Everything you need to know about Costing Methods. Learn about – Job Order Costing, Process Costing, Operating Costing, Output Costing, Multiple Costing and Batch Costing.

Job costing is the basic costing method applicable to those industries where the work consists of separate contracts, jobs or batches each of which is authorized by a specific order or contract. For example, Contract costing, Batch costing.

Process costing method is applicable where goods result from a sequence of continuous or repetitive operations or processes and products are identical and cannot be segregated. For example, Chemical Manufacturing Industries.

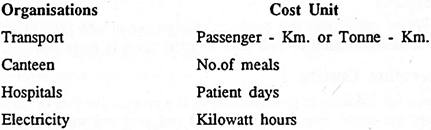

The cost of operating a service is known as the operating cost and the method of ascertaining the operating cost is known as “Process Costing and Operating Costing”. Selection of cost units, where Operating Costing is applied, requires careful consideration, because cost unit will be different types of services.

ADVERTISEMENTS:

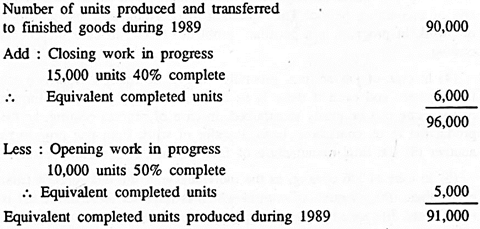

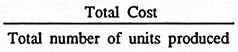

A cost unit is a unit of product, service or time in relation to which cost may be ascertained or expressed. According to CIMA as “a quantitative unit or product or service in relation to which costs are ascertained”.

For example:

(a) The cost of cement is associated in terms of per ton.

(b) Cost of carrying a passenger in terms of per kms, the cost of sugar is ascertained in terms of per quintal etc.

ADVERTISEMENTS:

Multiple Costing is to calculate the cost of product’s units which are produced after processing in different operations. When units of a product transfers from one operation to another. Its cost is calculated and like this each operation’s cost is calculated.

Batch Costing is defined as that form of specific order costing which applies where similar articles are manufactured in batches either for sale or for use within the undertaking. Batch Costing is used where articles are produced in batches and held in stock for assembly of components to produce finished products or for sale to customers.

Costs are collected against each batch. When the batch is completed cost per unit is computed by dividing total cost by the number of units in each batch.

Costing Methods (Methods of Cost Accounting): Learn about Job Order Costing, Process Costing, Operating Costing, Output Costing, Multiple Costing and Batch Costing

Costing Methods – Job Order Costing, Process Costing, Operating Costing and More…

There are different methods of cost accounting namely:

ADVERTISEMENTS:

Method 1 # Specific or Job Order Costing

Job costing is the basic costing method applicable to those industries where the work consist of separate contracts, jobs or batches each of which is authorized by a specific order or contract.

(i) Contract Costing:

Contract costing is a variant of job costing system applicable particularly in the case of organizations doing construction work. It is also known as Terminal costing. Each contract, short term or long-term, is treated as a job.

ADVERTISEMENTS:

It is understood that construction work involves massive investment and labour employment. So it may take much time to complete the work and may extend more than year period.

(ii) Batch Costing:

Batch Costing is defined as that form of specific order costing which applies where similar articles are manufactured in batches either for sale or for use within the undertaking. Batch Costing is used where articles are produced in batches and held in stock for assembly of components to produce finished products or for sale to customers.

Costs are collected against each batch. When the batch is completed cost per unit is computed by dividing total cost by the number of units in each batch.

ADVERTISEMENTS:

Method 2 # Process Costing

Process costing method is applicable where goods result from a sequence of continuous or repetitive operations or processes and products are identical and cannot be segregated. For example, Chemical Manufacturing Industries.

Method 3 # Service or Operating Costing

The cost of operating a service is known as the operating cost and the method of ascertaining the operating cost is known as “Operating Costing”.

ADVERTISEMENTS:

Method 4 # Unit and Output Costing

In this method, cost per unit of output or production is ascertained and the amount of each element constituting such cost is determined. In case where the products can be expressed in identical quantitative units and where manufacture is continuous,this type of costing is applied.

Cost statements or cost sheets are prepared in which various items of expense are classified and the total expenditure is divided by the total quantity produced in order to arrive at per unit cost of production. The method is suitable in industries like brick making, collieries, flour mills, paper mills,cement manufacturing etc.

Method 2 # Multiple Costing

Under this system, the costs of different sections of production are combined after finding out the cost of each and every part manufactured. The system of ascertaining cost in this way is applicable where a product comprises many assailable parts, e.g., motor cars, engines or machine tools, typewriter, radios, cycles etc.

Costing Methods – Specific Order Costing and Operation Costing

Various methods and techniques have been developed of cost accounting to meet the specific needs of the business organisations. The methods for calculating cost of production differ from industry to industry.

The methods of analysis and presenting the costs are different for different industries because of the difference in the nature and type of products produced or services rendered. The selection of the method of costing primarily depends on the manufacturing process and also the method of measurement of finished product.

Basically there are two methods of cost accounting:

These are:

1. Specific Order Costing

2. Operation Costing

1. Specific Order Costing:

These methods are applied where the work or job is of a special nature (i.e., according to the special requirement of the customer). As the design of a dress, design of furniture, design of the grill, design of the house etc. Under this method production takes place only when the order is received from the customer.

These include:

(a) Job Costing

(b) Batch Costing

(c) Contract Costing

(a) Job Costing:

Jobs are to be performed under the specific instructions of the individual customer. Every customer has special taste, design, quality of work and spending power. So the jobs are not comparable to each other. Each job has its own unique features.

Jobs are to be performed in a small duration, within the factory premises, and they are generally of small value. Under job costing work starts only after receiving the order of the customer. Examples can be – printing press, tailoring of dress, interior decorators, machine tool manufacturing, furniture making (specially designed) repair work etc.

(b) Batch Costing:

When the small orders of a large number of customers are made into one group on the basis of similarities of material, method, or nature of working it becomes one batch of products to be produced. A batch may refer to a number of small orders passed through the factory in a Batch (group).

The cost of each batch is calculated separately and one batch is considered as one cost unit. Cost per unit is calculated by dividing the cost of the batch by the number of units produced in the batch. This method may be applied in the industries producing medicines, toys, readymade garments, etc.

(c) Contract Costing:

This method is applied in those cases where the work to be performed is big, involves a lot of investment and takes more than a year to be completed. Contracts are carried outside the factory, generally at the work site.

In contract costing cost of each contract is ascertained separately. The contracts are generally of constructional nature like construction of roads, buildings, bridges, water works, dams, etc. This method of costing is applied by builders, civil engineering contractors, ship builders and various other mechanical engineering firms, etc.

2. Operation Costing:

When goods are produced on mass scale and of the standardised nature without waiting for the order of the customer. The produced goods are kept in stock and the order of the customers are compiled from the stock of finished goods. The production takes place continuously. The production is of repetitive nature. As for example, cement, fertilizer clothes, medicines, paints, sugar etc.

This includes the methods like:

(a) Process Costing System

(b) Unit Costing System

(c) Operating Costing System

(a) Process Costing System:

When the raw material has to pass through various processes, or departments or stages before it is converted into finished goods the method applied for cost calculation in these industries is known as process costing system.

The production is continuous under this method. In process costing the output of the first process becomes the raw material for the second process and the output of the second process becomes the raw material for the third process and so on until the product becomes finished goods ready for sale.

In process costing the cost of production for each unit is calculated at the end of each process or department. As the output takes continuous process the method is also known as continuous costing method. This method is applied in mass scale industries which produce the standardised product.

Under this method cost per unit is obtained by dividing the total cost of production by the number of units produced during the process. This method may be applied in industries like – sugar, textile, chemical, paper, paints, petroleum products etc.

(b) Unit Costing System or Single Output Costing:

This method of costing is applied in those industries which produce identical output and only one product. The output takes place by continuous manufacturing activity. Cost per unit is calculated by dividing the total cost by the number of units produced.

Under this method to calculate the cost of production a cost sheet with all the components of cost is prepared for a specific period or specific order of output. This method can be applied in the cement industries, fertilizer industries, mines, collieries, brick-kiln, flour mills, etc.

(c) Operating Costing System:

In cost accounting cost per unit of a product produced or service provided is calculated. When cost per unit of service provided is calculated then the system of costing applied is known as operating costing.

In daily life we the human being and human life need various services like transport service, telephone service, electricity service, medical services, education services, hotel services, water supply, etc.

The definition of the unit for which service cost is calculated is very important to define like passenger-km, pulse rate per minute or second, kilowatt-hours, patient per bed etc. It means it is a combination of two single units for which operating cost is calculated. Under operating cost system costs are divided into two parts, i.e., standing cost and running cost (charges).

Methods of Costing – Classified into Groups: Specific Order Costing, Non-Specific Order Costing and Others

There are different methods of costing for different industries depending on their nature of work. For example, the chemical industry follows a continuous production process where raw material is processed at different stages.

There are other industries which undertake jobs of different kinds. For example, a motor workshop accepts different jobs. In industries like transport, banks or insurance, the whole activity centres around certain service operations.

Similarly, many other industries may undertake production of only one product. Since the very nature of production processes and the methods of work differ from industry to industry, it becomes imperative to use different methods of costing.

However there are two basic methods of cost accounting, viz.:

(i) Job costing

(ii) Process costing.

All other methods of costing are either a variation, improvement, extension or combination of these two basic methods.

All methods of cost accounting may be classified into three groups:

1. Specific Order Costing:

(i) Job costing

(ii) Batch costing

(iii) Contract costing

(i) Job Costing:

This refers to a method of costing where the items of direct costs are traced to specific jobs orders. Each job or order is specific and involves different operations. The objective is to ascertain the cost of each job or order. A job cost card is prepared for each job to accumulate costs.

The cost of the job may be determined by adding all costs against the job when it is completed. As production is not continuous and each job may be different, more managerial attention may be required for effective control. The job costing method is used in printing foundries and general engineering workshops, interior decoration, advertising, etc.

(ii) Batch Costing:

Where small components of the same kind are required to be manufactured in large quantities, the method of costing used is called batch costing. In this, a batch of similar products is treated as a job and the costs are accumulated in respect of a batch. In a bicycle producing factory, if rims are produced in batches of 5,000 each, costs will be determined in relation to a batch of 5,000 rims.

(iii) Contract Costing:

This method of contract costing is used where a job is very big and takes a long time to complete. In this the cost of each contract is ascertained separately. It is suitable for firms which are engaged in the construction of bridges, roads, buildings, factories etc., on a contract basis.

2. Non-Specific Order Costing:

(i) Process and operation costing

(ii) Unit or single output costing

(iii) Operating costing

(i) Process and Operation Costing:

In industries where a continuous process of production is carried and the product is homogeneous, the method of ascertaining the cost of the product is called process costing. As distinct from job costing, in these industries, the cost of each process is determined for a given period of time.

Products lose their individual identity as they are manufactured in a continuous flow. Production process is usually standardised and quite stable. Therefore, control is comparatively easier. To determine the cost per unit, the total cost of production is divided by the total output produced during the period.

This method of costing is extensively used in steel, sugar, textiles, chemicals, soap, vanaspati, paper and paint manufacturing organisations.

Operation costing is an extension of process costing. This method of costing can be applied to all those process industries where a process comprises a number of distinct operations. In such industries, the cost of each operation is determined instead of a process.

(ii) Unit or Single Output Costing:

This method is applied in undertakings, which produce only product. Examples of such undertakings are – mines, quarries, collieries and breweries. The cost is determined per unit of measurement with which the ultimate production is measured.

(iii) Operating Costing:

In service rendering undertakings, the method of costing used is operating costing. For examples, transport, water supply, electric undertakings, telephone services, hospitals, nursing homes, etc. use this method of costing. A special feature of operating costing is that the unit of cost is generally a compound unit. For example, the unit of cost in electricity supply is kilowatt hour.

3. Others:

(i) Multiple or composite costing

(ii) Uniform costing

(i) Multiple or Composite Costing:

In some cases two or more methods of costing are used to determine the cost of the final product. This happens when a product consists of a number of parts and requires an assembly.

For example, in bicycles, the cost of the components will be determined through the batch costing method. But to arrive at the cost of assembling the product, the unit or single output method of costing will be used. The same is true of automobile and aeroplane industries.

(ii) Uniform Costing:

When various undertakings, under the same or under different managements in the same industry, use the same principles and/or practices of costing they are said to be using the method of uniform costing. In such a situation all costing information is dealt with in a similar manner. The use of uniform costing facilitates inter-firm comparison.

What are the Different Methods of Costing?

Basically, there are two methods of costing:

1. Specific order costing, and

2. Non-specific order costing.

These are explained as under:

1. Specific Order Costing:

It includes:

(i) Job order costing,

(ii) Contract costing or terminal costing and

(iii) Batch costing.

(i) Job Order Costing:

It is a system of assigning manufacturing costs to an individual product or batches of products. Generally, the job order costing system is used only when the products manufactured are sufficiently different from each other. It is used in printing, repair shops, interior decoration, etc.

(ii) Contract Costing:

It is the tracking of costs associated with a specific contract with a customer. For example, a company bids for a large construction project with prospective customers and the two parties agree in a contract for a certain type of reimbursement to the company.

(iii) Batch Costing:

Batch cost is the cluster of costs incurred when a group of products or services are produced, and which cannot be identified to specific products or services within the group. For cost accounting purposes, it may be considered necessary to assign the batch cost to individual units within a batch.

2. Non-Specific Order Costing:

It includes:

(i) Process costing,

(ii) Operation costing,

(iii) Single output or unit costing,

(iv) Operating or service costing,

(v) Departmental costing.

(i) Process Costing:

Process costing is used when there is a mass production of similar products, where the costs associated with individual units of output cannot be differentiated from each other. Under this concept, costs are accumulated over a fixed period of time, summarized and then allocated to all of the units produced during that period of time on a consistent basis.

(ii) Operation Costing:

Operating costing is a mix of job costing and is used in either of the following situations. A product initially used different raw materials and is then finished using a common process that is the same for a group of products or a product initially has identical processing for a group of products, and is then finished using more product-specific procedures.

(iii) Single or Output Costing:

Single or output costing is employed in case of industries where the production is uniform and a continued affairs, the units of production are identical and the cost units are physical and natural. The system is therefore, most commonly used in case of industries like bricks-works, cement-works, sugar mills, etc.

(iv) Operating Costing:

It is a method designed to ascertain and control the costs of the undertakings which do not produce products but which render services. Also known as service costing, operation costing is the cost of rendering services. It is the cost of producing and maintaining a service.

(v) Departmental Costing:

Under this method costs are ascertained department by department, generally, for ascertaining the cost of various goods or services produced by the department, the total costs will have to be analyzed, say, by the use of job costing or unit costing.

Methods of Costing – 2 Main Types of Product Costing Systems

Methods of cost accounting are the procedures by which product costs are accumulated. Different methods of cost finding are used because businesses vary in their nature and the type of products or services they produce.

There are two main types of product costing systems based on actual cost. These are:

1. Job costing

2 Process costing

1. Job Costing:

Job costing is specific order costing. It is designed to accumulate cost data for a manufacturing firm that produces goods of separate identification.

The key features of a job costing are:

i. Each job is a cost unit, and is of a comparatively short duration. Hence, generally each job is different from the other.

ii. Work is undertaken to customer’s special requirements,

iii. Each job moves through stages as an identifiable unit. Examples are, repair job in a garage, printing orders in a printing press.

The main variants of job costing are:

(a) Contract costing; and

(b) Batch costing.

(a) Contract (Terminal) Costing:

It is a method of costing in which each contract is taken as a separate costing unit for the purpose of cost ascertainment and control. The objective is to find out the profit or loss on each contract separately.

The terms of the contract usually allow for progress payment during the course of construction. This method is employed by firms engaged in ship-building, civil engineering for roads, bridges, dams, industrial estates, heavy engineering, factory construction, etc.

(b) Batch Costing:

It is a form of job costing in which a batch of identical products is taken as the cost unit. Here costs are accumulated by batches or runs. The manufacture of wooden pencils may be by batch so that a batch includes pencils of different colours, size or lead softness. Other examples include drugs, cigarettes, footwear, clothing, printing, engineering equipment, etc.

2. Process Costing:

It is a method of costing in which costs are accumulated by processes.

The key features of process costing are:

i. Manufacturing activity is carried on continuously.

ii. The output of one process becomes the input of the next process. Each process becomes the cost unit.

iii. When there are more than one process, costs flow from one process to the other process.

iv. It is not possible to trace the identity of a particular lot of output to any particular lot of input.

v. Costs are averaged over the units to find the average cost per unit.

vi. Joint products/by-products occur in the process.

Each process is treated as a cost centre and a separate account is opened for it. All costs relating to each process are debited to the respective process account. The output passing through the process is also recorded.

The total cost for a period divided by the units processed in that period gives the cost per unit in that process. This method is suitable for chemical works, sugar, paint manufacturers, oil refineries, bottling companies, breweries, rubber and tanning industries.

The main variants of process costing are:

(a) Single or output costing,

(b) Operation costing and

(c) Operating costing.

(d) Multiple (Composite) Costing

(a) Single or Output or Unit Costing:

The object of this method is to ascertain the cost per unit of output and the cost of each element of such cost. The unit of costing is chosen according to the nature of the product. This method is suitable for industries where manufacture is continuous and units are identical.

This method is applied in case of automobiles, refrigerators, typewriters, television and radio sets, mines and quarries, steel plants, brick works, paper manufacture etc.

(b) Operation Costing:

Here, the cost unit is an operation rather than the whole process (a process consists of a sequence of operations). Yarn spinning is a process but it does involve a series of operations. It is employed by firms where standardised goods or services are produced from a sequence of repetitive and more or less continuous operations. The firms could be those engaged in the manufacture of bicycles, ceiling fans, weighing machines, etc.

(c) Operating Costing:

Also known as service costing, it is a distinct type of costing where services are being provided rather than goods manufactured. This method is employed by undertakings like transport, electricity, gas, hospitals, hotels, educational institutions, etc. Naturally, the cost unit depends upon the service provided, e.g. tonne-km, passenger-km, patient-day, etc.

(d) Multiple (Composite) Costing:

Where more than one method are used together, the method becomes a composite or multiple costing method. This method is used in industries where a number of component parts are separately produced and subsequently assembled into a final product. It is suitable for factories manufacturing cycles, automobiles, television sets, radios, typewriters, aeroplanes etc.

Methods of Costing (Cost Accounting) – Historical, Normal, Standard, Absorption Costing, Marginal Costing, Direct Costing, Differential Costing

The methods of costing are briefly describe/defined below:

1. Historical costing

In this, product costs (material, labour and overheads) are ascertained after they have been actually incurred.

2. Normal costing

This is an improvement over historical costing. In this, product cost can be ascertained even before all the costs have been incurred. This is done by using historical (actual) costs of material and labour and predetermined rates for overhead costs.

Thus, normal costing differs from historical costing only in the treatment of overheads. It is termed normal costing because the overheads are applied to products on an average or ‘normalised’ basis, i.e., using budgeted overhead rates. The product cost so determined is called normal cost.

3. Standard costing

It involves the preparation and use of standard costs, their comparison with actual costs and the analysis of variances to their causes and points of incidence.

4. Absorption costing

This follows the practice of charging all costs variable and fixed to operations, processes or products.

5. Marginal costing

It is a technique of costing which considers only variable costs for decision making. In this, an ascertainment is made of marginal cost and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs.

In this, only variable costs are charged to products, processes or operations while fixed costs are written off against the profits for the period in which they arise. In the U.S., the term ‘direct costing’ or ‘variable costing’ is used for marginal costing.

6. Direct costing

In this, all direct costs, fixed as well as variable, identifiable with a product, service, job or activity are charged to the concerned product, service, job or activity and all indirect costs are written off to the profit of the period in which they arise.

7. Differential costing

A technique of costing which uses differential costs and/or differential revenues for ascertaining the acceptability of an alternative is called differential costing. The technique may be termed as incremental costing when the difference is increase in costs and decremental costing when the difference is decrease in cost.

Methods of Costing as Followed by Different Industries

Different industries are obliged to follow different methods of costing because of the differences in the nature of their work.

The various methods of costing are:

1. Job Costing:

This method of costing is applied where production is not repetitive and is done against orders. The work is generally carried out within the factory. Each job is treated as a distinct unit and related costs are recorded separately. It is suitable for repair shops, printing press, painting and decorating, etc.

2. Batch Costing:

It is a form of job costing in which a batch of production is treated as a job. The total cost of the batch is then divided by the number of articles produced in that job to determine the unit cost of the articles produced. It is used in the production of ready-made garments, toys, bicycle parts, biscuits and confectionery.

3. Contract Costing:

It is also a variation of job costing. If a job is big, it is known as a contract. Contract is a big job and a job is a small contract. Each contract is considered as a separate cost unit for the purpose of ascertaining the cost. It is most suited to construction work, ship building, etc.

4. Process Costing:

Where the manufacture is of a repetitive type, consisting of different distinctive processes, the output of one process being the input of the subsequent process and the cost of the output of each process has to be ascertained separately, the method of costing applied is known as process costing. It is applied in textile mills, paper mills, chemical works, etc.

5. Operating Costing:

This method of costing is adopted for determining the cost of providing a service such as transport, electricity, water, catering, etc. It is an extension of process costing. It can be applied to all those process industries where a process comprises of a number of distinct operations. In such industries, the cost of each operation is determined instead of a process.

6. Unit or Output Costing:

This method of costing is applied where production is continuous, uniform and consists of only a single product or a few products of similar type with variations in size, quality, shape, etc. It is applied to such industries as mining quarries, brick making, flour mills, etc.

7. Multiple or Composite Costing:

In certain industries, two or more methods of costing are applied to ascertain the cost of the final product. This happens when a product consists of a number of parts and requires an assembly.

For example, in bicycle manufacturing industries, the cost of the components will be ascertained through batch costing method. But to arrive at the cost of assembling the product, the output costing method will be applied. The same is true for automobile and TV industries.

9 Methods of Costing: Job Costing, Contract Costing, Batch Costing, Multiple Costing, Process Costing, Single Output or Unit Costing, Operation Costing, Operating Costing and Departmental Costing

The following are important methods of cost accounting or costing:

Costing Method # 1. Job Costing:

It is defined by ICMA, London as, “that form of specific order costing, which applies where work is undertaken to customers’ special requirements”. It means and applies to an industry which produces a definite article against individual orders from customers.

Job costing is of a shorter duration than contract costing. The work is carried out and each job moves through the process as a continuously identical product.

Where the cost of separate job is wanted, job costing method can be applied. This is a system of costing where the items of direct costs are traced for specific jobs or orders. Each job involves different operations.

The object of job costing is to ascertain the cost of each job separately. Every job is given a number and related costs are recorded separately. This type of costing is suitable for printing press, automobile garages, repair shops, building yards, furniture manufacture, heavy machine etc.

Costing Method # 2. Contract Costing:

The method of contract costing is applied where the job is big and of longer duration. For each individual contract, separate accounts have to be kept. Basically, this type of costing is similar to job costing, but takes longer time. It is also known as Terminal Costing. Each contract is given a number for identification. It applies to a concern like constructional work, roads, bridges, buildings etc.

Costing Method # 3. Batch Costing:

A batch may represent a number of small orders passed in batches through the factory. The unit of cost is a batch or group of identical products.

ICMA defines as, “that form of specific order costing, which applies where similar articles are manufactured in batches either for sale or for use within the undertaking. In most cases, the costing is similar to job costing”.

The total cost of a batch is ascertained; the same is divided by the number of units in the batch so as to know the cost per unit. All the units of a particular batch are uniform in nature and in size. This type of costing is adopted by industries producing medicines, biscuits, spare parts and components etc.

Costing Method # 4. Multiple Costing:

It means a combination of two or more of the above methods. This system of costing is adopted in manufacturing concerns where a variety of parts are produced separately and later assembled into a final product. The total cost consists of the cost of all the parts which go to make a final product. It is also known as composite costing.

One system of costing cannot be applied due to the fact each component differs from the other in respect of materials and manufacturing process. Therefore, it is a system of different methods such as job costing, unit costing, operation costing etc. This type of costing is in force in industries where cycles, radios, typewriters, and other complex items are produced.

Costing Method # 5. Process Costing:

It applies to industries where production is carried on through different stages (processes) before becoming a finished product. The output of each process becomes input of the next process; i.e., finished product of one process becomes the raw material of the subsequent process.

This is particularly important where by-products arise or wastage occurs at any stage. Finished products are obtained at the end of each process. It is necessary to ascertain the cost of each process and the cost per unit at each process.

Each process has an account to which all expenditure is charged. The process cost per unit in different processes is added to find the total cost per unit.

For example, take the sugar manufacture; the first stage is crushing the cane; the next stage is boiling juice into gur; the next stage is the conversion of gur into unrefined sugar and the final stage is the refining into white sugar that we get in the market.

The product under production yields by-products and wastage may also occur at stages. This method also helps in accounting for the by-products and wastages. This type of cost accounting is suitable for industries, such as chemicals, oil, paboveics, paint, rubber, glass, cement, varnish, soap, explosives etc.

Costing Method # 6. Single Output or Unit Costing:

Under this method production is continuous and units are identical. Producing a single article or a few articles, choosing the cost unit depends upon the nature of the product. By preparing a cost sheet, the cost per unit is arrived at by dividing the total cost by the total number of units produced. This method is suitable to industries producing pencils, cigarettes, dairy products, brick works, mines, steel works etc.

Costing Method # 7. Operation Costing:

This method is used where there is a mass production and processes are repetitive in nature, and there is a detailed application of processes costing. The procedure of costing is broadly the same as per process costing, except that cost unit is an operation instead of a process. Then each manufacturing process can be distinguished as a separate operation. Operation costing is confined to every minute operation of each process.

Since, this method provides for a more minute analysis of costs, it ensures greater accuracy and better control of costs. Hence, the cost of each operation per unit and cost per unit up to each stage of operation can be found out.

Therefore, it facilitates in solving problems, whether all the operations are profitable or not; in case of unprofitable operations, it can be given to outsiders. This method is adopted by industries like, toy-making, leather, engineering, spare parts etc.

Costing Method # 8. Operating Costing:

It is suitable to those industries which render services instead of producing goods. This system is adopted where expenses are incurred for provision of services; for example, transport companies, electricity companies, railways, hospitals, canteens etc. The cost is based on a specified unit or composite unit like tonne-kilometre, passenger-kilometer, bed-days, kilo-watt hours etc.

Costing Method # 9. Departmental Costing:

It is a method of cost finding adopted to ascertain the cost of operating a department or a cost center separately. Where the factory is divided into a number of departments, this method is adopted.

The total cost for each department is found out and divided by the total units produced in that department and this will give cost per unit. For example, departmental stores, sellers, publishers etc.

Costing Methods – Continuous Operating Costing and Specific Order Costing

There are various organisations which are engaged in the manufacturing of various products or single product or product having variations in size, shape, quality etc. These manufacturing organisations need suitable costing methods to develop effective cost management for their products.

Manufacturing organizations need cost accounting methods for their product requirements. They are required to establish suitable cost accounting methods for recording and collecting costs, allocating and apportioning and absorbing them into products and services. They are also required to analyse and control the costs for better and effective management.

Selection of costing method generally depends on the particular requirements of the manufacturing firms. But, basic costing principles of collection, analysis, allocation, apportionment and absorption are the same. However, their practices and processes are governed by the specific requirements of the individual costing method.

The costing methods are broadly classified in the following manner:

i. Continuous Operating Costing

ii. Specific Order Costing

i. Continuous Operating Costing:

There are some manufacturing organisations which are engaged in mass production of products on continuous basis. These products are produced through continuous operations and directly sold from the stock. The products are not produced to the specific requirements of the customers.

According to CIMA, continuous operation costing is the basic costing method applicable where goods or services result from a series of continuous or repetitive operations or processes to which costs are charged before being averaged over the units prod-uced during the period.

Important features of continuous operation costing include:

(a) Process involves in production of identical units of output, and

(b) Total costs are divided by the number of units produced to give average cost per unit.

Classification of continuous operation costing is given below:

1. Output Costing

2. Process Costing

3. Operating Costing

4. Service Costing

ii. Specific Order Costing:

It is used generally by those organisations which are engaged in production of goods as per the specific order of the individual customer. These organisations are supposed to make/assemble/ contract jobs or products to suit the demand of the individual customer.

According to CIMA, Specific order costing is “the basic accounting method applicable where the work consists of separate contracts, job or batches each of which is authorized by a special order or contract.”

The specific order costing is further divided into the following:

1. Job Costing

2. Batch Costing

3. Contract Costing

The basic difference between continuous operation costing and specific order costing bears important implications. In continuous operation costing, all costs, i.e., materials, labour and overheads are collected, allocated or apportioned to cost centre’s from which these costs are averaged over the cost units produced.

However, specific order costing provides for charging materials and labour cost directly to cost units and overheads are collected, allocated and apportioned to a cost centre before absorbing the costs over cost units.

Everything you need to know about Different Costing Methods

Different methods of costing are applied for ascertaining unit cost in different industries based on the nature of operation and unit of finished product involved. All these methods have the same general principles but they differ in so far as the methods used in collecting and presenting cost data are concerned.

Basically, there are two methods of costing viz., Job costing and Process costing. Job costing is applied to special order type of industry which is devoted to the execution of specific orders such as printing press, ship building, house building, road construction, bridge construction etc.

The main object of job costing is to ascertain the cost and profit or loss in respect of each job, contract or project undertaken. Process costing is applied to mass production type of industry engaged in the continuous production of uniform standard products such as chemicals, oil, cement, cloth, yarn, mining, colliery etc. The main object of process costing is to ascertain the cost of process or operation involved in converting raw materials into finished products.

The different methods of costing, which represent finer divisions of these two basic methods, may be enumerated as follows:

Method # 1. Single Costing or Unit Costing:

This method of costing is applied to ascertain the total and per unit cost of standard product turned out in a manufacturing concern.

This method of costing is generally applied to industries where the following features are present:

(i) The output or production is continuous.

(ii) The units of output are identical.

(iii) The units of output are natural.

(iv) It is desirable to ascertain the cost per unit of output e.g., per tonne, per kilogram, per metre etc.

The above mentioned features are present in industries like collieries, brick works, flour mills, quarries, cement mills, paper mills, iron and steel mills, sugar mills etc., which are engaged in producing only one type of product or a few grades of the same product.

This method of costing is adopted with a view to ascertain the total cost and also the per unit cost by making a detailed analysis of different elements of cost (e.g., direct material cost, direct labour cost, direct expenses and overhead) under various heads e.g., Prime Cost, Works Cost, Office Cost and Total Cost.

This method does not require a detailed apportionment of overhead since all overhead are incurred on identical units but the production of few grades or various sizes of the same commodity shall require a careful apportionment of overhead to these grades and sizes. The analysis of cost may be presented periodically in the form of a statement (known as Cost Sheet or Statement of Cost) or an account (known as Production Account).

Method # 2. Process Costing:

This method of costing is employed to ascertain the cost of production in industries where a product passes through different processes or stages, each distinct and well-defined, before its completion.

Under process costing, there is a finished product at each stage or process (which becomes the raw material of the subsequent process till it reaches the final stage of completion) and this renders it necessary to know the cost of production at each stage.

Process costing method is generally applied to industries where:

(i) The production is continuous and is carried on for its own stock.

(ii) The finished product, before completion, has to pass through various processes or stages, each being separate and well-defined.

(iii) The order or the sequence of processes is specific and pre-determined.

(iv) The units manufactured are uniform and standardised.

(v) The finished product of each process becomes the raw material of the next process except that of the last process which is transferred to the Finished Stock Account.

This method is generally employed in industries like chemical works, distilleries, refineries, edible oils, soap making, food products, paints making etc. Under this method, a separate account is opened for each process and costing information is presented in the form of Process Account which is debited with the costs incurred thereon.

Method # 3. Job Costing:

Job costing is the method of costing which is applied to ascertain the costs of specific jobs or work-orders which are treated as contracts of small size. These jobs are generally dissimilar, of non-repetitive nature and may not be comparable with each other.

This method is also known as ‘Job Lot Costing’ or ‘Lot Costing’ and has the following main features:

(i) Under job costing, production is carried on by a manufacturer against customer’s order and not for own stock.

(ii) Each job or work-order is of a separate nature.

(iii) The jobs or work-orders are generally executed in factories, work-shops and repair-shops. But sometimes the job work is also done outside the factory or work-shop e.g., plumbing job, sewerage work etc.

(iv) The unit of costing, under this method, is a job or specific work-order.

(v) Under this method, the production and its requirements are determined first and then the expenses are ascertained in relation to it.

Job costing method is most suitable to such activities as printing press, painting and decorating, automobile garages, repair shops, electrical fittings, engineering works, plumbing works etc., where work is done according to the customer’s specifications.

Method # 4. Contract Costing:

This method of costing is applied in a business where separate contracts of non-repetitive nature are undertaken. A contract is a job of large size which may extend even beyond one accounting period. The person executing the contract is known as ‘Contractor’ and the person for whom it is executed is known as ‘Contractee’.

The main features of contract costing may be summarised as follows:

(i) Contracts are executed at contract site away from contractor’s premises.

(ii) Contracts are jobs of large size and may continue over more than one accounting period.

(iii) Each contract is treated as a separate unit of cost for the purpose of cost ascertainment.

(iv) The contracts are executed as per the specifications given by the contractee.

(v) Since the work is executed at the contract site, most of the items of cost to be incurred are direct in nature.

(vi) The contract is executed by the contractor for some agreed amount of consideration known as ‘Contract Price’.

(vii) The payments by the contractee are made to the contractor in instalments on the basis of the extent of the work already completed by him and certified as complete by contractee’s engineer or architect.

Contract costing is most suitable for ship-building, road construction, building construction, civil engineering works etc. The presentation of costing information relating to contracts is made in the form of a separate contract account opened for each contract.

Method # 5. Operating Costing:

Operating costing is the method of costing applied to ascertain the cost of providing or operating a service. This method of costing is employed in those undertakings which are engaged in operating or providing services rather than in manufacturing tangible products.

The undertakings, adopting operating costing, generally have the following features:

(i) These undertakings are engaged in rendering services of unique nature to their customers.

(ii) These undertakings are required to invest a large proportion of their total capital in fixed assets e.g., buses, trucks, motor lorries, ships, aircrafts, railway engines, wagons, railway lines etc.

(iii) The amount of working capital required to meet out the day-to-day expenses, is comparatively less.

This method is applicable to road transport undertakings, railways, tramways, airways, shipping companies, electricity companies, gas companies, hospitals, cinemas, hotels, canteens, water works etc. The presentation of costing information is made in the form of a statement known as “Operating Cost Sheet.”

Method # 6. Operation Costing:

Operation costing represents a refinement of process costing. Under this method, the cost of each operation in each process or stage of production is ascertained separately. Operation cost generally refers to ‘conversion cost’, i.e., cost of labour and overhead.

At the end of each operation, unit operation cost is ascertained by dividing the conversion cost by output. Thereafter, the cost of finished unit is determined by adding the material cost and the cost of various operations through which it passes.

This method is employed in industries where mass or repetitive production is carried out or where articles or components have to be stocked in semi-finished stage, to facilitate the execution of special orders, or for convenience of issue for later operations.

Method # 7. Multiple or Composite Costing:

Multiple or composite costing is applied to ascertain the cost of complex products manufactured by a manufacturing concern where no single method of costing is applicable. Under this method, the total cost is ascertained by aggregating component costs which are collected by both job costing and process costing.

Multiple costing is applied to industries engaged in the production of bicycles, motor cycles, scooters, motor cars, radios, televisions, typewriters, accounting machines, engines and other complex products.

Method # 8. Departmental Costing:

This method of costing is adopted where the factory is divided into several departments and it is desired to ascertain the cost of production of each department rather than the cost of each article produced. Under this method, the costs are first allocated to the various departments of the manufacturing concern and then to the different products manufactured in a particular department.

What are the important methods of Costing?

1. Job costing

In this case, the cost of each job is determined separately. It is suitable in cases where a product is made according to customer’s order, such as paper printing press, motor workshop, stainless steel tanks, etc.

2. Batch costing

It is the derivative of job costing. The batch may consist of a number of small orders passed through the factory in batches. Each batch constitutes a unit of cost, and thus separately costed. Here, cost per unit is ascertained by dividing the total cost of a batch by the number of units produced in that batch.

Suppose a factory produces a certain quantity of a part within a given period, say 5,000 screws of bicycle of a specific type, then the cost incurred for this batch can be determined separately. In this case, like a job, the specific cost can be ascertained. In such a case, it is known as batch costing.

3. Contract costing

The cost of each contract is computed separately. It is suitable for firms engaged in the construction of bridges, roads, buildings, etc.

4. Single or output costing

This type of costing is implemented in industries where only a single product is manufactured, e.g., bricks, coals, only one type of detergent powder, etc.

5. Process costing

The cost for completing each stage or process of work or process is determined, e.g., cost of making yarn from cotton. In mechanical operations, the cost of each operation is calculated separately. This is known as the method of operation costing.

6. Operating or service costing

This type of costing is used in firms which render services, e.g., luxury buses concerns, telecom companies, truck transport undertaking, etc.

7. Multiple costing

When any of the above two or more methods of costing are combined, it is termed as multiple costing. Suppose a firm manufactures television sets including its components; then either job or batch costing is followed for costing the parts, but the cost of assembling the television set will be computed by the single or output costing method. The overall system of costing is called as multiple costing.

Top 3 Methods of Costing (as Studied in Cost Accounting)

(1) Job or Batch Costing:

This method is adopted, in a factory undertaking a large number of jobs according to customer specifications. Each individual job or batch of jobs is taken separately for costing purposes. It may be a large job or a small job; an individual order or a number of small orders treated as a batch.

It may even be a stock order for stock replenishments for one’s own use. In each case, a cost account is opened for the particular job or batch and all the appropriate expenditure is charged to it. The actual time spent by workers on the job, as recorded on time sheets, or job cards, indicates the direct labour element of the job.

Direct materials are taken into cost as per the priced requisitions from the stores; which parts brought from sub-contractors and any work subcontracted, are directly allocated as a simple percentage of the labour cost or time, as a machine-hour rate, as a percentage of the material cost or according to some other appropriate method, devised by each unit, considering investment in plant and machinery, etc.

(2) Process Costing:

Process costing is normally applied in any industry or a factory, where the final product has passed through several distinct stages of manufacture (processes). It is common in industries such as – textile manufacturing units in which the basic raw materials like wool, cotton, asbestos, and man-made fabrics undergo such processes as according, dyeing, spinning and weaving before emerging as the finished product; or in continuous industries, e.g., the manufacture of gas, chemicals, glass and paper industries.

In process costing, it is customary to ascertain the cost of operating each process to which all expenditure incurred is charged. When the process or a particular operation is complete, the partially completed product passes to a process cost account, from which it is requisitioned for the next process; or it becomes the raw material of the next process, and is then charged to that process account.

Three special problems arise from process costing.

(a) Firstly, in the manufacture of main product, certain by-products may be unavoidably obtained.

(b) Secondly, wastage is inevitable but it should be kept as near as possible to the theoretical minimum, and

(c) Thirdly, the main product of the one firm may be the by-product of another firm that may be available in the open market, at a lower price than the cost of producing it in one’s own factory.

(3) Standard Costing:

Standard costing is a method by which actual costs are compared with targeted or estimated costs. Standard costs have been defined as the value of work which it is estimated, should be provided in a given period of time. It provides a method of analysing the deviations from the forecast and measures the costs of these deviations in terms of money.

It is generally applied in repetitive industries where a large range of products are produced with relatively few operations. It is also applicable to jobs or batch productions, which are based on standard processes or standard operations, for which standard operation times, etc., can be pre-set.

Costing Methods – Job Costing, Batch Costing, Contract Costing, Process Costing, Operation Costing, Output Costing, Operating Costing (With Formulas)

The basic object of Cost Accounting i.e., the ascertainment or analysis of cost with respect to the individual cost centre, is the universal object and remains the same in case of all types of operations.

However, the manner in which this objective is achieved does not remain the same in case of all the operations. As such, it is necessary to adopt the most suitable of the various methods of costing, depending upon the nature of operations.

There may be basically two branches of the methods of costing, the remaining methods being the variants of these basic methods

A. The first branch consists of the methods like:

1. Job Costing

2. Batch Costing

3. Contract Costing.

B. The second branch consists of the methods like:

1. Process Costing

2. Operation Costing

3. Output Costing

4. Operating Costing.

We will discuss these methods in brief:

Costing Method # 1. Job Costing:

This method of costing is applicable where individual jobs are identifiable and each of the jobs becomes a cost centre. As such, the basic aim of costing in this type of costing is to ascertain and analyse the cost with respect to the individual jobs. This basic aim may be achieved by preparing the job cost sheet.

By valuing the material requisition slips, the cost of the material may be available. By analysing the wages register, the cost of the labour may be available. The overheads which cannot be allocated to the individual jobs, may be apportioned on some suitable basis.

Costing Method # 2. Batch Costing:

In case of this method of costing, the batch of the products is a cost centre. The costs are collected and analysed with respect to the individual batches. This method of costing can be extensively used in case of organisations which produce various components in convenient economic batches for subsequent assembly or which produce comparatively small number of items on large scale.

The basic principles for collecting and ascertaining the cost are similar to those as in case of job costing. By valuing the material requisition slips, the material cost may be available. By analysing the wages register, the cost of labour may be available.

The overheads which cannot be allocated to the individual batches, may be apportioned on some suitable basis. However, one peculiar question is required to be decided with respect to the batch costing and that is “What should be the size of the batch?”. When the production is carried out in intermittent batches, two types of costs may be associated with the same.

Firstly, there may be the costs in the form of machine set up and machine disassembly on the completion of the batch. These costs are independent of the size of the batch and as such, aggregate of such costs may reduce if the size of the batch is large and vice versa.

Secondly, there may be the costs incurred for carrying the inventory of batch units. If the size of the batch is large, the number of units to be carried in stock and thus the costs attached with the same are also large.

As such larger the batch size, higher will be the aggregate of inventory carrying costs and vice versa. The inventory carrying costs may consist of the costs like storage cost, insurance costs, interest on funds blocked and so on.

Thus, the setting up costs and the carrying costs vary conversely with the increasing size of batch. From a prudency point of view, the intention would be to reduce total of such costs to minimum. As such, determination of the economic batch quantity is important.

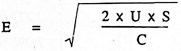

It is possible to decide the economic batch quantity with the help of following a simple and popular formula.

Where

E = Economic Batch Size

U = Annual usage in units

S = Setting up and order processing cost per batch.

C = Unit carrying cost for one year.

It may be observed that the above formula is similar to that for Economic Order Quantity (EOQ).

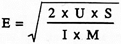

If the annual rate of interest and the manufacturing cost per unit is known, the said formula takes the following form –

Where

E = Economic Batch Size

U = Annual usage in units

S = Setting up and order processing cost per batch

I = Annual rate of interest

M = Unit manufacturing cost.

As such, time gap between two production runs –

Costing Method # 3. Contract Costing:

Under this method of costing, every contract accepted for execution is treated as the cost centre and the costs are ascertained and analysed with respect to the contract accepted for execution. This may be done by preparing a contract account for every contract.

This method of costing is applied extensively in case of concerns like builders, civil engineering contractors, construction firms etc. The specific aspect of contract costing as a method of costing, is that majority of the costs can be allocated to the individual contracts. Overheads form comparatively an insignificant portion which can be apportioned on some suitable basis.

The various costs in relation to the contract may be in following forms:

i. Material Cost:

This represents the cost of material consumed for contract and debited to contract account.

This comprises of the following items:

Cost of material purchased for contract

Add – Cost of material transferred from another contract

Add – Cost of material issued from stores.

Less – Cost of material returned to stores

Less – Value of material at site on accounting year end.

ii. Labour Cost:

This represents the remuneration paid to all workers engaged on a contract either directly or indirectly (i.e., through subcontractor)

iii. Expenses:

This represents all costs except material cost and labour cost.

iv. Plant and Machinery:

This represents the cost for the use of plant and machinery for the contract.

This may be decided in either of the following ways:

a. If the machinery is used for the contract only for a short period of time, contract account may be charged with the hourly rate x number of hours of use.

b. If the machinery is used for a longer period of time, the contract account may be debited with the original cost of the same and at the end of contract, contract account may be credited with the sale proceeds of machinery or depreciated value of machinery.

However, certain peculiar features of contract costing need to be considered:

i. In case of large contracts, the contractor cannot afford to receive the contract price at the end of contract only and hence obtains funds from contractee from time to time depending upon the extent to which the contract work has progressed.

At the same, the contractee is not technically competent to judge the extent of completion of the work. As such, he may take the help of an independent surveyor who issues the certificate to certify the extent of work completed and on the basis of this certificate the contractee pays the money to the contractor.

ii. In case of large contracts, the execution and completion of the contract may be extended to more than one accounting year, however financial statements are required to be prepared every accounting year.

The profitability of the contracts cannot be assessed correctly before the completion of the contract, though it may be necessary to decide the profitability on incomplete contacts for the purpose of financial statements. If this is not done, the profitability statements will disclose a very high amount of profits in the year in which contact is completed.

As such, it is ideal to take credit of conservative part of estimated profit on large contracts at the end of accounting year.

There may be various methods available to decide the amount of profit on incomplete contracts for taking credit to profit and loss account:

(a) If the Contract is not Sufficiently Advanced:

No credit is taken to profit and loss account towards profit on incomplete contracts.

(b) If the Contract Work is Sufficiently Advanced:

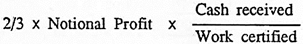

For this, the notional profit is calculated as below:

Value of work certified.

Less – Cost of work certified.

The amount of profit for credit to Profit and Loss Account is decided as below –

(c) If the Contract Work is Almost Complete:

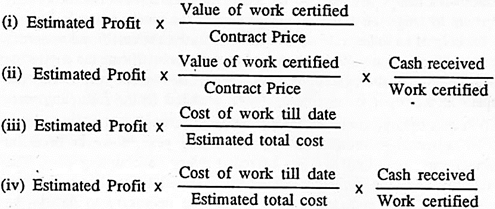

For this, the estimated profit is calculated as below –

Value of contract

Less – Cost of contract till date

Less – Estimated additional expenditure to complete the contract.

The amount of profit for credit to profit and loss account is decided in any of the following ways:

iii. Valuation of Work in Progress:

For the purpose of Balance sheet, the work in progress may be valued in the following way:

Cost of contract till date

Add – Amount of profit credited to profit and loss account

Less – Cash received.

Costing Method # 4. Process Costing:

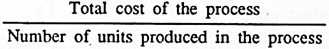

Under this method of costing, costs are ascertained and analysed with respect to the individual processes carried on and the unit cost of the product is determined as below –

This method of costing is extensively used in industries like chemical, paper, paint, textile, oil refining, cement, glass and so on, where the production processes are of a continuous and repetitive nature.

Job Costing vs. Process Costing:

i. Job costing is applicable where the production is done as per specific order and the jobs are independent from each other, so that they can be identified separately.

Process costing is applicable where the production is carried out on continuous basis and is of repetitive nature, and as such the products do not have any individual identity.

ii. In case of job costing, every job is a cost centre and the costs are ascertained and analysed with respect to the various jobs accepted for execution.

In case of process costing, every process is a cost centre and the cost are ascertained and analysed with respect to the individual process and the unit cost of the product is decided as –

iii. In case of job costing, the cost is ascertained when the job is completed. The question of determination and valuation of work in progress does not pose much of the difficulty.

In case of process costing, cost is required to be ascertained at the end of accounting period. The question of determination and valuation of work in progress is a peculiar problem faced in case of process costing.

iv. In case of job costing, generally there is no transfer from one job to another and even if there is such transfer taking place, the impact of the same can be easily ascertained. In case of process costing, as the production is on a continuous basis, transfer of work from one process to another till the final manufacture of the final product is a routine feature.

v. In case of job costing, as the individual jobs are independent from each other, the degree of control which is required to be exercised is much more. In case of process costing, as the production is of continuous, repetitive and standardised nature, the degree of control which is required to be exercised is much less.

The basic principles for collecting and ascertaining the costs are similar to those as in case of any other method of costing. By valuing the material requisition slips, the material cost may be available. By analysing the wages register, the labour cost may be available.

The overheads which cannot be allocated to the individual process may be apportioned on some suitable basis. For calculating the unit cost of the product, the total cost of the process may be divided by the number of units produced in the process.

However, the determination of the number of units produced during an accounting period may pose problems, specifically due to the stock of work in progress existing at the beginning and at the end of an accounting period.

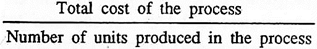

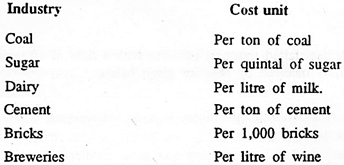

To overcome this difficulty, the stock of work in progress is expressed in terms of equivalent completed units and the units produced during the accounting period are calculated as –

Number of units produced and completed.

Add – Closing stock of work in progress in terms of equivalent completed units.

Less – Opening stock of work in progress in terms of equivalent completed units.

E.g., Work in progress on 1.1.89 – 10,000 units 50% complete.

Work in progress on 31.12.89 – 15,000 units 40% completed.

Units produced and transferred to finished goods – 90,000.

The units produced during 1989, in terms of equivalent completed units, can be expressed as below:

It should be observed here that it is assumed in the above example, that the extent of completion with respect to the individual cost components of work in progress (i.e., material, labour and overheads) is uniform, which is rarely the case in practice.

As such, while computing the equivalent completed units, the extent of completion with respect to the individual cost components is required to be considered.

Merits of Process Costing:

i. By using predetermined overhead absorption rates, the costs can be ascertained at very short intervals.

ii. Due to standardised operations, it is easy to establish the standards which facilitate effective managerial control by making proper evaluation of estimated and actual performance.

iii. Due to standardised operations, it is easy to submit the price quotations promptly.

iv. Allocation of costs is easier and more accurate.

v. The process of cost ascertainment is comparatively simple and less expensive.

Demerits of Process Costing:

i. The cost ascertainment is made at the end of the accounting period and being historical in nature may be less effective from control point of view.

ii. The valuation of work in progress is not accurate. The extent of completion with respect to individual cost components cannot be determined accurately and involves a degree of approximation.

iii. Due to the problem of accurate determination of work in progress, the ascertainment of equivalent completed units also tends to be approximate and as such unit cost of production is also not accurate.

iv. When more than one product emerges out of one process only, the determination of unit cost of production is more difficult.

Costing Method # 5. Operation Costing:

This is a refined form of process costing. If a process consists of various operations, the costs may be ascertained and analysed with respect to each and every operation carried out, treating every operation as an independent cost centre.

The process of collecting and ascertaining the cost is similar to that in case of process costing. The total cost is the aggregate of costs of all operations taken together. As in case of process costing, this method of costing may be used in industries where production processes are of a continuous and repetitive nature.

Costing Method # 6. Output Costing:

This method of costing is useful in case of those industries which produce only one product and where it is necessary to ascertain the cost of one unit of product.

The industries where this method of costing may be used are stated below:

As only one product is involved, the question of apportionment does not arise. Total cost consists of allocated cost only.

The unit cost of product is ascertained in the following manner:

Method # 7. Operating Costing:

This method of costing is similar to output costing except the fact that it is applicable in case of industries providing the services, where it is necessary to ascertain the cost of one unit of service provided.

The organisations where there is method of costing may be used are stated below:

For ascertainment of cost per unit, the costs are suitably classified (say as fixed costs and variable costs, to facilitate managerial control), analysed and collected.

The unit cost may be determined in the following manner:

E.g., Transport – Total kms run.

Canteen – Total meals served.