending on their level of efficiency. This system is adopted to reward the efficient workers and to encourage inefficient workers.

Under this system various differential are given by different economists.

Among them the important two differential piece rate systems are as under:

(A) Taylor’s Differential Piece Rate System

(B) Merrick’s Differential Piece Rate System

Suitability of Piece Rate System:

1. Where Quality and workmanship are not important.

2. Where quantity of output or Work can be measured accurately.

3. Where Quantity of output directly depends upon the efforts of the worker.

4. Where standardized goods are produced.

5. Where the nature of job is repetitive.

6. The system is flexible and rates can be adjusted to changes in price level.

7. Materials, tools and machines are sufficiently available to cope with the possible increase in production.

8. Time cards are maintained so that workers are punctual and regular so that production may not slow down.

Advantages:

1. It helps in reducing idle time or laziness of the employee.

2. It helps to reduce the cost of production per unit.

3. It helps the management to reach the estimated output of production easily.

4. Number of units produced by the employee is increased.

5. Better utilisation of plant capacity.

6. Available materials are used properly.

7. The efficient workers are recognized and rewarded.

8. It facilitates direct relation between efforts and reward.

Disadvantages:

1. Fixing of piece work rate is difficult as low piece rate will not induce workers to increase production.

2. Quality of output will suffer because workers will try to produce more quickly to earn more wages.

3. There may not be an effective use of material, because of the efforts of workers to increase the production. Haste makes waste. Thus there will be more wastage of material.

4. When there is increased production, there may be increased wastage of materials, high cost of supervision and inspection and high tools cost and hence cost of production might increase.

5. Increased production will not reduce the labour cost per unit because the same rate will be paid for all units. On the other hand, increased production will reduce the labour cost per unit under the time wage system.

6. Workers have the fear of losing wages if they are not able to work due to some reason.

7. Workers may work for long hours to earn more wages, and thus, may spoil their health.

8. Workers may work at a very high speed for a few days, earn good wages and then absent themselves for a few days, upsetting the uniform flow of production.

9. Workers in the habit of producing quality goods will suffer because they will not get any extra remuneration for good quality.

10. The system will cause discontentment among the slower workers because they are not able to earn more wages.

Difference between Time Rate and Piece Rate System of Wage Payment:

Time Rate System:

1. Under this system earnings of a worker are calculated on the basis of time spent on the job.

2. In this system, minimum guaranteed time rate is paid to every worker.

3. Under time rate system, remunerations are not directly linked with productivity.

4. Under this system emphasis is on high quality of work.

5. Under time rate system, strict supervision is essential.

6. This method may lead to trade unions to support it.

7. More idle time arises in time rate systems.

Piece Rate System:

1. In this system earnings of a worker are calculated on the basis of number of units produced.

2. Under this system, no guarantee of minimum payment to every worker.

3. Remuneration of workers directly linked with productivity.

4. Under the piece rate system there is no consideration for the quality of work.

5. In this system, close supervision is not required.

6. The attitude of trade unions is not to cooperate with the schemes.

7. Compared with time rate system there is no change of idle time in piece rate schemes.

Types of Differential Piece Rate Systems:

(A) Taylor’s Differential Piece Rate System:

This system is based on the assumption that the degree of efficiency varies from worker to worker and the worker must be paid wages according to his degree of efficiency.

The following are the features of this system:

(1) The Standard time or a standard output is set after careful time and motion studies for determining the level of efficiency of workers.

On the basis of standard time, the level of efficiency of the worker is determined as under-

(2) On the basis of standard output, the efficiency of a worker is determined as under-

(3) If the efficiency of the worker is equal to or more than 100%, then he will be paid the higher piece rate than the normal piece rate. On the other hand, if the efficiency of the worker is below 100%, then he will be paid at a lower piece rate than the normal piece rate.

In the problem if the higher or lower piece rates are not given, then the following two differentials can be applied as specified by Taylor.

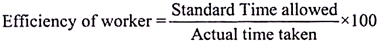

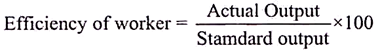

Efficiency of the Worker:

i. If the efficiency is < 100%

ii. If the efficiency is ≥ 100%

Differentials Applicable:

i. 83% of Normal Piece Rate

ii. 175% of Normal Piece Rate.

(4) Under this method wages is calculated as under –

Piece Wages of Earnings = (Number of Units produced) × (Normal price rate) × (Differentials applicable)

(B) Merrick’s Differential Piece Rate System:

This system is a slight variation of Taylor’s piece rate differential system.

The main features of this system are:

(1) On the basis of standard set, the efficiency level of worker is determined in the same way as under Taylor’s Method.

(2) Merrick has specified 3 rates or differentials which are as under-

(a) Lower rate for the beginners

(b) Middle rate for the developing workers.

(c) Higher rate for the experienced workers.

The rates are as under:

Efficiency of the Worker:

i. If the efficiency is < 83%

ii. If the efficiency is in between 83% – 100%

iii. If the efficiency is > 100%

Differentials Applicable:

i. 100% of Normal Piece Rate

ii. 110% of Normal Piece Rate.

iii. 120% of Normal Piece Rate

(3) Under this method wages is calculated as under-

Wages or Earnings = (Number of Units produced) x (Normal piece rate) x (Differentials applicable)

Method # 3. Premium or Bonus or Incentive Schemes:

Bonus schemes are intended to reward employees for their efficiency in saving cost for the organization through the saving of time. These are therefore schemes for sharing extra profits with employees. Conceptually, bonus can only be awarded where there has been cost savings or improved performance that leads the organization to exceed its profit target.

To be able to compute bonus, we must first know the following concepts:

a. Time allowed

This refers to the expected time to be spent in doing some piece of work.

For Ex- if time set for one unit is 5 hours, then for 100 units time required shall be 500 hours. Time allowed may therefore not be the same as the hours worked.

b. Time taken

It means the number of hours actually used in performing a piece of work.

c. Time saved

It is the difference between time allowed and hours worked, when time allowed is greater than hours worked.

d. Bonus

This is paid when time has been saved. Therefore the magnitude of the bonus depends upon the time saved.

i. Halsey plan or Halsey Bonus System or Halsey 50:50 Bonus Plan

ii. Rowan plan

i. Halsey Bonus Method:

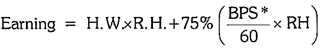

This Plan was developed by F. A. Halsey. This system also termed as Split Bonus Plan or Fifty-Fifty Plan. Under this plan, standard time is fixed for each job or operation on the basis of past performance. If a worker completes his job within or more than the standard time then the worker is paid a guaranteed time wage.

If a worker completes his job within or less than the standard time, then he gets a bonus of 50% of the time saved plus normal earnings.

Under this method, the total earnings is calculated as follows:

Total earnings = Wages + Bonus

(Or)

Total Earnings = (Time taken x Rate per hour) + 50% of (Time saved x Rate per hour)

Advantages of Halsey Plan:

1. It is simple and easy to understand.

2. Total earnings of each worker can be easy to calculate.

3. Both employer and employee get equal benefit of time saved.

4. This system not only benefits efficient workers but also provides average workers with guaranteed minimum wages.

5. This system is based on time saved and it can reduce the labour cost.

6. This plan provides opportunity to earn bonus.

Disadvantages of Halsey Plan:

1. Lack of cooperation among the employees. The workers may not like to share the benefit of time shared with the employer.

2. Under this system establishment of standard is very difficult.

3. Earnings are reduced at high level of efficiency. .

4. The workers may neglect the quality to produce more units and to earn bonus.

5. The incentive is not as strong as with piece rate system.

ii. Rowan Plan or Rowan Bonus System:

David Rowan introduced this plan. It is similar to that of Halsey plan except bonus. According to this plan bonus is the proportion of the wages of the time taken, which the time saved, bears to the standard time.

Advantages of Rowan plan:

1. It guarantees minimum wages on the basis of time.

2. Upto 50% of the time saved provides a higher bonus than Halsey plan.

3. It offers protection to the employer when the standard has not been properly fixed.

4. At higher levels of efficiency, the worker is not induced to rush to the work because the bonus increases at a lower rate.

5. Results in reduction of labour cost per unit.

Disadvantages of Rowan Plan:

1. It cannot be easily understood by the workers.

2. It is not easy to operate.

3. It encourages inaccuracies in rate fixing.

4. If the time saved is more than 50% of the standard time the total earnings start decreasing.

Similarities between Rowan & Halsey Plans:

1. Both plans guarantees time wages to workers.

2. Bonus is paid in both the schemes for time saved.

3. Both the plans provide the same bonus when the work is completed in 50% of the time allowed.

4. Both plans are time saved by the workers and are shared by both the employer and employees.

Differences between Rowan & Halsey Plans:

1. Halsey system is simple to understand. But, Rowan system is complicated and difficult.

2. The time saved by the employee is shared between the employee and employer equally under Halsey system. But, under Rowan system time is not shared by employee and employer proportionally.

3. In Halsey plan bonus is given for 50% of time saved and hourly rate. But, in Rowan plan bonus is given for the proportion of the time taken which time bears to the standard time allowed at the hourly rate.

4. Under Halsey plan bonus increased steadily with rise is efficiently. But in Rowan plan bonus increases rapidly up to the 50% of time saved of the standard time. But, thereafter it declaims.

Everything you need to know about the Methods of Wage Payment

These methods of wages under the following heads:

1. Remuneration on Time Basis i.e., Time Rate System.

2. Remuneration on Work Basis i.e., Payment by Results.

3. Incentive/Bonus Systems –

i. Individual Incentive Systems

ii. Group Incentive Systems.

4. Indirect monetary remuneration –

i. Profit sharing

ii. Co-partnership

5. Non-monetary incentives.

1. Time Rate System:

Under this, a worker is paid on the basis of time attended by him. He is paid at a specific rate irrespective of the production achieved by him. The pay rate may be fixed on a daily basis, weekly basis or monthly basis.

This type of remuneration system is helpful in the following circumstances:

i. If the output of the worker is beyond his control e.g., his speed depends upon speed of a machine or speed of other workers.

ii. If the output can’t be measured or standard time can’t be fixed e.g., Maintenance work.

iii. If close supervision is possible.

iv. If quality, accuracy and precision in work is of prime importance e.g., Artist, Ad-agency person.

The time rate system of remunerating the workers is useful due to the following features:

i. Useful for highly efficient and highly inefficient workers.

ii. Easy for calculations.

iii. Easy to understand for the worker.

iv. Assurance of minimum wages.

The time rate system has one most important disadvantage attached to it that the efficiency of the worker is disregarded while paying remuneration to him.

To avoid this difficulty, some variations as described below can be applied in practice:

i. High Wage Plan:

Under this system, timely wage rate of the workers may be fixed at such a level which is higher as compared to wages paid to workers in the same industry or locality. Suitable working conditions are provided. Correspondingly, a high standard of efficiency is expected from the workers. Those who are not able to come up to the standard, are taken off the scheme.

ii. Differential Time Rate:

Under this method, different hourly rates are fixed for different levels of efficiency. Up to a certain level of efficiency, normal day rate is applicable which gradually increases as efficiency increases.

This can be illustrated as below:

Up to 80% efficiency – Rs. 1.00 per hour (Normal Rate)

80% to 90% efficiency – Rs. 1.25 per hour

90% to 100% efficiency – Rs. 1.40 per hour

101% to 125% efficiency – Rs. 1.50 per hour

2. Payments by Results:

Under this system, workers are paid according to the production achieved by them. In many cases, time attended is not material.

These methods can be reclassified as below:

i. Straight Piece Rate System:

Under this method, each job, production or unit of production is termed as a piece and the rate of payment is fixed per piece. The worker is paid on the basis of production achieved irrespective of the time taken for its performance.

Thus, the earnings of the worker can be computed as –

Wages = No. of units produced x Piece Rate per unit

This method can be suitably applied if the production is of standard or repetitive nature. It can’t be applied if the production can’t be measured in suitable units. It can be seen that the crux of this method is to decide the time required to complete a piece.

The fixation of this time should be done in such a way that within such time, a normal worker can complete the piece. This can be done either on the basis of previous experience or on the basis of time and motion study.

ii. Piece Rate with Guaranteed Time Rate:

Under the straight piece rate system, the remuneration of a worker depends upon the production achieved. If the production is less due to some factors beyond his control, he is likely to be penalized.

To remove this difficulty, it may be decided that he will be paid on time rate if his piece-rate earnings fall below time rate earnings, so that the worker is assured of minimum earnings on time basis. However, if this guaranteed time rate payment is too high, the incentive to increase output to get piece rate payment is less.

iii. Differential Piece Rate System:

Under this system, higher rewards are guaranteed to more efficient workers. The piece rates are fixed in such a way that normal piece rate is paid for work performed within and up to the standard level of efficiency. If efficiency exceeds the standard, payment at higher piece rate is made.

This can be illustrated as below:

Up to 83% efficiency – Normal Piece Rate

Up to 100% efficiency – 10% above normal piece rate.

Above 100% efficiency – 30% above normal piece rate

This method offers more inducement to the workers to work more efficiently and earn higher wages. But it is complicated to understand and expensive to operate.

Following systems use this principle of differential piece rates:

i. Taylor Differential Piece-Rate System:

This was introduced by F.W. Taylor. It provides two piece rates, a low piece rate for output below standard and a high piece rate for output above standard and does not provide for any guaranteed time rate payment.

E.g., if standard output is 10 units and piece rate is Re. 1 per unit, the total wages are:

a. If actual hourly output is 8 units i.e., below standard, the piece rate is say 80% of normal piece rate i.e., Rs.0.80. Hence total wages are 8 units x Re. 0.80 = Rs.6.40

b. If actual hourly output is 12 units i.e., above standard, the piece rate is say 120% of normal piece rate i.e., Rs.1.20

Hence, total wages are 12 units x Rs.1.20 = Rs.14.40.

The basic defect with this system is that even though the efficiency of the worker is below standard even marginally, he is punished heavily and even though the efficiency of the worker is above standard even marginally, he is benefited to a very great extent.

ii. Merrick Differential Piece-Rate System:

To remove the defect existing in case of Taylor’s System which heavily punishes the worker who produces below standard, the Merrick System provides for three piece rates E.g., –

It should be observed that under this method also, no guaranteed time rate payment is provided.

3. Individual Incentive Systems:

In case time rate systems, the losses due to inefficiency of workers or benefits due to efficiency of workers are suffered or enjoyed by the employer alone. Similarly in case of piece-rate systems, the losses due to inefficiency of workers or benefits due to efficiency of workers are suffered or enjoyed by the worker alone. (The employer may be indirectly affected in the form of increased or decreased per unit overheads).

The incentive systems differ from both these systems in such a way that the financial advantages arising out of the efficiency of workers are enjoyed by both employer as well as workers. There are various systems by which the incentive may be paid to workers.

We will consider following main systems:

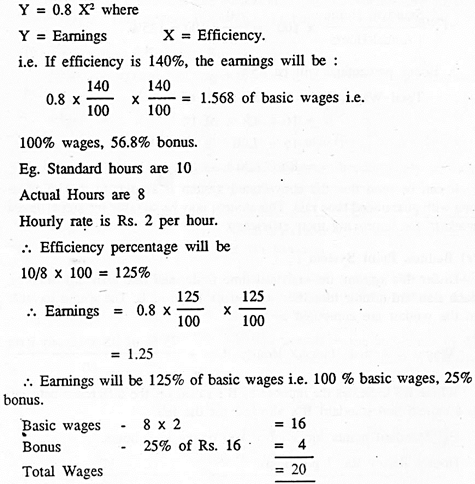

i. Halsey Premium System:

Under this system, if the actual time taken is equal to or more than standard time, worker is paid at the time rate. If actual time is less than standard time, the worker, in addition to time wages for hours actually worked, gets a bonus payment.

The bonus is equivalent to the wages for the time saved in the decided percentage to be shared with the employer. The percentage allowed to worker may vary from 30% to 70% (usually 50%).

The total wages payable to the worker under this system, can be computed as below:

ii. Halsey – Weir Premium System:

This system is a deviation of Halsey Premium System only with the exception that the ratio of sharing between the worker and the employer is fixed as 1/3 : 2/3. The computation of total wages is the same as in case of Halsey Premium System, except the change in this ratio.

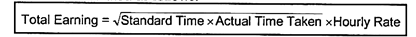

iii. Rowan Premium System:

Under this system also, guaranteed time rate payment is made. The amount of bonus paid is a percentage of hourly rate which is in proportion to the time saved.

The total wages payable to the workers under this system can be computed as below:

The other systems for making the payment of premium can be briefly described as below:

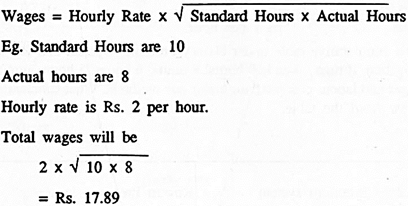

i. Barth Premium System:

Under this system, the wages payable to the workers are computed below:

It should be observed that this system does not provide for any guaranteed time wages. This system is suitable for beginners or apprentices.

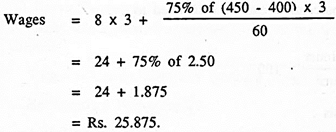

ii. Emersons’s Efficiency Bonus System:

Under this system the wages payable to the workers are computed as below:

Wages = Actual Hours x Hourly Rate + Bonus Percentage x Actual Hours x Hourly rate.

For calculating bonus percentage, following directions are provided:

The efficiency percentage can be calculated as below:

a. On Time Basis:

b. On Output Basis:

It can be seen that the system is similar to that of piece rate with guaranteed time rate. This system may be suitable for non-efficient workers for improving their efficiency.

iii. Bedaux Point System:

Under this system, the standard time is divided into standard minutes, each standard minute identified as Bedaux Point or B.

The wages payable to the worker are computed as below:

Where BS indicates the number of B’s saved i.e., the difference between B’s earned and standard B’s allowed for the job.

E.g., Standard points for a job – 400 points in 8 hours.

Hourly Rate – Rs. 3 per hour.

It should be observed that a very accurate system of work study is required for this system. It is difficult to understand and involves a lot of clerical efforts.

iv. Accelerating Premium System:

Under this system, incentive increases at a fast rate with the increase in output.

Total wages payable to the worker are computed as below:

This system is very difficult to understand.

v. Baum Differential Plan:

This is a combination of Taylor’s differential piece rate system and Halsey system and is also known as Milwankee Plan.

vi. Diemer System:

This is a combination of the Halsey System and Gantt system.

4. Group Incentive System:

In many cases, the output of the individual workers cannot be measured though the output of a group of workers can be measured. In such cases, the individual time rates or in some specified proportion depending upon the skill of the workers or equally.

5. Indirect Monetary Remuneration:

This may take the following two forms:

i. Profit Sharing:

According to this method, the workers are entitled to share in profits earned by an organisation, in addition to the regular wages, at a specified percentage. The legal provisions in this regard are enacted by way of Payment of Bonus Act, 1965.

According to the provisions of this Act, all the employees drawing a monthly remuneration of Rs. 2,500 or less are entitled for a bonus at the minimum rate of 8.33% of wages of the subject to the maximum ceiling of 20% of the wages.

It should be observed that the statutory requirement of the payment of bonus does not depend on the profit earned necessarily, as the bonus is payable even though there are no profits.

It is also worth noting that the statutory requirement of payment of bonus is the specific percentage of the wages or salaries paid to the workers and hence remains unaffected by any changes, either upwards or downward, in the profits earned by the organisation.

ii. Co-Partnership:

According to this method, the workers are granted ownership rights in the operations of the organisation by which the workers are in the position to control the affairs of the organisation. In corporate organisations, it may be in the form of offering the shares of the company to the workers or granting of loans to the workers to buy company’s shares, according to which the workers get the voting rights to control the affairs of the company.

The workers get dividend on the shares as bonus. With the help of this method, the morale of the workers is increased. However, certain objections are raised against this method.

First, the increase in earnings is too small. Second, the shareholding of the workers is too small to control the affairs of the company. Third, the workers are not rewarded according to the individual efficiency.

6. Non-Monetary Incentives:

The intention of these incentives is to attract better workers, retain the existing workers, encourage loyalty, reduce labour turnover, and provide better working conditions to workers and so on.

Various benefits as stated below may be granted to the workers, either free or at reduced rates, remaining amount being contributed by the workers:

i. Health and safety services.

ii. Education and training to workers and their children

iii. Canteen facility

iv. Pension, superannuation fund etc.

v. Loans at reduced rate of interest.

Methods of Wage Payment (With Suitability, Merits and Demerits)

The methods of wage payment are:

1. Time Wages:

In time wage system, wages are based on time, i.e., per hour, per day, per week or per month basis with no reference to the output.

Computation of Time Wages:

Earnings of a worker under the time wage system, assuming that the worker is paid on a per day basis, will be calculated as under:

Earnings = No. of days worked x Wage rate per day

A working day is generally of 8 hours. If a worker works beyond 8 hours on a day, he is paid at a higher rate per hour for overtime work.

Suitability:

This system of wage payment is suitable/applicable where

(i) The quality of work is an important factor

(ii) Quantum of work cannot be measured

(iii) Strict supervision of a worker is possible

(iv) Different processes are involved

(v) Indirect labour is employed

(vi) Work-flow is regulated by the speed of a machine, and

(vii) Learners and apprentices are engaged

Advantages (Merits):

(i) Simplicity-easy to understand

(ii) Stability in wages

(iii) Sense of security to workers

(iv) Quality production is possible

(v) Unity in labour, and

(vi) Economical to operate – less clerical work

Disadvantages (Demerits):

(i) No distinction is made between efficient and inefficient workers

(ii) No inducement for hard work

(iii) Prompts workers to lengthen the work period

(iv) Discontentment among efficient and quick workers.

2. Piece Wages or Payment by Results:

In this system, there are two variations:

(a) Straight Piece Rate System:

In this, wages of a worker are based on his output. The earnings of a worker are directly related to the quantity of production or the number of pieces turned out by him. In such a system, the attendance of the worker or the time he takes for doing a job has no bearing on the payment.

This system of wage payment provides direct financial incentive to the worker to produce more and gives him liberty to increase his earnings. The system ensures payment to workers according to their ability, energy and speed.

Computation of Piece Rate Wages:

Under piece rate wage system, the total wages of the worker are calculated by multiplying the total output by the wage rate per unit. For example, if the wage rate per unit is Rs. 2 and a worker produces 50 units in a day, his wages for that day will be Rs. 100. Thus,

Earnings = No of units produced x Wage rate per unit

(b) Piece Wages with Guaranteed Time Wages:

The piece rate is generally determined in a way to keep it comparable with the time rate. However, in piece wages with guaranteed time wages, provision is made for payment of minimum guaranteed time wages to piece workers when their output is less enough to ensure minimum time wages.

This provision protects workers from erosion in their wages, particularly when non-production is beyond their control e.g., non-availability of materials, machine breakdown, failure of power, etc. In such a situation any amount paid to a worker in excess of piece wages will be charged to overhead.

Thus in this system, wages are paid on piece basis as long as these exceed time wages. But when wages of a worker fall below time wages, he is paid time wages to ensure minimum guaranteed wages to a worker.

Suitability:

Payment by results system is suitable/applicable when:

(i) Quantum has predominance over quality

(ii) Work is of repetitive nature

(iii) Strict supervision is not possible

(iv) Quantum of work can be easily measured

(v) Single process is involved

Advantages (Merits):

Payments by results has various advantages.

These are:

(i) This system recognises the merit and efficiency of the worker.

(ii) As the workers are directly compensated for their efforts, they are motivated to produce more by working hard. At the same time, the firm also benefits through reduced per unit overhead cost.

(iii) The total earnings of a worker can be easily ascertained.

(iv) Workers can have the option of increasing their earnings by producing more.

(v) The system induces workers to adopt better and efficient methods of production to increase output as well as their earnings.

(vi) The system does not require much supervision with regard to the quantum of output.

(vii) Inefficient workers can be easily identified.

Disadvantages (Demerits):

The disadvantages of payment by results system are:

(i) The biggest draw-back of the piece rate system is deterioration in the quality of the product due to greater emphasis on quantity.

(ii) In this system, very close and regular quality control measures are required.

(iii) The system generally causes higher loss & tear wear on account of spoilage and careless handling of tools and equipment.

(iv) The system may cause resentment among those workers who have high technical skills but cannot be remunerated according to piece rate. Sometimes these skilled workers may get lower wages than what others get.

(v) The system may prove unhealthy to workers who work beyond limit to earn higher wages.

(vi) Higher wages of efficient workers may cause discontentment among slow workers.

(vii) Difficulty in fixing piece rates – time and motion studies are required to fix piece rates.

(viii) Piece rates once fixed cannot be easily lowered.

Methods of Wage Payment (With Formulas)

Methods of wage payment are as follows:

1. Time Wage Rate System:

In this system, payment of wages is made to the workers according to the time i.e., per day or per month or per hour. The time rate is fixed according to the rate paid in same industry. In this method, guarantee is given to the worker up to a fixed minimum amount for a specific time. Output given by him is not considered in this method.

Formula:

Wages = Actual Time spent x Time rate

For example, a worker works for 7 hours and time wage rate is Rs. 20 per hr. He will get Rs. 140 according to this method.

Advantages:

i. Easy to understand and simple to operate.

ii. Minimum guaranteed wages are assured irrespective of output.

iii. Workers concentrate on quality not on quantity because of stability in wages.

iv. No distinction is made between an efficient and inefficient worker.

v. This method is economical because records of work done by labour are not required.

Disadvantages:

i. No distinction between efficient and inefficient workers leads to no motivation for hard work.

ii. Idle time is increased because workers become lazy and dull.

iii. To get work, a high degree of supervision is needed. Supervisor’s salary increases the cost of overheads.

iv. Efficient workers get discontented.

Suitability:

This method is suitable in the following cases:

i. Where output cannot be easily measured counted and inspected.

ii. The nature of work is non-standardized and non-repetitive.

iii. Where there is strict supervision.

iv. Where price of output is fixed according to the process or machine cost.

2. Piece Wage Rate System:

In this system, the payment is made to the workers in direct proportion of his work. The wage rate is fixed according to per unit of product. The time spent on job by workers is not considered at all.

Formula:

Wages = No of units produced x Piece rate per Unit

For example – a worker gets Rs 10 per piece if he produces 20 pieces,

Then wages = 20 x 10 = Rs. 200

Advantages: