A budgetary control is one of the important tools of control. It involves a constant checking and evaluation of actual with the budgeted figures in order to take corrective action where ever necessary.

The Written form of forecasts made in respect of various functional activities of a business concern is called a budget. When the budget so prepared is used to evaluate the actual performance or results is called budgetary control. Thus budgetary control is a system under which budget is used as a means for planning and controlling all aspects pertaining to business operations.

The Institute of Cost and Management Accountants, London, defines budgetary control as ‘the establishment of budgets, relating the responsibilities of executive to the requirements of a policy and the continuous comparison of actual with budgeted results either to secure by individual action the objective of that policy or to provide a firm basis for its revision’.

Contents

- Introduction to a Budget

- Definitions of Budgetary Control

- Meaning and Definition of Budgeting

- Need for Budgeting

- Features of Budgetary Control

- Elements of Budget

- Characteristics of Budget

- Characteristics of Budgetary Control

- Objectives of Budget

- Objectives of Budgeting

- Objectives of Budgetary Control

- Difference between Forecast and Budget

- Forms of Budgeting Process

- Types of Budget

- Steps Involved in the Exercise of the System of Budgetary Control

- Essentials of a Successful Budgetary Control System

- Aims and Steps of a Successful Budgetary Control System

- Requirements of Good Budgeting System

- Requisites of an Efficient Budgetary Control Organisation

- Advantages of Budgetary Control

- Limitations of Budgetary Control

- Significance of Budgetary Control in Management Accounting

- Seasonal Industries

- Budget Reports

- Responsibility Accounting

- Budget Variances

- Comparison of Activity Based Budgeting with Traditional Budgeting

- Difference between Fixed Budget and Flexible Budget

- Distinction between Budgetary Control and Standard Costing

- Ratios

- Revision of Budgets

- Implementation of Budgets and Conditions of Uncertainty under Which Budgetary Control Can be Applied

- Current Global Scenario

Budgetary Control: Definitions, What is, Meaning, Features, Characteristics, Objectives, Steps, Requirements, Budget Reports, Responsibility Accounting, Types and Examples…

Budgetary Control – Introduction to a Budget

A Business organisation in order to survive, needs future planning to ensure effective functioning. The world of business today is very competitive and exposed to a number of risks. These uncertainties and risks which are complex in nature has led to the development of a number of tools and techniques necessary to manage a business successfully.

ADVERTISEMENTS:

One of the techniques of managing a business is by way of preparing budgets which is a part of planning activity. It is a useful device of planning and control widely used in the business. The aim of every management is maximum utilization of resources which is possible through proper planning.

A Budget is a plan expressed in qualitative and monetary terms. In the language of business a budget is a formal expression of the expected incomes and expenses for definite future period. The objective of budget and budgetary control is to reduce the cost and maximize the profit.

Reduction in the cost can be done in a number of ways like elimination of wastage of material, training the labour using standard quality of material and so on which helps in increase in the profits. This requires careful planning on the part of management.

ADVERTISEMENTS:

A budget can function as a device not only for planning and coordination but also for control. Whereas budgetary control is a use of a comprehensive system of budgeting to aid management in carrying out its functions of planning, coordinating, and controlling operations.

A budgetary control is one of the important tools of control. It involves a constant checking and evaluation of actual with the budgeted figures in order to take corrective action where ever necessary.

According to ICMA London, a budget is “a financial and/or quantitative statement, prepared and approved prior to a definite period of time, of the policy to be pursued during that period for the purpose of attaining a given objective.” It may include income, expenditure and employment of capital.

Budgetary Control – Definitions

The Written form of forecasts made in respect of various functional activities of a business concern is called as budget. When the budget so prepared is used to evaluate the actual performance or results is called as budgetary control. Thus budgetary control is a system under which budget is used as a means for planning and controlling all aspects pertaining to business operations.

ADVERTISEMENTS:

According to Brown & Howard, “Budgetary Control is a system of controlling costs which includes the preparation of budgets, co-ordinating the departments and establishing responsibilities, comparing actual performance with budgeted and acting upon results to achieve maximum profitability.”

The Institute of Cost and Management Accountants, London, defines budgetary control as ‘the establishment of budgets, relating the responsibilities of executive to the requirements a policy and the continuous comparison of actual with budgeted results either to secure by individual action the objective of that policy or to provide a firm basis for its revision’.

A budgetary control system secures control over costs and performance in various parts of an enterprise by:

1. Establishing budgets;

ADVERTISEMENTS:

2. Comparing actual results with budgeted ones and

3. Taking corrective action or revising the budget if necessary.

Budgeting means the process of preparing budgets. It is an act of planning the activities of a firm and expressing the same in numerical terms. Budgetary control is the act of adhering to the plan.

Rowland and Harr have stated the difference between budgets, budgeting and budgetary control thus – “Budgets are the individual objectives of a department, etc., whereas Budgeting may be said to be the act of building budgets. Budgetary control embraces all and in addition includes the science of planning the budgets themselves and the utilisation of such budgets to effect an overall management tool for the business planning and control.”

ADVERTISEMENTS:

In the words of Van Sickle, “the budget is the financial plan. Budgetary control results from the administration of the financial plan.”

Budgetary Control – Meaning and Definition of Budgeting

A budget is essentially a statement of the intention of management. Budgeting refers to the management action of formulating budgets. Preparation of budgets involves study of business situations and understanding of management objectives as also the capacity of the enterprise. It includes the entire processing of making the budget plans.

Preparation of budgets or budgeting is a planning function, and their application or implementation is a control function. When plans are embodied in a budget and the same is used as the basis for regulating operations, we have budgetary control. Budgetary control starts with budgeting and ends with control.

Budgeting is defined as:

ADVERTISEMENTS:

“The entire process of preparing the budgets is known as budgeting”. – Batty

Budgetary Control – Need For Budgeting

Decision making is essential to the performance of every managerial function. As such, it is necessary, in this context, to repeat Peter Drucker’s statement that “whatever a manager does, he does through decision making.” Although each manager, regardless of the level in which he functions, follows the same principle underlying decision making, he takes a decision concerning his own area of authority and responsibility.

Such a decision may be in the best interests of the organisation. But yet, he forgets, at that moment, the inter-relationship amongst the various business functions such as purchasing, production, finance, marketing and personnel. Consequently, what he thinks to be in the best interests of the organisation may not be so in fact, when considered in the context of the organisation as a whole.

For instance, the purchase manager may decide to buy a particular quantity of material at the best possible price. He may also enable his concern to take advantage of bulk discount. If this decision is taken without a reference to the related activity of production, there is the danger of over-stocking materials and the resultant loss. Same is true of the production department.

If a decision is taken by the production manager to produce a certain quantity of output without taking into consideration the capacity of the market to absorb the same, a large quantity of output may remain as closing stock. It is, therefore, necessary for him to take a decision with due consideration to the marketing function.

While making decisions, it is, therefore, necessary for every manager to coordinate the inter-related aspects of business activities. The desired co-ordination is brought about by means of a budget. A budget is thus, a plan of action for a future period. Budgeting is the act of preparing a budget.

Being a plan of action, a budget guides every manager in the decision making process. It does not take away from a manager, his freedom of taking a decision pertaining to his own sphere of activity. It only guides him about the course of action he has to take after making a particular decision. Budgeting thus leads the action of every manager of each level, to the achievement of organisational goal or goals. Hence, the need for budgeting.

Budgetary Control – 5 Salient Features

The following are salient features of a budgetary control system:

Feature # (i) Targets / Objectives –

To determine the targets/objectives to be achieved during the budget period, and the policy or policies that might be adopted for the achievement of these objectives.

Feature # (ii) Activities –

To determine the various activities that should be undertaken for achieving the objectives.

Feature # (iii) Plan for each activity –

To draw a plan or a scheme of operation for each class of activity in physical as well as monetary terms for the full budget period and its parts. The budgets prepared for various departments/ activities are consolidated to prepare a master budget consisting of the budgeted profit and loss account and the balance sheet.

Feature # (iv) Comparison / ascertain causes –

To lay a system of comparison of actual performance of each person, section or department with the relevant budget and to ascertain the causes for the variations/discrepancies, if any.

Feature # (v) Remedial action –

To ensure that corrective action is taken where the plan is not being achieved and, if that be not possible, the plan will be revised.

In brief, budgetary control system assists the management in the allocation of responsibility, authority and planning for the future. It facilitates the analysis of the variation between budgeted targets and actual performance.

The budgetary control system develops a proper basis of measurement or standards for evaluating the efficiency of operations. It enjoys equal prominence in both non-profit and profit seeking organisations.

For the effectiveness of budgetary control, an organisation should also have a standard costing system in operation. The whole organisation should be so integrated that all lines of authority and responsibility are laid, allocated and defined.

This is essential since the system of budgetary control assumes a separation of various functions and a division of responsibilities. It presupposes that the organisation shall be so planned that everyone, from the managing director down to the shop foreman, will have his duties properly defined.

Budgetary Control – Top 8 Elements of Budget

1. Budgets can be prepared in terms of monetary value, say, rupees, dollars etc. and in terms of physical units, say, units expressed as kilos or tonnes or quintals or simply pieces etc. Material can be measured in terms of weight, while labour in terms of man-hours etc. If the different components are to be aggregated in a budget, the unit of measurement must be common or homogenous.

2. Budgets are prepared for a specified period of time. The periodicity may be month, quarter, half year, a year or even more than that, say, 5 years.

3. Budgets are prepared for different elements of cost separately and in a consolidated form also. The break-up can be as per different divisions, departments, cost centres, responsibility centres, organisational activities etc. Segmental budgets are aggregated too.

4. The budget exercise takes place before the period to which it relates, commences. Advance preparation is necessary as it relates to a forthcoming period.

5. Budgets are comprehensive plans of actions. A budget is known as a blueprint of the projected plan of action by the management. The plan is put in a concrete form so that follow up action can be taken later.

6. Budgets are prepared for the sake of implementation of the managerial policies, which are laid down beforehand. The objectives are also determined in advance and the budgets are prepared as per these objectives.

7. A budget is a mechanism to plan for the operations of the organisation and utilisation of its resources. Thus, revenue planning and expenditure planning together with planning of investments and sources of capital are included in various budgets.

8. Budget is a comprehensive plan, together with specific chalked out detailed plans to take care of all possible situations and problems apprehended to run the business.

Different types of budgets are prepared by an industrial concern for different purposes. A Sales Budget is prepared for the purpose of forecasting sales for a future period. A Manufacturing Cost Budget is prepared for forecasting the manufacturing costs.

The Master Budget embodies forecasts— for sales and other incomes, for manufacturing, marketing and other expenses, for cash and capital requirements besides forecasting the figure of profit or loss.

Budgetary Control – Top 4 Characteristics of Budget

A budget has the following characteristics:

1. It is a quantitative statement expressed in terms of money.

2. It is prepared in advance and approved prior to a definite period of time during which it is to operate.

3. It relates to the future. In other words budgets are prepared for future implementation.

4. A budget is prepared for the implementation of the policy formulated by the management for the purpose of attaining a given objective.

Budgetary Control – 5 Main Characteristics of Budgetary Control

Following are the characteristics of Budgetary Control:

1. Establishment of budgets for each function/department of the organisation.

2. Comparison of actual performance with the budgets on a continuous basis.

3. Analysis of variations of actual performance from that of the budgeted performance to know the reasons thereof.

4. Taking suitable remedial action, where necessary.

5. Revision of budgets in view of changes in conditions.

Budgetary Control – Objectives of Budget

1. It directs the attention of all concerned to the attainment of a common goal.

2. It leads to the disclosure of organisational weakness. The budgets are compared with actual performance; and variances, if any, are investigated. This step helps in taking corrective and remedial measures.

3. It aims at careful control over the performance and cost of every function.

4. It contributes to coordinated efforts of all departments in order to achieve an integrated goal. Budgets grow from bottom and are controlled from top-level.

Budgetary Control – Main Objectives of Budgeting

The main objectives of budgeting are:

1. To obtain more economical use of capital.

2. To prevent waste and reduce expenses.

3. To facilitate various departments to operate efficiently and economically.

4. To plan and control the income and expenditure of the firm.

5. To create a good business practice by planning for future.

6. To fix responsibilities on different departments or heads.

7. To coordinate the activities of various departments.

8. To ensure the availability of working capital.

9. To smooth out seasonal variations, by developing new products.

10. To ensure the matching of sales with productions.

Budgetary Control – Top 5 Objectives

Objective # (i) Planning for Future in Advance –

In budgets, first planning is done in advance for different activities e.g., production, sales, raw material, labour, marketing, programmes, research and development, capital requirements etc. Planning solves many business problems in the beginning.

Objective # (ii) Coordination between Various Departments –

Budgetary control brings coordination in organization by uniformity in objectives of all departments. Budgets of various departments are prepared by mutually considering each other. E.g., sales department’s budget is coordinated with the production department.

Objective # (iii) Communication Device –

Budgeting also helps in effective communication. The final budget approved by the committee is sent to all departments to familiarize with it. Then only, different departments understand the objectives, advantages and limitations of the budget.

Objective # (iv) Motivation through Incentives –

Targets set in the budget motivates the employees to achieve them. They get incentives for completing them on time.

Objective # (v) Control through Deviations –

Plans and objectives set in budgets are compared with the actual performance. If actual performance is less than objectives, this deviation is reported to the top level management to take corrective action for future. In this way, control becomes possible.

Difference between Forecast and Budget

Difference # Forecast:

Control – Forecast is only a statement of future events, thus it has no sense of control.

Scope – Forecast can be made in several other spheres where budgeting cannot reach.

Subject Matter – Forecast is a statement of probable events which are likely to happen.

Duration – Forecast can be made for long period.

Start and End Point – Forecast is a preliminary step for budgeting.

Difference # Budget:

Control – Budget is a tool of control because it represents and gives shape to the activities according to the target fixed.

Scope – Budgets are made for quantitative spheres related to the business.

Subject Matter – Budget includes policy and programme to be implemented in future period.

Duration – Budget is generally prepared for each accounting period.

Start and End Point – Budgeting starts where forecasting ends.

Important Forms of Budgeting Process

A budgeting exercise is approached in different ways.

A brief description of important forms of budgeting process currently in vogue is given below:

Form # 1. Continuous and Periodic Budgets:

In continuous budgeting, budgets are continuously updated after reviewing the actual performance of a predetermined period, say a month or a quarter, out of the total budget period. In this system, a forecast for a specific budget period is always available. For example, if the total budget period is of twelve months, the forecast for this period will always be available.

It is updated by adding a month or a quarter in the future and dropping the month or the quarter just ended from the budget period. Thus, where one time period is over, the forecast for the same future time-period is incorporated in the budget.

A counterpart of the continuous budget is periodic budget. In this, a budget is prepared for a predetermined period, generally a year-at a time.

Form # 2. Zero Base Budget (ZBB):

Generally, budgets are prepared by adjusting the previous year’s figures. Adjustments in the previous year’s figures for foreseeable variations on account of planned growth, inflation, changes required on the basis of actual experience in the previous year, etc., are made to arrive at the figures for the new budget. This is the most popular way of preparing budgets in business, industry and the government.

In zero base budgeting, every budget item is independently and critically examined before its inclusion in the budget instead of taking previous year’s figures as the base. Every item has to justify its inclusion in its own right. In case of business and industry, zero base budgeting is more relevant to fixed overheads than direct or variable costs.

Zero base budgeting has assumed greater significance in recent years, particularly in the government sector. It has given a new thrust to the theory of budgetary control. It is argued that the traditional approach to budgeting in which generally a certain percentage is added to the previous year’s expenditure to take care of inflation, etc. is not scientific.

The system does not examine whether the base figure is correct or not. In the government sector, it is generally experienced that the budgeted amount must be spent before the budget period otherwise the future budgeted amount will be reduced without caring whether the budgeted amount was really high. The zero base budgeting attempts to justify each expenditure and thus control costs. It ensures efficient allocation of scarce resources and reduction in cost.

However, ZBB is not free from criticism. It is generally complained that ZBB involves heavy paper work. The cost and efforts involved in the analysis of each item from scratch every time the budget is prepared may exceed the savings. This may defeat the basic objectives of budgetary control.

Form # 3. Programme and Performance Budget:

The concept of programme and performance budget is generally used in the government. A programme and performance budget is essentially a projection of the government activities and expenditure thereon for the budget period. It shows budgeted expenses classified by functions and activities and wherever practicable, unit cost also.

In comparison to other budget forms, the objectives of programme and performance to provide a closer linkage between planning and action and to provide a more common basis for review, control and reporting.

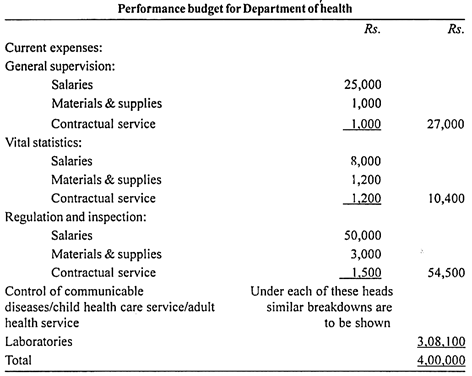

A programme and performance budget can be concentrated with one prepared by organisation units without regard to their activities or objects. For example, in a municipality, the following budget of current expenses for its health department showing only various expense heads is of little help to the departmental head in planning his work and to the higher authorities or the legislature in reviewing estimates –

In a programme and performance, the above budget estimates will be broken down and rearranged by main activities as shown below –

Depending on the size and circumstances, the above functions can be further broken down into component activities. Thus “regulation and inspection” might consist of such separate operations as of milk and dairy products, other eatables, products, drugs and sanitary conditions. Similarly, ‘control of communicable diseases’ might be tuberculosis, venereal diseases, polio, inoculations, small-pox inoculation and other communicable diseases.

The more detailed and extensive the breakdown by activities, the more readily and accurately total expenditure can be estimated, controlled and reviewed. It will always be an ideal situation if the activity can be broken down into adequate detail to measure the performance in terms of cost per unit of activity.

For example, if sanitary inspection is shown as a separate activity and if forecast of average inspection time required for each visit and the number of inspectors required and the annual cost can be easily determined to calculate the cost per inspection, the unit cost of this activity. For performance evaluation, it can be compared with the standard cost per unit and the corresponding cost per unit in the past.

Form # 4. Planning Programming Budget (PBB):

In the U.S.A. the term ‘planning programming budget’ (PPB) is applied to a system of administration which takes into consideration modern concepts of management.

This system of budgeting involves:

i. Long-term and short-term planning in respect of clearly identified objectives and end products in terms of timing and requirement of resources such as manpower and materials, etc.

ii. An uninterrupted association of realistic costs at the beginning of planning stage.

iii. An intensive search for improved alternative courses of operation to save costs.

iv. Budgetary projections of output in relation to authorised inputs of goods and services.

v. Reports on current and prospective outlays prepared in such a way as to serve management control and supply timely budgeting information to all concerned throughout the year.

Budgetary Control – 8 Important Types of Budget

1. Sales Budget:

Generally sales factor becomes a key-factor in the majority of cases, and therefore, it is the starting point. This is the most important budget, as it is usually the most difficult to forecast. It is prepared by the sales manager.

In the preparation, the sales manager should consider the following points:

(a) Analysis of the sales of the previous year.

(b) Salesman’s assessment

(c) General trade conditions

(d) Availability of raw materials

(e) Availability of funds

(f) Plant capacity

(g) Seasonal fluctuations

(h) Restrictions imposed by the government

(i) Competition and consumer’s preference

(j) Efficiency of advertising

Sales budget must show in terms of finished products, quantities and price; and it is prepared according to products, territories, periods, types of customer or salesman etc.

2. Production Budget:

It is a budget prepared by the production manager, showing the forecast of output. The objective is to determine the quantity of production for a budgeted period. It is in quantity of units to be produced during the budget period. It is based on the sales budget.

It is in two parts—one part contains the volume of production and the other part shows the cost of production. Apart from the sales budget, optimum utilisation of plant, availability of raw materials, labour etc., are to be considered. It must avoid overwork in rush seasons. It must maintain a minimum stock of finished goods.

Cost of Production Budget is divided into material cost budget, labour cost budget and overhead cost budget, because cost of production includes materials, labour and overheads. Therefore separate budgets are required for each item.

3. Material Budget:

To carry out the production satisfactorily regular supply of materials during the budget period is ensured by preparing a budget. In this, the decision regarding the quantity of materials as shown at different times during that period is followed. Only direct materials are taken into account; indirect materials are not taken into account and they are considered under overheads. The material budget helps proper planning of purchases.

It shows the estimated quantities as well as the cost of raw materials, required for production as per production budget.

4. Labour Budget:

It is a part of the production budget. The budget is prepared by the personnel department and it shows an estimate of the requirements of labour to meet the production target, on the basis of previous records and budgeted production. This budget gives detailed information relating to the number of workers, rates of wages and cost of labour hours to be employed.

5. Works Overhead Budget:

It sets out the estimated costs of indirect materials, indirect labour and indirect factory expenses, during the budget period in order to achieve the target. This is classified into fixed, variable and semi-variable.

This facilitates preparation of budgets and further department-wise sub-division to have effective control. The preparation of budget is based on the previous year’s records for fixed overheads; and budget targets are verified for variable expenses, which are bound to change with the change of output.

6. (a) Administration Overheads Budget:

This budget covers the expenditure of administrative office and management salaries. It is prepared with the help of past experiences and expected changes in future. The administration cost of each budget center is drawn separately and incorporated in administrative cost budget.

(b) Selling and Distribution Overhead Budget:

This budget relates to selling and distribution of products for the budget period and is based on sales budget. It is generally prepared territory-wise by the sales manager of each territory. The costs are divided into fixed variable and semi-variable; and estimate is taken on the basis of past records.

7. Capital Expenditure Budget:

This budget shows the estimated expenditure on fixed assets—land, building, plant, machinery etc. It is a long-term budget. The capital expenditure is necessitated on account of replacement of old machines, increased demand of products, expansion of industry, adoption of new technological progresses etc.

8. Cash Budget:

This budget represents the amount of cash receipts and payments, and a balance during the budgeted period. It is prepared after all the functional budgets are prepared by the chief accountant either monthly or weekly giving the following hints –

(i) It ensures sufficient cash for business requirements.

(ii) It proposes arrangements to be made overdraft to meet any shortage of cash.

(iii) It reveals the surplus amount, and the effect of the seasonal fluctuations on cash position.

The objective of cash budget is the proper coordination of total working capital, sale, investment and credit.

Main Steps Involved in the Exercise of the System of Budgetary Control

The exercise of the system of budgetary control involves the following main steps:

(a) The establishment of budgets for each section or department of the organisation;

(b) The measurement of actual performances;

(c) The continuous comparison of actual performances with budgeted performances so as to determine the deviations or variances; and

(d) The ascertainment of reasons for such variances and taking suitable actions to remedy the defects in order to achieve the objective under the original policy or to provide a basis for its revision.

10 Essentials of a Successful Budgetary Control System

(i) Clear Defined Objectives –

In Budgets, objectives should be set in clear terms, so that there is no ambiguity. For clarity, goals should be in writing.

(ii) Achievable and Realistic Goals –

The targets set in budgets should be realistic so that they can be achieved in practical situations. Unrealistic goals may distort the success of budgetary control System.

(iii) Top Management Support –

For Budgetary Control system to be successful, it should get full support from the management side. Top management should give time to time directions to the middle and lower level. Then only these levels will give efforts to achieve the budgets.

(iv) Employees’ Participation –

While preparing budgets employees should be given role in participation so their interest to achieve goals can be build up. Actually budgetary control is the outcome of employees’ participation culture.

(v) Flexibility –

The budgets should contain reasonable flexibility so as to change them according to future conditions/situations.

(vi) Effective Communication and Timely Reporting –

There should be proper system of communication and reporting between various levels of management. Communication should be a two way system. The top management can communicate the target plan to the lower level in a clear way and also the feedback should be reported from the lower level side so that corrective action can be taken.

(vii) Integrity with Standard Costing –

Standard Costing and Budgetary Control should be integrated with each other. Standard costing is intensive in nature. Budgetary control helps in implementation of standard costing system by making favourable conditions in business.

(viii) Sound Organizational Structure –

For effective budgetary control, a sound and efficient organization is essential. Authority and responsibility of each person should be clear. Then only in case of deviations corrective actions can be taken.

(ix) Budget Education –

In any organization, every employee should be given complete knowledge about the budget to make him clear about the objectives and importance of the budget.

(x) Minimum Cost and Maximum Profit –

The budgets should concentrate upon maximizing profits by controlling cost.

Aims and Steps of a Successful Budgetary Control System

A successful budgetary control system aims at:

(i) Preparing a plan to implement the policy of the firm (planning);

(ii) Co-ordinating of the activities of various departments of the business (coordination); and

(iii) Control of each function for achieving the best possible results (control).

The following steps are necessary for achieving these objectives:

1. Establishment of Budget Centres and Budgets:

For the efficient functioning of the budgetary control system, the whole organisation is divided into a number of centres or departments and for each of them budgets are prepared with the help of the concerned departmental heads.

2. Preparation of an Organisation Chart:

It is a chart which depicts the functional responsibility, the position and the inter-relation of various executives/managers in the organisation and the budgets to be prepared by them. The existence of an organisation chart prevents buck-passing when budgeted results are not achieved.

3. Fixation of the Budget Period:

Budget are drawn up on a monthly to yearly basis. But this also depends upon the nature of business and type of budget. For example, a seasonal industry may prepare budget for each season (and off season).

An industry which takes long period to complete its work, prepares a budget for a longer period. Capital expenditure budgets by necessity are long term budgets whereas sales, production, cash budgets may be for short periods. However, from the point of view of effective control, it is important that budgets are not prepared for a period longer than necessary.

4. Identifying the Principal Budget Factor or Key Factor:

In every business there are one or more factors which limit the activity level and influence all functional budgets. For examples, machine capacity, availability of skilled and unskilled labour or raw materials may decide the extent up to which output can be achieved. It is also possible that the market may absorb only a certain quantity.

Any such factor, which limits the activity level, is known as principal budget factor or key factor. It is of utmost importance to identify the principal budget factor. Otherwise all planning will prove a futile exercise.

5. Appointment of Budget Officer:

There should be a budget officer or controller to coordinate the work connected with budgeting. He should be equal in rank to other departmental managers. He plays a very important role in the success of the system of budgetary control.

His duties include:

(i) To ensure that budgets are drawn up on time. He also helps in the preparation of budgets and later on, if necessary, makes suitable modifications in budgets on the basis of changed conditions,

(ii) To regularly compare actual performance with the budgets, identify variations and bring the same to the attention of the concerned departmental heads.

6. Consent and Cooperation of All Concerned:

Budgets are prepared for various aspects or activities of a concern. For the success of the budgetary control system, it is necessary that all concerned should extend their full cooperation. For this, it is necessary that they get an opportunity to offer their views freely and have the right to criticise the proposed budget. If it is not done, the cooperation of the various departments and persons may not be forthcoming.

7. Formation of a Budget Committee:

In small organisations, a budget officer or an accountant may coordinate all work relating to budgets. But in large organisations, it is advisable to form a budget committee. This committee should prepare a budget manual listing the various steps to be taken to prepare budgets.

It should also suggest formats in which the budgets should be prepared. It should also frame a budget timetable so that the budgets are prepared well in advance of the beginning of the period to which they relate.

When all the budgets have been prepared, the budget committee can examine, compile and finally approve the various budgets. After approval, budgets are circulated to various departments signifying the sanction for activities to be undertaken by various departments.

8. Recording and Reporting the Actual Results:

The establishment of budgets centres and budgets is the first step in the budgetary control system. To achieve the ‘control objective’ of budgetary control, it is essential that each budget centre continuously records and periodically reports actual results.

This can be done by preparing periodical reports called budget reports or departmental operating statements. These reports may contain actual figures alongside budgeted figures, variations between the actual and the budgeted figures and causes thereof. These reports provide a basis for control to the managers responsible for implementing the budgetary control technique by taking appropriate action.

9. Budget Manual, Preparation and Monitoring Procedures:

A budget manual is a document which contains a detailed procedure about the operation of a budgetary control system in an organisation. It contains routine forms and documents to be used and responsibilities of various persons responsible for the preparation and implementation of budgets.

It indicates the dates by which necessary data, information, budgets and reports are to be prepared and supplied. In fact, all the steps enumerated above may form the contents of a budget manual.

The budget manual serves as a rule book for the implementation of a budget programme in the organisation. It lays down what is to be done, how it is to be done, when it is to be done and by whom. It is always preferable to devote adequate time in the preparation of the budget manual to avoid any confusion in carrying out the various jobs for the effective and successful operation of the budgetary control system.

The budget manual should be circulated to all the departmental managers to facilitate the work of budgeting.In brief, the budget manual will contain information and guidelines about budgets, budget centres, budget period, principal budget factor, organisation chart, budget officer, and budget committee for preparation of budgets and monitoring procedures of budgetary control system to record and report the actual results.

Requirements of a Good Budgeting System

Following are the requirements of a good budgeting system:

1. Budgeting process should be backed and supported by the chief executive of an organisation.

2. The organisational goal should be quantified and clearly stated. These goals should be within the framework of organisations’ strategic and long-range plans.

3. The organisational goals must be divided in functional goals.

4. The functional goals should not conflict with overall organisational objectives.

5. All in the organisation should mentally accept the exercise of budget preparation.

6. The persons responsible for execution of budget should participate in budget preparation.

7. The budget should be realistic. It should represent goals that are reasonably attainable.

8. The budget should cover all phases of the organisation

9. The budgeting should be a continuous exercise.

10. Periodic reports should be prepared promptly, comparing budget and actual results, i.e., there should be effective follow-up.

11. Clear cut organisational lines should be established with appropriate delegation of responsibilities for effective budget implementation.

12. The budgeting system should be based on information, communication and participation.

12 Essential Requisites for an Efficient Budgetary Control Organisation

It is necessary to have a sound and efficient organisation for the preparation and implementation of budgets. To be effective, the budget must be well coordinated with the related management and accounting systems. There must be a sound organisation structure, an organisation chart and chart of accounts.

The essential requisites for an efficient budgetary control organisation are:

(a) Budget Officer:

The head of a formal budgetary control organisation is usually designated as the budget officer. In some organisations, he may be designated as the budget director of budget controller. Regardless of his designation, he derives authority from the Chief Executive. He is, therefore, directly responsible to the Chief Executive for the functions performed by him.

Although his main function is to coordinate the work connected with budgeting, he is expected to perform the following functions:

(i) To act as the secretary of the budget committee,

(ii) To advise the Committee on all matters connected with budgeting,

(iii) To prepare the budget manual,

(iv) To issue budget instructions in accordance with the budget manual,

(v) To design and recommend essential forms, schedules and reports necessary in the budget procedures,

(vi) To receive budgets from the heads of budget centers and scrutinise them,

(vii) To prepare the summary budget, and place the same along with the other functional budgets before the budget committee,

(viii) To have revisions made in accordance with the decisions of the budget committee,

(ix) To furnish to the heads of budget centers, their portions of the master budget,

(x) To receive from the cost accounting department, comparison statements and reports scrutinise the same and place them before the Committee,

(xi) To transmit to managers, decisions and recommendations of the budget committee for their action, and

(xii) To review the budget manual and make such modifications as are necessary to improve the administration of budgetary control.

(b) Budget Committee:

In the case of small concerns, the budget officer takes up the responsibility of coordinating the work connected with budgets. In large concerns, however, a Budget Committee exists. It consists of the Chief Executive, Budget Officer and heads of budget centers.

The functions of the budget committee are:

(i) To define general policies of management,

(ii) To assist departmental managers in the work of forecasting by supplying historical data,

(iii) To receive instructions concerning the general policy to be followed,

(iv) To receive and review individual budget estimates relating to different functions,

(v) To suggest budget revisions,

(vi) To approve the revised budgets,

(vii) To receive, from time to time, budget reports comparing actual results with the budgeted performance,

(viii) To locate responsibilities and recommend corrective action where necessary, and

(ix) To coordinate budget programme.

(c) Budget Centre:

According to CIMA Official Terminology, a budget center is “a section of an entity for which control may be exercised and budgets prepared.” For purposes of control, an organisation is usually broken down into budget centers. Each budget center is a cost center, or a group of cost centers. The cost of each such budget center is accumulated separately.

The main object of setting up budget centers is to see that costs are accumulated and controlled at the point of incurrence. Accordingly, a budget center is one of responsibility for controlling all its costs.

(d) Budget Manual:

The Official CIMA Terminology defines a budget manual as “a detailed set of documents providing guidelines and information about the budget process.

A budget manual may include:

i. A calendar of budgetary events;

ii. Specimen of budget forms;

iii. A statement of budgetary objective and desired results;

iv. A listing of budgetary activities;

v. Original, revised and approved budgets.”

A budget manual is thus a set of documents showing the budgeting organisation and procedures. It specifies in detail, the procedures to be followed, the forms to be used and the responsibilities of those who take part in the budgetary process. It formalises budget procedures thereby avoiding misunderstanding.

(e) Budget Period:

According to the CIMA Official Terminology, budget period is “the period for which a budget is prepared and used, which may then be subdivided into control periods.”

Before any attempt is made to compile budgets, it is necessary to determine the period over which they are to operate. This period is known as the ‘budget period’. There is no general rule governing the selection of the budget period. Decision on the budget period depends upon the nature and type of business. While a majority of concerns confine to a yearly budget, there are also some which prepare their budget for more than a year.

In the case of structural or constructional industries and those engaged in rendering service to the community, the budget period varies from five to twenty years. In the case of seasonal industries, the period covers a complete business cycle. In the case of mass producing industries, however, the most suitable period is one which lasts for one year and coincides with the financial year of the business.

A period, which is more than one year, introduces the difficult problem of predicting with fair degree of accuracy the conditions which are likely to exist after the expiry of a year. It is, therefore, necessary to make fairly detailed forecasts for a period of one year. For control purposes, however, the budget may be divided into a number of shorter periods.

It is only on the basis of the budget period that budgets are distinguished as long-term budgets and short-term budgets.

(f) Chart of Accounts:

The chart of accounts is the principal means by which the operating plans are translated into money values. In fact, the budget department has to depend upon the accounts department for historical data on which estimates are based. Further actual costs and revenues are to be compared with the budgeted figures.

As such there is the need for close co-operation between the budgeting and accounting functions.

The CIMA Official Terminology defines chart of accounts as “a comprehensive and systematically arranged list of the named and numbered accounts applicable to an enterprise.”

To ensure close coordination between the budgeting and accounting departments, it is necessary for the budget department to utilise the same chart of accounts and employ the same classification of accounts for incomes and expenses as that in the accounts department.

(g) The Rolling Budget:

A budget covering a period of one year, and compiled before the commencement of the year, may become unrealistic by the end of that year due to inflationary conditions. As such, the budget will not be a good measure of actual performance.

To get over the difficulty, a rolling budget is prepared for a twelve-month period. After three or four months, the same is replaced by another twelvemonth budget. Frequent budget reviews and revision may reduce the usefulness of budgeting.

At the other extreme, the annual budget may restrict the ability of an organisation to react to changed conditions. A rolling budget, on the other hand, extends the planning horizon and makes room for flexibility.

According to the CIMA Official Terminology, a rolling budget is “a budget continuously updated by adding a further accounting period (month or quarter) when the earliest accounting period has expired. Its use is particularly beneficial where future costs and/or activities cannot be forecast accurately.”

A rolling budget is prepared with the help of a rolling forecast. The Terminology defines a rolling forecast as “a continuously updated forecast whereby each time actual results are reported, a further forecast period is added, and intermediate period forecasts are updated.”

(h) Principal Budget Factor:

As defined by the CIMA Official Terminology, “a factor which will limit the activities of an undertaking and which is often the starting point in budget preparation.” While defining the term ‘limiting factor’, the same Terminology gives the example of shortage of supply of a resource or a restriction on sales demand at a particular price as limiting factors. It also observes that an entity seeks to optimise the benefit it obtains from the limiting factors.

Whether restriction on sales demand, shortage of supply of material, shortage of supply of requisite skilled labour, insufficient plant capacity, bottlenecks in certain processes, lack of financial resources or insufficient research, the influence of any of these or all of these has to be first assessed before preparing budgets.

It is necessary to remember, in this context, that the key factors mentioned above are only temporary. It is possible, by managerial action, to minimise the effect of these factors. However, none of these factors can be totally avoided.

(i) Preparation of Budgets:

The long-term plan is the starting point in the preparation of budgets. Planning is “the design of a desired future and of effective ways of bringing it about.” While short-run planning is also known as ‘budgeting’, long-run planning is the same as strategic or corporate planning.

The latter is defined as “a systematic and formalised process for purposely directing and controlling future operations towards desired objectives for periods extending beyond one year.”

Apart from goals or objectives, every enterprise will have its own policies. These policies may be in respect of output, product-mix, expansion and contraction of certain activities, wages, prices, recruitment of labour, etc.

Such policies, framed by top management, should be communicated to the managers responsible for preparing the budgets. This is because of the reason that those charged with preparation of budgets should know the policy of their concern for implementing the long-term plan.

The next step in the preparation of budgets is making forecasts of all activities of the enterprise. While forecasts relate to probable events, budgets which are based on the implication of forecasts, relate to planned events. Managers, who are responsible for meeting the budgeted performance, should be made to prepare budgets for such areas for which they are responsible.

(j) Participative Approach to Budgeting:

The budgeting process may either be bottom-up budgeting or top-down budgeting. The former is also known as ‘participative’ budgeting and the latter, ‘imposed’ budgeting. The Official CIMA Terminology defines both these approaches to budgeting.

Participative budgeting is “a budgeting system in which all budget holders are given the opportunity to participate in setting their own budgets.” Imposed or top-down budget is “a budget allowance which is set without permitting the ultimate budget holder to have the opportunity to participate in the budgeting process.”

In order to promote participative budgeting, it is necessary to originate the budget at the lowest level of management, and be refined and co-ordinated at higher levels. Usually, functional heads, which are responsible for their own spheres of activity, are made to prepare their own budgets.

The justification for this kind of approach is that managers are enabled to participate in budget making. Consequently, there is every probability of their striving hard to achieve targets set in the budgets by themselves.

(k) Coordination and Review:

Budgets prepared by the various functional heads are submitted to their superiors for their approval. The superior who receives the budget from his subordinate, incorporates the same with other budgets for which he is responsible, and submits the same to his superior for approval. Thus, budgets prepared bottom-up, are approved top-down.

Budgets, moving up from lower levels, are scrutinised in relation to other budgets. In case there is any discrepancy, the same is brought to the notice of the concerned manager. Necessary changes are effected by him and in his turn, pass the same on to his superior. This process of receiving the budget, effecting changes, and submitting the same to his superior for approval may be effected as many times as are necessary, until there is perfect coordination.

(I) Final Acceptance of Budgets:

After achieving coordination and correcting discrepancies, budgets become acceptable to all persons involved in preparing the same. Subsequently, a budgeted profit and loss account and a budgeted balance sheet, together with a cash flow statement are prepared to ensure that different budgets for different activities are combined into an acceptable whole.

Budgetary Control – Main Advantages

Budgetary control system secures the following advantages:

Advantage # (a) Enables Management to Think Ahead:

Forward planning and policy formulation are indispensable to a system of budgetary control. In order, therefore, to introduce any efficient system of budgetary control, management has not only to define clearly the goals or objectives of the enterprise but also lay down the policies to be communicated to the framers of budgets.

Budgetary control thus guides management in planning and formulation of policies thereby enabling them to think ahead. Managers are forced to anticipate problems and identify alternative courses to be followed.

Advantage # (b) Promotes a Spirit of Cooperation:

Budgets are prepared for every major activity of an enterprise. For this purpose, each functional head is drawn into the budgeting process. Further, the process being ‘bottom-up’ and participative, managers at the lowest level in the hierarchy are asked to initiate the budgeting process. The work of budgeting thus promotes cooperation amongst managerial personnel.

Advantage # (c) Brings about Coordination of Activities:

Each functional head prepares his own budget. Consequently, there is every likelihood of each manager making his own decision believing the same to be in the best interests of the enterprise as a whole. In point of fact, however, the decisions may be conflicting in nature.

It is the aim of budgeting to avoid these conflicts and reconcile the differences. Budgeting makes every manager to examine the relationship between his own operations and those of others. In this process, differences and conflicts are ironed out.

Advantage # (d) Promotes Delegation and Fixation of Responsibility:

All managers in charge of the concern’s activities are made to participate in the budgeting process. This process is ‘bottom-up’ and budgets are not imposed on line managers. There is thus delegation of authority deep down the hierarchy.

Further, not merely a manager is drawn into the budgeting process, he is also made responsible for the performance of his activities in accordance with the standards or targets laid down in his own budget. Therefore, there is no question of any functional head passing on responsibility for variation to some other person.

Advantage # (e) Ensures Effective and Efficient Usage of Resources:

Budgeting standardises production, equipment and processes. It also facilitates introduction of efficient production control. It ensures availability of resources in time and avoids shortages. By avoiding sales of less profitable and unprofitable products, it aims at making the best and maximum usage of the available resources.

The existence of idle capacity as well its cost is easily revealed. It also ensures availability of sufficient working capacity and pinpoints operational efficiency by setting targets of performance.

Advantage # (f) Facilitates Introduction of Principle of Management by Exception:

It acts as a constant reminder to managers, of the level of performance to which they have committed themselves by accepting their part of the budget. Besides making them realistic in achieving the budgeted targets, budgetary control facilitates effective control over actual performance.

Constant and periodical comparison of actual performance with that budgeted in advance may bring to light operational deficiencies. Such deviations, if any, may be corrected on the basis of application of management by exception.

Advantage # (g) Stabilises Business:

Budgetary control forces management to give timely and adequate attention to the effect of expected trend of general business conditions. Thus, it stabilises conditions of business which are subject to seasonal a cyclical fluctuations.

Advantage # (h) Facilitates Introduction of Standard Costing:

Budgetary control and standard costing go hand in hand. Although there may be budgetary control without standard costing, its existence makes the introduction of standard costing much easier.

Advantage # (i) Assists Performance of Managerial Functions:

Budgetary control is not necessary in order to enable managers to perform their functions efficiently. However, the very existence of a budgetary control system may be quite helpful in enabling managerial personnel to perform their functions of planning, coordination and control much better than they could have, in the absence of budgetary control.

Budgetary Control – Major Limitations

It is, no doubt, true that budgetary control is immensely useful. But yet, budgets cannot be considered to be perfect tools in the hands of managerial personnel.

The limitations of budgetary control are:

(i) Budgets are Based on Estimates:

The usefulness of budgeting depends upon the extent to which forecasts can be relied upon. Since forecasting cannot be considered to be an exact science, the accuracy of the data on which estimates are based determines the adequacy or otherwise of a budgetary programme. If forecasts are made on the basis of inadequate and inaccurate data, budgeted figures would be far removed from reality. The targets set would also be inaccurate.

(ii) Tendency to Become Rigid:

A budget programme should be dynamic. It should be capable of being adapted to changing circumstances. When budget are prepared with predetermined targets of performance, there is a tendency to consider the budget figures as something final. In such a case, the budgetary programme is bound to become rigid. If the standard set by the budget becomes rigid, deviations due to changed conditions beyond the control of management might not be allowed.

If, however, budget standards are revised very frequently, and significant deviations are excused on the ground that the standards set are too high to be accomplished, personnel are bound to lose faith in budgeting. As such, although it is necessary to adapt budgeting techniques to changed conditions for purposes of improvement, frequent revisions should not be made.

(iii) Execution of Budgets is not Automatic:

Budgetary control implies preparation of budgets as well as their implementation. As such, mere preparation of budgets does not mean that their implementation is automatic. Execution of budgets demands a unified effort of all the personnel in the organisation. In other words, budgetary control demands active cooperation of managerial personnel at all levels.

(iv) Not a Substitute for Management:

Budgets are not substitutes to the managerial personnel. They cannot replace management. “A budget is not designed to reduce the managerial function to a formula. It is a managerial tool.”

(v) An Expensive Tool:

Budgeting necessitates employment of specialised staff. This involves expenditure which small concerns may not afford. Even in the case of large concerns, the utility of budgetary control should be viewed from the point of cost. The cost of installing and operating a budgetary control system should be commensurate with the benefits derived therefrom.

Significance of Budgetary Control in Management Accounting

In management accounting, budgetary control occupies a very important place. It is the main tool of planning and control. It assists the management in allocation of responsibility and authority; in making estimates and plans for the future and in the analysis of the variations between actual results and budgeted targets. It develops a basic measurement or standard to evaluate the efficiency of operations.

The following are the main parts played by budgetary control in the system of management accounting:

(i) Budgets provide various levels of an organisation with appropriate indicators of their expected performance.

(ii) They lead to planned actions in place of haphazard work. Since everything is done in a planned manner, wastage and losses are reduced or minimised.

(iii) A budgetary control system acts as an instrument of control. In this, once the targets have been fixed, the actual execution can be delegated to the middle level management. The targets are so fixed as to induce everyone in the organisation for better performance.

Since every employee knows what is expected of him, he tries to do his best. A comparison of the actual with the budgeted targets indicates whether or not the actual performance is on the lines of what was decided.

(iv) Budgetary control makes ‘management by exception’ possible. The top management can concentrate on areas where actual performances are at variance with budgeted targets. Where performance falls short of expectation, the management can immediately take corrective action to set things right.

It is thus obvious that the system of budgetary control is of great value in management accounting for planning and controlling business operations.

Budgetary Control – Seasonal Industries

There are many industries, which due to their seasonal character, have seasonal peak sales directly attributable to the weather conditions. For example, if the summer is intense, the demand for ice, aerated water and ice-cream, etc., rises.

Similarly, if the winter is particularly cruel, the demand for woolens, heaters and such other commodities would rise sharply. Hence, for such industries, it may not be possible to forecast precisely the demand/sale of their products.

Many people argue that since in seasonal industries sales are attributable to weather conditions which cannot be forecast in advance, it is not possible to estimate sales accurately and therefore, there is no use of operating the budgetary control system in such industries. But this is not a wise attitude.

The technique of budgetary control is not dependent entirely on the single point of estimates of sales. In seasonal industries, the technique of flexible budgeting can be adopted successfully since a flexible budget is designed to change in accordance with the level of activity actually attained.

Budget Reports – Essential Features and Various Reports Prepared and Submitted

Success of a budgeting process lies in taking corrective action when there is adverse deviation from budgeted activity level. Budgeting being a short-term planning is waste without proper control over the actual performance.

This control function is possible only when the top management receives feedback from the lower levels about the actual performance. So provision is to be made in budgets for sending performance reports at periodical intervals.

These reports enable the management in evaluating the actual performance and taking control measures where necessary. So budget reports are fundamental to budgetary control.

The following are the essential features of a budget report:

1. Materiality – All important informations which are essential for judging the actual performance should be included in the reports.

2. Time Factor – Informations are useful only when they are provided when it is required. So reports are to be submitted at the appointed time.

3. Accuracy – The informations given in performance reports should be accurate. It gives a correct basis for management to take suitable corrective measures.

4. Appropriateness – The reports are to be submitted to those who will use it. Only relevant informations are to be sent to the related executives. Giving unwanted information leads to waste of time of the top executives.

5. Clarity – The report should be clear and to the point.

The following are the various reports prepared and submitted:

1. Top Management:

These are presented in the form of annual reports.

i. Balance sheet

ii. Profit and loss account

iii. Cash flow statement

iv. Statement showing working capital

v. Capital expenditure

vi. Sales, production reports.

2. Sales Management:

Actual sales reports should include the following informations like product-wise sales, territory- wise sales, selling price, types of customers, quantity discounts offered, bad debts, doubtful debts, selling expenses and market conditions. These reports are presented either monthly or quarterly.

3. Production Management:

Production reports are also presented either weekly, monthly or quarterly. These reports should include the details of labour efficiency achieved, plant utilisation, productions overheads incurred, material usage and scrap reports.

Responsibility Accounting: Prerequisites, Major Considerations, Responsibility Centres and Limitations

Responsibility accounting emphasises division of an organisation among different sub- units in such a way that each subunit is the responsibility of an individual manager. This approach recognises cause and effect relationship between a Manager’s decisions and actions and it seeks to relate the cost and revenue results of these decisions and actions.

The basic theme of this approach is that a manager should be held responsible for those activities, which are under his or her direct control. This approach should be used exclusively to assist management in planning and controlling the organisational activities efficiently and effectively.

Prerequisites for Responsibility Accounting:

1. The area of responsibility and authority of each centre should be well defined (usually by the organisation chart);

2. Each responsibility centre should have a clear set of goals for the manager;

3. Only the revenues, expenses, profits and investments that are controllable by the manager of a responsibility centre should be included in the performance report for that centre;

4. Performance reports for each responsibility centre should be prepared highlighting variances, the items requiring management’s attention.

5. The manager of each responsibility centre should participate in establishing the goals that are going to be used to measure their performance.

Major Considerations in Responsibility Accounting:

1. All inputs and outputs are expressed in monetary terms as far as possible.

2. A manager’s total performance depends on a variety of measures such as quality control and morale of workers in addition to financial performance. The idea of responsibility centre applies only to the financial performance.

3. The financial performance of a manager should be measured by how well controllable factors are managed.

Responsibility Centres:

Responsibility centre can be defined as a unit of function of an organisation headed by a manager having direct responsibility for its performance. Five types of responsibility centres can be established for management control purposes a cost or expense centre; a revenue centre; a profit centre; an investment centre and contribution centre.

These are discussed below:

1. Cost Centre:

A cost centre is a smaller segment of activity or area of responsibility for which costs can be accumulated. Responsibility in a cost centre is restricted to costs only. In general, cost centres are segments of the firm that provide tangible or tangible service to departments.

In a manufacturing environment, all production centres and service centres are termed as separate cost centres. CIMA defines cost centre as a production or service location, function, activity or item of equipment whose costs may be attributed to cost units.

2. Revenue Centre:

The revenue centre is the smallest segment of activity or an area of responsibility for which only revenues are accumulated. A revenue centre is a part of that organisation whose manager has the primary responsibility of generating sales revenues. A revenue centre manager has no control over the investment in assets or the cost of manufacturing a product, but may have control over some of the expenses of marketing the product.

Most of the sales offices, for example, are considered revenue centres. CIMA defines revenue centre as a centre devoted to raising revenue with no responsibility for production e.g., a sales centre. Often used in not-for-profit organisation.

3. Profit Centre:

A profit centre is a segment of activity or area of responsibility for which both revenues and costs are accumulated. In general terms, most responsibility centres are viewed as profit centres—taking the difference between revenues and expenses as profit. The manager holds responsibility for both revenues and expenses.

The main objective of profit centre’s manager is to maximise the centre’s profit. CIMA defines profit centre as a part of business accountable for costs and revenues. It may be called a Business Centre, Business unit, or Strategic business unit.

4. Investment Centre:

Investment centre is a segment of activity for area held responsible for both profits and investment. For planning purposes, the budget estimate is a measure of rate of return on investment. For control purposes, performance evaluation is guided by a return on investment variance.

In short, the objective function of an investment centre is to maximise the centre’s return on investment. CIMA defines investment centre as a profit centre whose performance is measured by its return on capital employed.

5. Contribution Centre:

Contribution Centre is a segment of activity or area of responsibility for which both revenues and variable costs are accumulated. CIMA defines contribution centre as a profit centre whose expenditure is reported on a marginal or direct cost basis. The main objective of contribution centre manager is to maximise the centre’s contribution.

Limitations of Responsibility Accounting:

Responsibility accounting sounds to be a very good idea, but its implementation is equally difficult for following reasons:

1. It is difficult to prepare an organisation chart, which clearly delineates lines of responsibility and grants authority requisite to responsibility assigned. If a person has complete jurisdiction over both acquisition and use of material and services, he should be rightly given full responsibility for cost incurrence.

It sounds very correct, but situation as clear as this seldom occurs. Departments are so intermingled and interdependent that it is usually impossible to draw distinct responsibility lines.

2. It requires proper meshing of organisational chart and chart of accounts.

3. Individual interest may conflict with organisational interest and serious problems of implementation may occur.

4. The system faces passive resistance, if not active and it will lose its purpose, till it is judiciously applied.

5. At times, it ignores the personal reactions of the people, who are involved with its implementation.

For these reasons, if responsibility accounting is rigidly enforced without regard for its limitations, it will lead to wrong conclusions. It is a well-known fact that any manager will place his well-being ahead of company’s best interest.

For example, a foreman may postpone needed maintenance to avoid an unfavourable variance. The successful responsibility accounting systems require good reporting.

Budget Variances (With Illustration)

The budget variances mean identifying variations between the actual and budgeted figures and causes thereof. The establishment of budget centres and budgets is the first step in the budgetary control system.

To achieve the control objective of budgetary control, it is essential that each budget centre continuously records actual results, computes budget variances and periodically reports them to concerned managers.

This can be done by preparing periodical reports called budgets reports or departmental operating statements. These reports may contain budget variances showing actual figures alongside budget figures. These reports provide a basis for control to the managers responsible for implementing the budgetary control technique by taking appropriate action.

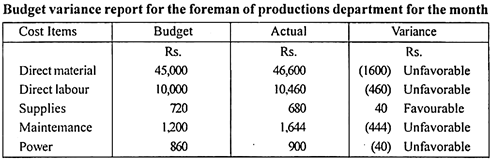

An illustrative budget variances report is given below:

On receipt of the above variance report, the foreman would explain the causes of the variation and comment on their controllability.

Comparison of Activity Based Budgeting with Traditional Budgeting

ABB completes Activity-Based Costing (ABC) by focusing on the costs of activities required for production and sales. Activity cost is the ratio of resources consumed by an activity to the output obtained from the activity. ABC attempts to trace costs to products/services instead of arbitrarily allocating them.

In this approach costs are separated into homogeneous cost pools and cost drivers. ABB budget finds the cost of doing certain activities whereas a traditional budgeting budgets costs for functional or spending categories.

The following chart compares traditional budgeting with ABB:

Traditional Budgeting:

1. Budgets cost functional or spending categories.

2. Focuses on the cost elements themselves.

3. Generally does not consider vendors or customers.

4. Employs accounting terminology.

5. Considers variable cost and fixed cost.

6. Controls performance.

7. Highlights repetition of history.

8. Contains last year’s inefficiencies.

Activity-Based Budgeting:

1. Determines the cost of doing activities.

2. Focuses on output and work done.

3. Approaches vendors and customers to find out their requirements.

4. Employs the language of the activities done.

5. Considers utilized and unutilized capacity.

6. Controls processes or activities.

7. Highlights continuous improvement.

8. Forecasts workload based on customer’s requirements.

Difference between Fixed Budget and Flexible Budget

Difference # Fixed Budget:

1. Activity level – It is prepared for a specific activity level.

2. Rigidity – It is rigid. It cannot be modified for activity levels other than the budgeted activity level.

3. Cost analysis – Costs are not classified on the basis of variability.

4. Conditions – It is prepared on the assumption that the operating level will not change.

5. Practical application – Fixed budget can be used only when the actual activity level matches the budgeted level.

6. Cost control – It does not help to control the cost and business operation.

7. Cost estimation – As the costs are not classified on the basis of their variability it is difficult to estimate the cost for a particular level of activity.

8. Decision making – It does not help in decision making because actual activity level changes most of the time.

9. Variance analysis – Variance analysis to find the cause for difference in cost is difficult, as the activity level differs from budget.

Difference # Flexible Budget:

1. Activity level – It is prepared for many activity levels.

2. Rigidity – It is flexible. It can be modified for any activity level.

3. Cost analysis – Cost are classified as variable, fixed and semi-variable on the basis of their variability.

4. Conditions – It is prepared that future activity level may change.

5. Practical application – It can be applied for all activity levels.

6. Cost control – It helps to control cost and business operations.

7. Cost estimation – Costs are analysed on the basis of their variability, so it helps to estimate the cost for any level of activity. So it is easy to submit tenders and quotations.

8. Decision making – It helps the management in decision making through accurate estimation of cost.

9. Variance analysis – It is possible to introduce standard costing and variance analysis. Actual cost can be compared with estimated cost for an actual activity level.

Difference between Budgetary Control and Standard Costing

The following are important points of distinction between budgetary control and standard costing:

Budgetary Control:

(i) Basis:

Budgets are prepared for different functions of business, say, sales, production, purchase, capital assets, etc. Control is exercised by comparing actual figures with budgeted figures.

(ii) Scope:

Scope of budgeting is wider. It relates to business operations as a whole. In addition to production, it covers sales, capital and financial expenses.

(iii) Concern:

Budgetary control is concerned with the overall profitability and financial position of a business. It culminates in the preparation of master budget.

(iv) Projection:

Budgetary control includes projection of financial accounts as well as of cost accounts.

(v) Recording of Variances: