Retailing has become such an intrinsic part of our everyday lives. All developed nations has strong organized retail sector.

Retailing in India is the largest industry accounting 10- 11 per cent of GDP. Organized retail is only 2-3 per cent of total retailing. India has largest number of retailers about 12 million and having around 5 million retailers.

Retailing includes all the activities involved in selling goods or services directly to the final consumer for personal or non-business use. (Philip Kotler). In other words, retailing is the sale of goods and services to the ultimate consumer for personal, family or household use.

Thus, retailing involves more than selling tangible products. It includes every sale of goods and services to the final consumer.

ADVERTISEMENTS:

Learn about:

1. Introduction to Retailing 2. Evolution of Retailing 3. Meaning 4. Definitions 5. Concepts and Features 6. What Constitutes Retailing 7. Importance of Retailing

8. Functions 9. Factors 10. Areas in Retailing 11. Theories. 12. Retail Industry in India 13. Growth Drivers of Indian Retail 14. Growth of Organized Retailing in India

15. Development of Retail Sector in India 16. Reasons for Growth of Retailing in India 17. Current Retail Market Scenario 18. Challenges for the Retail Sector 19. Recent Trends 20. Careers in Retailing.

Retailing in India: Evolution, Meaning, Factors, Theories, Challenges, Recent Trends, Careers, Importance and Development

Retailing in India – Introduction

India is one of the fastest growing economies in the world with 8 per cent economic growth rate. The present retail business contributes about 10-11 per cent of country’s GDP. Organized retail is only 2-3 per cent of total retail in India. India is the fastest growing Asian pacific market for international tourist spending and it has largest young population in the world.

ADVERTISEMENTS:

The Indian retail industry remained a largely unorganized sector till the eighties. Corporate houses like Raymond’s, Bombay Dyeing, and Titan stepped into retailing after recognizing the vast potential of this sector. Besides the economic growth, India is the second highest populated country in the world and has also been recently ranked as the fourth largest economy in the world. Big players of international retail as well big domestic business groups like Reliance, Bharti, ITC, TATA etc. have ventured or planning to venture into retail business.

Factors contributing to the growth of retail industry in India are- rise in income, rise in number of working women in urban areas, demand for quality and branded stuff and large middle class society. All this made goods more attainable to large portion of population. We should not neglect the potential rural segment of in which disposable income and standard of living is increasing rapidly.

Now retailing is not limited to big cities, with growing Internet, Satellite T.V and mobile communication in small cities people are increasingly exposed to modern living. This will act as a catalyst for retail business. Indian customers are on the March. Therefore retailers must act quickly to seize this opportunity.

ADVERTISEMENTS:

Retailing provides the highest employment after agriculture in India. This trend is poised to grow further, with customers ready to spend higher prices for the products if the retailers can provide high quality service quality with increased efficiency, convenience, and a wide product range.

The application of information technology in the retailing sector has been increasing over the past few years. Technological advancements have also prompted retailers to focus on television shopping and online shopping. In television shopping, customers are shown the product demonstration along with its features and benefits and asked to place an order for the product by calling a toll free number.

Present Status of Retail Sector in India:

Retailing has become such an intrinsic part of our everyday lives. All developed nations has strong organized retail sector. Retailing in India is the largest industry accounting 10- 11 per cent of GDP. Organized retail is only 2-3 per cent of total retailing. India has largest number of retailers about 12 million and having around 5 million retailers.

ADVERTISEMENTS:

In a move considered forward-looking to the opening up of FDI with in retailing in India, in January 2006 the government of India permitted up to 51% foreign direct investment in single-brand retailing in the country. International retailers entering the country through joint ventures, and domestic players are warming up to retailing.

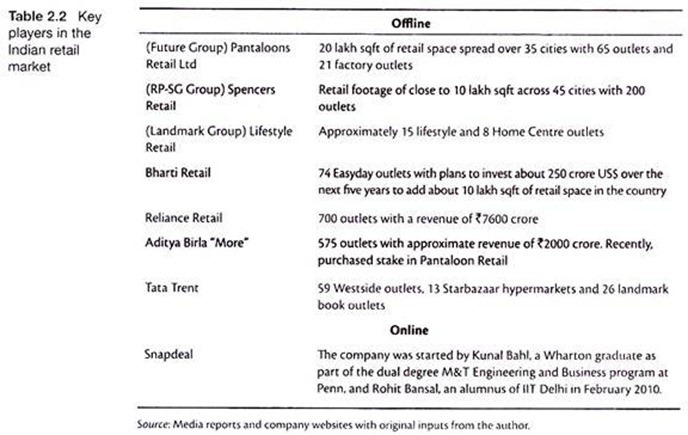

Major domestic conglomerates such as Reliance group, Aditya Birla Group and Bharti Group have all signaled their intentions to success in what is seen as next big business In India. This move is also seen as the first step towards allowing 100% foreign direct investment, thereby permitting international players to open bigger-format outlets such as hypermarkets in the future. With the economy booming, competition in the marketplace is fierce.

Today in India organized retailing is confined to class A cities, about top 10 cities account for 94% of all retailing in India. But new format of retailing is spreading in non-metro cities like Jalandhar, Dehradun, Patna, Lucknow, Agra etc. According to GRDI (Global retail development index) by AT Kearney India is ranked number -5 in emerging retail market. In 2003 India had only 25 operational malls but in 2006 there were nearly 200 malls.

Some big names in Indian retailing are – Mass Merchant Wal-Mart, Big Bazaar, Discount Club, Category Killer- Vishal Chain, Specialty Retailers-Time Zone, Tanishq, Hyper Market- RPG, Retail Chain- Reliance, ITC, Bharti. In terms of outlets though, Bata India Ltd. with over a thousand footwear shops was the leading retailer. Among non-store retailers, Amway India Enterprises came first with its retail value share almost twice that of its nearest competitor.

Factors contributing to the growth of retailing in India:

(i) High economic growth rate.

(ii) Expansion of industrial structure.

(iii) Rising incomes leads to increase in disposable income.

ADVERTISEMENTS:

(iv) Increasing consumerism in urban areas and an upswing in rural consumption.

(v) Changing lifestyles.

(vi) India’s vast middle class.

(vii) Availability of satellite television, internet and mobile communication in small cities, people are increasingly exposed to modern living.

(viii) Entry of foreign brands in India.

(ix) Entry of India big business houses like Reliance, Bharti, ITC, TATA etc.

(x) Potential of rural market especially in FMCG and consumer durables.

(xi) Redesigning the retail mix by the traditional retailers.

Retailing in India – Evolution

Retail or selling goods to customers can be traced back to the times when humans started settling down in agricultural communities. People needed manufactured goods such as cloth and edible goods like salt and sugar. Travelling traders went around towns with their collection of goods and sold door to door.

Local traders established shops—mostly as extensions of their homes—which sold food items and manufactured goods. Village fairs were also a means of retail. Later, mandis dealing in agricultural, livestock, and other goods were established; in many Indian towns one can still find markets named after old mandis. Cities and towns in India have farmers’ mandis that serve the needs of both large and small consumers.

It is interesting to see that the systems of old survive to this day in certain parts of the country. Travelling traders can still be seen carrying around carpets, shawls, sarees, and other goods. In a modern city like Chandigarh, weekly farmers’ mandis are organized in various parts of the city. These ancient forms of retail exist in the country along with modern systems of retail.

As the number of manufactured goods began to increase, so did the shops. Around the old mandis grew shops with each shopkeeper dealing with goods of his choice. Entrepreneurs opened shops in crowded areas, sometimes operating from their own residences, to sell daily needs to those who lived nearby. Hawkers continued to operate, and still do, to bring vegetables and other products to the doorstep of their customers.

Later, with planned cities, shopping areas were clearly demarcated. Shopping centres were developed with restaurants and facilities for entertainment. In some cities, opening retail stores in residential areas was forbidden.

After the country embarked upon a programme of economic liberalization, developers started building malls. Many malls were opened in urban centres. Prize winning author Aravind Adiga (2010) writes, ‘nothing seems to symbolize India’s transformation from a stagnant third-world country into an emerging economic super power as much as its sparkling new malls’. These malls offered retail space for high-end stores and supermarkets.

Malls have evolved in the west and customers are used to making a weekly trip to the supermarket. This implies that a customer drives to the supermarket, buys large quantities, and has a deep freezer at home where food products can be stored. This was not the case in India, where many consumers wanted fresh produce daily, they lacked storage facilities, and considered driving down for shopping as a waste of time and effort.

Thus, hopes that supermarkets and shopping malls would transform Indian retail were short lived, since many remained empty. Though some malls are doing well in the country, many are not. Mr. Adiga quotes Vikram Bakshi, managing director of McDonald’s (Northern India), as saying, ‘If all the planned malls do come up, 70 per cent of them will fail’. How retail evolves in India remains to be seen but traditional retail will continue to play a big role in the country.

In its report, The Evolution of Retailing – Reinventing the Indian Customer, KPMG (2009) says that the contracting global economy, advances in technology, proliferating distribution channels, and increasingly well-informed consumer base are altering the means, modes, and manner in which customers shop. Retailers have to cater for two trends – (1) weakened consumer spending and cautious consumer attitudes, and (2) a volatile economic environment. Because of these two reasons, the retail industry is at an inflection point, where it has to rethink traditional business models.

The Indian retail scenario today consists of all kinds of retail. High-end malls dominate the landscape of big cities, but traders in the less glamorous centres continue to do well. Small shacks sell tobacco and other products and these are seen virtually everywhere. Hawkers are the preferred source for buying vegetables. It is hardly a wonder that unorganized retail still holds about 96 per cent share.

A report by the Investment Commission of India (2006) says that organized retail constitutes only 3 per cent of total retail sales – about $6.4 billion per annum. Reports by other researchers put the present figure between 4 to 6 per cent. All systems of retail exist side by side in India.

Retailing in India – Meaning

Retailing includes all the activities involved in selling goods or services directly to the final consumer for personal or non-business use. (Philip Kotler).

In other words, retailing is the sale of goods and services to the ultimate consumer for personal, family or household use. Thus, retailing involves more than selling tangible products. It includes every sale of goods and services to the final consumer.

Thus purchase of a service such as reservation of railway ticket, consultancy of a physician, maintenance services of a plumber, carpenter, hair-cut etc., dry cleaning, stay at hotel, rental of book/video cassette, home delivery of goods, consultation by lawyer/doctor are also a retail transaction.

The term ‘final consumer’ is a key issue in the concept of retailing. The person/s who run the retail shop will not be the ultimate or final or ‘end of the chain’ customers (end users). The person/s to whom the retailers sell are the final players in buying the goods or services. Intermediate customers can also be frequently found.

Examples can be- Maruti Udyog for automobile parts produced by an outsourced manufacturer, a pharmaceutical firm buying chemicals from another firm, a pan wala getting beetle leaves (pan leaves) from a wholesaler, Liberty Shoes buying readymade shoe soles from a small scale sole manufacturer.

Purchases made by manufacturers, wholesalers, and other organizations for their use in the organization or further resale or industrial use are not part of retailing. Thus purchase of intermediate products to produce another products, for example, purchase of crane for further business use etc., will not be part of retailing transactions. Retailing is the final leg in the distribution channel of goods and services.

Retailing involves:

(i) Identifying target markets (customers)

(ii) Interpreting needs of the targeted customers

(iii) Developing good assortments of merchandise

(iv) Presenting them in an effective manner so that consumers find it easy and attractive to buy.

Retailing differs from marketing in the sense that it refers to only those activities, which are related to marketing goods and/or services to final consumers for personal, family or household use.

Whereas marketing, according to American Marketing Association, refers to- “the process of planning and executing the conception, pricing, promotion and distribution of ideas, goods and services to create exchanges that satisfy individual and organizational objectives.”

You must be wondering whether all retailing occur through stores or shops. You are right, not all retailing is done through stores or shops. There are numerous examples of non-store retailing, such as, sale of Aquaguard by Eureka Forbes, sale of cosmetics by Avon, catalogue sales by L.L.Bean, Spiegel and Burlington, sale of goods by TV Brands and Asian Sky Shop through television, and by Jaldi(dot)com and Yahoo and Amazon(dot)com through Internet etc.

Also retailing does not need physical presence of retailer or his representative. For example, automatic vending machines.

Thus, any organization selling a product or service to final consumers whether a manufacturer, wholesaler, or a retailer, is doing retailing. It does not matter how the goods or services are sold, i.e., by person, mail, telephone, vending machine, TV, or Internet. Also, it does not matter where the goods and services are sold, i.e., in a store, on the street, or in the consumers’ home, or in the virtual world (internet).

Retailing is one of the most important industries in any country employing major share of workforce. Selling, whether in a store or at the doorstep requires many people. In other words, retailing is labour intensive. Probably many more people are needed to sell most products than to manufacture them. While automation has been widely adopted in manufacturing, retailing has yet to see its presence on a large scale.

Some retailers have introduced self-service. Some others have stepped into mail order. But in India, these methods are not commonplace. Only a few retailers have brought such changes. Most others stick to counter sales or personal attention.

Wal-Mart (The Biggest Retailer in the World) – How it started:

Wal-Mart was founded by Sam Walton. Walton majored in Economics at university of Missouri, graduating in 1940. An interview with J. C Penney attracted him to retailing. He began working as management trainee in the Des Moines store for $ 85 a month. In 1942, he left to join military.

At the end of the World War II, he bought a Ben Franklin variety store franchise in Newport, Arkansas. When his landlord declined to renew his lease in 1950, Walton relocated to Bentonville, Arkansas (Wal-Mart’s corporate headquarters) and opened a Walton 5 & 10. By 1962, his business had grown to 15 stores (mostly Ben Franklin Franchises).

After failing to get Ben Franklin’s upper management to join him in opening discount stores, he opened his first discount store in Rogers, Arkansas. “Old Number 1” has now joined by 1,800 Wal-Mart Discount City stores and 200 Sam’s Ware house clubs in all 50 states of USA and five countries.

Wal-Mart’s initial strategy was to offer name -brand merchandise at discount prices to small communities. Walton felt that the key to his success was people: his customers and his employees (called associates, a term adopted from his initial job at Penny).

He said, “Our goal has always been in our business to be the very best. We believe completely that in order to the very best you have to make a good situation and put the interests of our associates first. If we really do that consistently, they will in turn cause our business to be successful.” Sam Walton died in 1992 but his spirit and ideas remain a driving force at Wal-Mart.

Retailing in India – Definitions

The actual term ‘retailing’ means ‘a piece of’ or to cut up. This implies that retailers acquire large quantities of products and divide them up into smaller units to be sold to individual consumers. The definitions of retailing therefore emphasis it as the business activity of selling goods to the final consumers.

Philip Kotler defines retailing as “all the activities involved in selling goods or services directly to final consumers for personal or business use”.

David Gilbert defines retailing in the following words, “any business that directs its marketing efforts towards satisfying the final consumers, based upon the organization of selling goods services as a means of distribution.”

“Retailing includes all activities directly related to sales of goods and services to the ultimate consumers for personal and non-business use.” W.J. Stanton

“Retailing is selling final consumer products to households.” Mc.Carthy

“Retailing consists of those activities involved selling directly to ultimate consumers.” Cundiff and still.

Retailing in India – Concepts and Features

Concepts:

1. Sales of goods and service are a means of distribution. The final consumer within the distribution chain is a key concept. The retailers are involved in a direct interface with the customer. The emphasis on final consumers is different from that on a customer.

A consumers is the final user of a purchase while a customer may have bought for his or her own use as a part of own business activity. Purchases for business or industrial use are not retail transactions. Retailing includes more than the sale of tangible products. It involves service such as financial services, hair-cutting or dry-cleaning.

2. Retailers are middlemen or intermediaries in the chain of distribution. They occupy a middle position, receiving and passing on the products from producers and wholesalers to finally customers. This is made possible by opening the store in a convenient location to provide a successful channel of distribution.

The successful channel ensures availability of the right product in the right quantity, at the right time and through to customers. Customer satisfaction is the focal point for the selection and display of a wide range of stocks in any retail outlet.

Features:

Retailing can be distinguished in various ways from other businesses such as manufacturing.

Retailing differs from manufacturing in the following ways:

(i) Location is a critical factor in retail business.

(ii) There are a larger number of retail units compared to other members of the value chain. This occurs primarily to meet the requirements of geographical coverage and population density.

(iii) In most retail businesses services are as important as core products.

(iv) It is the only point in the value chain to provide a platform for promotions.

(v) Sales at the retail level is generally in smaller unit sizes.

(vi) There is direct end-user interaction in retailing.

(1) Point-of-Purchase Display and Promotions:

A significant relevant chunk of retail sales comes from unplanned or impulse purchases. Studies have shown that shoppers often do not carry a fixed shopping list and pick up merchandise based on impulsive or situational appeal. Many do not look at ads before shopping.

Since a lot of retail products are low involvement in nature, impulse purchases of the shopper is a vital area that every retailer must tap into. Therefore, display, point-of-purchase merchandise, store layout, and catalogues become important. Impulse goods like chocolates, snack foods, and magazines can sell much more quickly if they are placed in a high visibility and high traffic location.

(2) Larger Number of Retail Business Units:

Location of retail store plays an important role compared to other business units. Manufacturers decide the location on the basis of availability of factors of productions and market. Similarly, retailers consider factors like potential demand, supply of merchandise, and store image-related factors in locating the retail outlet. The number of operating units in retail is the highest compared to other constituents of the value chain, primarily to meet the needs for geographic reach and customer accessibility.

(3) Direct Interaction with Customers:

Retail businesses have a direct interaction with end-users of goods or services in the value chain. They act as intermediaries between end-users and suppliers such as wholesalers or manufacturers. Therefore, they are in a position to effectively communicate the response and changing preferences of the consumers to the suppliers or sales persons of the company. This helps the manufacturers and marketers to redefine their product and change the components of its marketing strategy accordingly.

Manufacturers require a strong retail network both for reach of the product and to obtain a powerful platform for promotions and point-of-purchase advertising. Realising the importance of retailing in the entire value chain, many manufacturers have entered into retail business by setting up exclusive stores for their brands.

This has not only provided direct contact with customers, but has also acted as advertisement for the companies and has provided the manufacturers with bargaining power with respect to other retailers who stocked their product. Retailing provides extensive sales people support for products which are information-intensive, such as in the case of consumer durables.

(4) Lower Average Amount of Sales Transaction:

The average amount of sales transaction at retail point is much less in comparison to the other partners in the value chain. Many consumers buy products in small quantities for household consumption. Due to lower disposable incomes, some consumer segments in India even buy grocery items on a daily basis rather than a weekly or a monthly basis.

Inventory management becomes a challenge for retailers as a result of the many minor transactions with a large number of customers. Hence, retailers must take care of determining average levels of stock, order levels, and the popularity of different brands. The small amount also means that the retailer has to keep a tight control on costs associated with each transaction in the selling process.

Credit verification, employment of personnel, value-added activities like bagging, gift-wrapping, and promotional incentives all add up to the costs. One way to resolve this is for the retail outlets to be able to attract the maximum possible number of shoppers.

Retailing in India – What Constitutes Retailing?

Retail may be divided into two broad areas:

1. Tangible features

2. Intangible services.

Retailing is an amalgamation of goods and services. It comprises a mix of the physical surroundings, signage, uniforms, changing rooms, displays and other tangible features such as merchandise. Retailing gives the beneficial utility of a place for purchase. It is also characterised by the service component such as the intangible interaction with sales staff and other retail departments.

The type and timing of the service delivery to other customers and the nature of a retail sales staff and other customers and the nature of a retail environment through their advice on the use of the product, its maintenance and the type of alterations or adjustments required to make it fit.

Retailing is, by and large, intangible. Sometimes, it assumes the characteristics of pure service with operations such as banking, insurance and investment service. Retailing can be pure services or an amalgam of services and goods based upon their relationship to different types of shops and merchandise offers.

Retailing includes a wide array of services performed by dry-cleaners and laundries, photographic studios, hair-dressers, shoe-repairers, undertakers, health clubs, reprographic shops, public houses, garage services, car rentals, cinemas, catering outlets, travel agents, banking, insurance investment, etc. In retail business, there is little movement of physical goods through distribution channel.

Retailing Transactions with Merchandise:

Retailing offers three types of services with goods:

(i) Owned- goods service,

(ii) Rental-goods service,

(iii) Service with bought goods.

(i) Owned-Goods Service:

This type of service comes with the outright purchase and ownership of a good from a retailer. The retailer performs the service of channel management

(ii) Rental-Goods Service:

The retailer delivers a tangible good such as a car for the personal use of the customer. The buyer does not own the good and it has to return to the service provider.

(iii) Service with Bought Goods:

The retailer performs certain extra services. These include delivery, wrapping, providing credit in respect of goods bought by consumers.

Transactions without Merchandise:

Retailing involves service without goods. These can be the pure services. Arranging or organizing travel, financial transactions, service specially personal services such as dry cleaning, haircut, shoe-repair, etc., are examples of pure services.

Retailing in India – Importance of Retailing in Indian Economy

The Indian economy has grown by about 9% annually over the last 3 years and even higher growth rates are being projected in the future. Retailing has been growing even faster and is already a significant component of the Indian economy. In recent years, organized retailing has gained momentum. Malls and large-size departmental stores have become a fixture in the urban landscape across the country.

The importance of managing retailing efficiently and effectively is obvious in the light of this sector’s growth potential and the increasing levels of competition. For a whole new set of business skills and competition. The emergence of organized retail operations.

In addition, it has posed tremendous challenges to existing producers of goods and services – they now need to revisit their distribution policies and distribution relationship management strategies.

Among many issues, value of assortment, purchase experience, logistics and supply chain issues, financing options channel consolidation, volume driven relationships and people strategies have acquired completely new dimensions.

Even otherwise, since shopping is all-pervasive retailing is important, both economically and socially, since it affects a large populace in the form of consumers and employers. All this has led to a renewed interest in the retailing phenomenon.

Reported estimates show that retailing has the potential to create 2 million new (direct) jobs within the next six years on the basis of an 8 to 10 per cent share of organized retailing in the total retail business.

In India, due to the following factors, retailing gains its importance:

1. Consumer incomes growing

2. Consumer aspirations rising

3. Growing urbanization

4. Very low penetration of modern retail

5. Modern retail’s capability to achieve and share efficiencies.

The property of retail sector in Indian is one of the prime indicators of economic health of India. The importance of retail sector can be gauged form the fact that retailing is the second largest industry in terms of number of employees and establishments in the US. Who has not heard of Wal-mart and its contribution to the US economy?

India retail sector belonging to India Retail Estate accounts for about 9-10% of the country’s GDP. It remains one of the least developed sectors in India. According to Associated Chambers of Commerce & Industry (ASSOCHAM), the estimated annual retail sales accounts for about $ 6 billion and is expected to reach $ 17 billion dollar mark by the year 2010.

The decision is fuelled by booming economy and the positive reports of leading retail assurors of the world. The favourable business environment in the country is indicated by the increased NRI investment in India since the past few years.

The Non-Resident Indians are also putting added pressure on the government to open up the retail sector in India for the FDI, as the prices of commercial property in India are alertly on the consumers lend positive air to the business environment in the country.

India has just started to feel the mails, Cineplex, multiplex cultures that have revolutionized the West. All the majors global players like Wal-Mart, Tesco and others are keen to enter the Indian retail market with a bang. A T Kearney has ranked India 5th out of 30 most attractive retail markets in terms of investment.

It is being estimated that if the government adopts the favorable policies, then by 2010, the retail industry will start appreciating by the rate of 25-30% per year. Further, millions of jobs are expected to be generated by the retail sector. Integrated retailing—is already booming in major cities of India. And with the liberalized policy of FDI in retail sector, things can only get better.

Retailing in India – Functions: Essential and Optional Functions

The work of distribution of goods and services is a gigantic task and it would not be possible for the manufacturers to serve all the consumers directly. It is in this context, retailers render a yeomen service to the different segments of our economic institution Retailers’ functions are unavoidable link between consumers and the manufacturers. Thus, retailing has an economic justification.

The various functions performed by retailers to customers can be broadly categorised into two viz., essential functions and optional functions. The functions such as providing merchandise from which consumers select their purchase, providing accommodation (place, location) and providing staff and equipment to assist customers in selecting goods, etc., which are unavoidable and whose provision is a must are called essential functions.

There are certain other functions which the retailer can choose to provide to help customers in buying their goods such as delivery and credit, discount and provision of amenities such as cloak-rooms, parking places, etc., which have no direct connection with the purchase of goods but which make shopping more attractive, comfortable and convenient.

In what follows, the functions-essential and optional, of retailing are described below:

1. Essential Functions:

They are again classified into:

(i) Provision of merchandise,

(ii) Provision of accommodation, and

(iii) Provision of services.

For the purpose of in-depth understanding, they are briefly discussed:

(i) The Provision of Merchandise:

The primary function of any retailer is to make goods available to the consumers. Retailers purchase goods of different varieties from different suppliers and present them in a place convenient for customers. Suppliers are generally scattered throughout the country and sometimes from outside.

Thus the retailer enables the customer to tap the goods of the world. Further, in view of the variety of goods available in different product lines, retailers want to specialize continuing their activities to a particular type of merchandise. That is the reason why there will be number of shops in the same line of business in the same street, but each offering within that range a selection of goods which is markedly different from that offered by other shops.

In brief, the retailer’s important job would be to provide right goods, in the right quantity at the right time, in the right condition and at the right price. A brief explanation of these “rights” will provide an insight into the retailers’ functions with regard to merchandising.

The goods offered by the retailer should be appropriate to the needs of the people in the area and should reflect their tastes, preferences, living conditions, etc. Keeping in view the competition, retailer may concentrate on a particular section of the consumers in terms of their incomes, sex, age, etc.

The right quantity refers to the fact that the retailer should be able to satisfy the consumer with the sizes of goods of their choice. No customer should return from the shop without purchasing goods in the quantity which he wants.

The right time refers to making available goods when consumers want them. The manufacture or production of goods may not be uniform throughout the year or may be seasonal, but retailer must purchase and store them in anticipation of demand till they are purchased by consumers.

Offering goods in right condition refers to the fact that goods should be in perfect condition, which will create confidence in the minds of consumers that goods are standard and not of inferior quality.

(ii) The Provision of Accommodation:

The accommodation which refers to the building in which retail shop is to be housed should be able to protect goods, consumers and staff from the weather, dust, damage, thefts, etc. This apart, building should also reflect proper layout, attractive presentation and ease of operation.

The decision of the retail building varies with factors like type of goods to be sold, the method of service to be used, the anticipated volume of trade, the market to be served and the type of organisation for whom the premises are to be built, etc. For example, the importance of hygiene in food trades necessitates buildings which can be thoroughly and quickly cleaned.

(iii) The Provision of Service:

There are three important methods of service, to assist customers in selecting their goods:

(a) Personal service in which staff of the retailer assist the customer in the selection of goods,

(b) Self-selection in which customers select merchandise from a counter and hand it to the staff at that counter for wrapping and payment, and

(c) Self-service in which customers select their goods and pay for them near the exit at a check out.

The method of service used depends on the merchandise and the type of customer. Personal service is necessary where goods are expensive and complex, while self-service can be used for cheap, portable necessities like food, etc. and self-section for wide-range of inexpensive items.

2. Optional Functions:

They are again considered as the provision of:

(i) Services,

(ii) Amenities, and

(iii) Information.

They are described as under:

(i) The Provision of Services:

For certain types of goods like soft furniture the provision of service is a must. Services are facilities which are necessarily part of a sale or which directly encourage a sale. These services include delivery, credit, fitting rooms, installation, maintenance and repairs, etc.,

(ii) The Provision of Information and Communication:

The retailers provide a great service to both-producers, on one hand, with regard to likes and dislikes of consumers and also to the consumers with regard to the products available, forthcoming or new products, their features, prices, advantages, etc., on the other.

(iii) The Provision of Amenities:

These amenities are meant for improving the customer comfort and also to attract the customers. These include the provision of lifts and escalators, chairs and restrooms, telephones, cloak-rooms, creches, cafes and restaurants, parking places, etc.

Retailing in India – 4 Factors Affecting Retailing

(a) Higher GDP:

The value that retailing can add to the economy should not be underestimated. Organised retailing has huge potential, which could lead to higher GDP growth and generate employment. Organised retailing could also bring about the transformation of the agricultural supply chain, remove inefficiencies in the distribution of consumer goods and improve productivity while providing consumers with a better range of products at better prices in a better ambience at the same time.

(b) Tourism/Outbound Shopping:

One of the best features of any city that attracts a large number of tourists every year — London, Singapore, Dubai, New York and so on — is a well-developed shopping environment. Organised retailing will help significantly in developing our cities as tourist destinations. And, if well-marketed and managed, it can significantly enhance government revenues, apart from spreading the word about ethnic Indian brands across the world.

(c) Real Estate:

The retail industry’s real-estate requirement will be in millions of square feet. This will release for productive use large tracts of land lying with various government agencies such as the ports, railways, the armed forces, mill land and so on.

(d) Outsourcing Opportunities:

If organised retailing is a $200 billion industry, how big can its outsourcing opportunities be? Pretty big, including everything from supply chain management to pilferage control to loyalty management. Take Solutions, a Chennai-based firm. It has set up a nationwide network of transporters and warehouse owners. Checkpoint Systems has just launched its pilferage prevention system, and Venture Infotek has come in with transaction management for loyalty programmes.

Expenses on advertising and promotions have also gone up three-fold. The benefits are difficult to quantify, but clearly they will be huge. In countries where retailing and modernisation has progressed, it has favourably affected the value-capturing capacity and modernisation of the farming industry.

It has also restructured the supply chain for all FMCG products, driven end-customer prices down on a sustained basis, created significant employment opportunities, been a source of considerable revenue for governments both local and national, and in general been a catalyst for creating considerable national wealth. There is no reason why it should not do the same in India.

Retailing in India – Areas in Retailing

Many recent findings on best practices in retailing will have an impact on decision making in the management of a retail operation. The H. R. Chally Group has also identified several best-practice areas used by world-class sales organisations.

These areas include customer — centric cultures; market segmentation; market adaptability; information technology; customer feedback and satisfaction; sales, service, and technical support systems; and selecting and developing sales personnel. Each of these areas has relevance for retailing.

Customer-centric cultures require the creation of a performance-driven culture that is focused on individual consumers rather than the mass market. Activities aimed at shifting the focus to individual customers include the adoption of a relationship or partnership business model with shared rewards and risk management, redefining the selling role in terms of consulting with customers and solving their problems, becoming more proactive in consumer education (teaching customers about value chains and cost reduction strategies), and focusing on continuous-improvement processes.

Retailers will continue to rely on customisation to increase sales and gain customer loyalty. For example, Bath Junki, a franchise specialty shop in Richmond Heights, Missouri, allows customers to create their own lotions, soaps, and body washes by mixing and matching up to 160 different fragrances.

In 2000, Nike, Inc. created the Nike ID website, which allows users to design their own athletic shoes. Lands’ End also utilises a technological customisation approach. Customers can create online models that resemble themselves. They can then dress the models to determine how various items of clothing will look on them. All of these initiatives demonstrate a true customer- centric culture.

Retail segmentation appears to be leaning toward the development of a system that creates segments based on how the customers prefer to buy their products. Some customers prefer distance in the customer-retailer relationship; others want to develop longer-lasting relationships or obtain solutions to problems. It is important for retailers to recognise and nurture relationships when customers are receptive.

Market adaptability refers to retailers’ knowledge about environmental changes and their ability to react to these changes in a way that benefits both the retailer and the consumer. Critical components of adaptability include decentralising decision making to more quickly adapt to consumer needs, streamlining processes, focusing on core competencies, implementing the free exchange of information, and developing reward systems based on responsiveness to customers.

Information Technology (IT) will continue to play a major role in developing competitive advantage in retailing. Best practices in the IT area include an emphasis on market and customer tracking, and leveraging IT to create and solidify retailer-customer relationships. The movement in IT in retailing is toward “rocket science retailing,” described as a blend of employee intuition and the power of information technology.

Four critical areas in rocket science retailing are:

(1) Demand forecasting,

(2) Supply chain speed,

(3) Inventory planning, and

(4) Data gathering and organisation.

In addition, standardisation of applications and integration of various IT systems are very important undertakings for retailers. U.S. Retail IT Spending Forecast, 2003-2007, a report by IDC, a global market intelligence and advisory firm, noted that IT spending in the retail industry is projected to increase. The increase is expected to reach $29.6 billion by 2007, which represents a five-year compound annual growth rate of 5.3 percent.

In 2003, Keynote Systems, a Web performance monitoring company in San Mateo, California, introduced the Keynote Consumer E-Commerce Transaction Index, the retail industry’s first Internet transaction performance benchmarking index.

The index offers retailers an improved method of evaluating Internet retail performance relative to direct competitors instead of a cross-section of general business sites. Powerhouse e-tailers such as Amazon, eBay, Barnes & Noble, Target, Wal-Mart, JCPenney, Sears, Nordstrom, Neiman Marcus, and L. L. Bean make up the index.

Customer Feedback and Satisfaction:

Customer feedback and satisfaction remain important areas of best practices. The use of feedback systems will increase the value of customer concerns and allow retailers to better understand their changing customer segments. To be effective, feedback must be systematic and timely. Best practices include involving customers in the measurement processes and sharing customer feedback throughout the organisation.

Sales, Service, and Technical Support Systems:

The benchmark for sales, service, and technical support systems is applying the tools of total quality management to enhance the customer’s perception of quality with regard to his or her overall shopping or service experience. According to the Chally Group, best practices include building specialised sales approaches for each target market, separating marketing functions from logistics functions, and streamlining flows in the sales cycle. In addition, retailers must utilise new sales and support technologies. All retailing functions must be integrated and focused on understanding customers’ gales and technical support needs.

Selecting and Developing Sales Personnel:

Selecting and developing sales personnel are vital to the retailer’s success. The emphasis will be on the need to upgrade the competency, as well as the commitment, of sales-personnel on a long-term basis. More and more companies are using multiple-channel systems, cross-functional teams, and global/strategic account managers.

Because these trends require new-skills- based employees, retailers should consider shifting from a job-based model of retailing human resource management to a competency-based perspective. According to Edward E. Lawler, “Instead of thinking of people as having a job with a particular set of activities that can be captured in a relatively permanent and fixed job description, it may be more appropriate and more effective to think of them as human resources that work for an organisation.”

In an article from the Harvard Business Review, Leonard Berry describes five important actions for retailers.

These actions, deemed pillars, sound simple but are often difficult to implement:

1. Solve your customers’ problems.

2. Treat customers with respect.

3. Connect with your customers’ emotions.

4. Set the fairest (not the lowest) price.

5. Save your customers’ time.

Retailers should always keep these pillars in mind when conducting business. As the work force becomes more diverse and the retail environment continues to change, consumers’ needs are rapidly changing. Retailers must prepare for the challenges ahead and pay particular attention to this evolving consumer. In addition to following the five pillars, a good grasp of consumer trends is essential for retailer success.

Retailing in India – Theories

Retailing, however judged, is dynamic. One of the areas of retailing that has been addressed by authors is the way in which the retail environment changes.

Brown (1987) has reviewed the research in this area and suggests that theories of retail institutional change may be classified into three groups:

1. Environmental,

2. Cyclical and

3. Conflict theories.

1. Environmental Theory:

Environmental theories seek to explain developments in the retail industry as resulting from changes in the wider environment such as variations in lifestyle patterns. A whole array of factors shape the nature of retail environments – factors of an economic, social, political, regulatory, cultural and demographic nature all impinge upon the environment in which retailers operate.

It is easy to see direct links between some environmental conditions and retail change – for example, a relaxation in regulations governing store opening hours changes the retail offer available. Other changes in the wider environment may be less direct but still play a fundamental part in shaping the nature of retail development; for example, increasing acceptance of female waged labour influencing lifestyle and consumer purchasing patterns. Changes in government planning guidelines may provide further examples of significant environmental factors.

There are specific examples illustrating how environmental factors have directly influenced the development of particular types of retail format. For example, Appel (1972) suggested that the success of the import of the self-service format from the USA to Europe in the 1940s was due — in part— to environmental conditions.

The format was based on price competitiveness which made it particularly appropriate in a time of economic downturn. Some consumer groups were characterised by increasing rates of car and refrigerator ownership, which meant there was a growing demand for less frequent buying.

More recently superstores have transformed the grocery retailing marketplace in the UK and now account for the majority of retail expenditure each week by UK consumers. The development of superstores is a means by which the leading grocery retailers have increased their market shares.

Customers have switched to this relatively new form of grocery retailing, moving away from smaller local stores. Superstores (sales areas greater than 25,000 square feet) have grown to what could be a saturation point for the market as there are now over 1100 such outlets.

Environmental theories have taken a ‘Darwinian’ approach and suggest that only retailers with the most appropriate organisational structure and formats will survive. This implies that if retailers expand into new markets where there are different environmental conditions in terms of, for example, economy and culture, they may need to adapt in order to succeed. It also suggests that if retailers are to survive over time they must respond appropriately to the evolution of market conditions or otherwise face the possibility of extinction.

2. Cyclical Theories:

Cyclical theories, allied to the business cycle, suggest there are patterns of development which may predict changes in the retail industry, just as cycles can be seen in general economic conditions.

One of the original theories addressing the issue of retail institutional change is the wheel of retailing. This concept proposes ‘a more or less definite cycle’, as follows. When retailers enter a market they compete by offering goads at the lowest possible price or the hold new concept, the innovation in order to attract customers. As retailers develop their experience and gain capital, they tend to increase their level of service and quality — and therefore their price.

This success allows mature retailers to move steadily into an upmarket position. However, retailers in this position may become vulnerable due to high costs, declining efficiency and, perhaps, stagnating management strategies which culminate in a downturn in sales. If this is the case the retailer may plunge into decline and even he forced to withdraw from the market. The consequence of this move around the wheel of retailing is that a gap is left at the bottom end of the market — an opportunity for a new retailer to enter.

An example of this process is provided by changes within the UK food retail sector. In the 1970s the main players were very much price oriented, illustrated by Tesco’s sales cry of ‘pile it high, sell it cheap’. However, throughout the 1980s the main, grocery retailers moved to a higher quality and service orientation, operating larger stores from more accessible sites.

This trend has resulted in further-consolidation of the market during the 1990s and a considerable gap being left at the lower end of the market. This opportunity has been seized by the Continental hard discounters who have moved into the UK market. For example, German retailers Aidi and Lidl have followed an aggressive expansion strategy, rolling out smaller-scale stores and offering heavily discounted limited lines relying on high volumes and an efficient operation to make their money.

In the classic phases of the wheel of retailing there are three stages – entry; trading up; and vulnerability. At the entry stage a retailer enters the market as a low-price, low- status competitor with operating expenses reduced to a minimum. This is reflected in restricted services, low rent location, modest shopping atmosphere and limited product mix.

As the retailer becomes successful, and accepted- others emulate the original business. The retailer then trades-up through success to improved facilities, and offers enhanced services and improved or additional product lines. With maturity, the retailer becomes more vulnerable due to an inability to adapt, producing a decline in the rate of return from the business. The entry of new lower-price innovators signals decline for the mature business.

In practice the wheel of retailing can explain some of the changes in the UK retail marketplace. The change from corner store to supermarket as price vulnerability occurred fits the model. However, the factors in modern retailing such as size of operation of leading retailers, the importance placed on branding and loyalty schemes and a continual drive for efficiency by all personnel create highly competitive operations. The basic difficulty in utilizing the wheel of retailing approach is the timescale. It can vary extensively, depending on the speed of economic, social and technological change.

(b) The Retail Accordion Theory:

The retail accordion theory suggests that retailers initially enter a market as- a general retailer; with experience they focus down on particular product sectors and/or consumer groups. Over time they begin to diversify their offer in order to grow, but again will revert to specialisation. The premise of the retail accordion is that the changes in retail operations are related to strategies that alter the width (selection) of the merchandise mix.

An example of this type of pattern is the establishment of small-scale specialist food retailers such as grocers or bakers followed, over time, by the takeover of the food retail sector by large-scale superstores with diverse product ranges. We are now witnessing the next stage in this pattern, the re-emergence of the small store in the guise of convenience formats such as Tesco’s Metro and Sainsbury’s Local and Central with limited ranges for a different market but trading under the same name, brand and reputation.

We can see this specialisation occurring due to:

(i) Store sizes in some locations being unable to accommodate greater variety in order to compete and therefore specialisation occurs;

(ii) Greater disposable income and large urban populations allowing for profitable segmentation;

(iii) The importance of the specialist shopping experience and convenience stores;

(iv) Established retailing brands wanting to obtain more specialist coverage of the market.

The trend to become more general is due to:

(i) Expansion of complementary lines as part of the retail offer;

(ii) A skimming policy — that is, carrying more of the profitable lines and creaming these off from those of the competition;

(iii) A move to increase the density of shoppers in-store by providing a complete range offering (one-stop shopping);

(iv) A the growth of large shopping centres with outlets which allow for expansion of lines and ranges.

(c) The Retail Life-Cycle Theory:

The retail life-cycle theory suggests that retail developments pass through stages. At birth (termed the embryonic stage in the context of industry life cycles), there are slow rates of growth due to limited resources and experience. This is followed by 2 time of rapid growth as efficiency and experience increase. Eventually growth will-level off into the mature stage due to increased costs and competition and reduced efficiencies.

In a mature market the competition remains intense, growth slows and profits begin to fall. A continued decrease in market share and profitability will eventually cause the development to decline and, if the situation worsens, ultimately to withdraw from the market. The less competitive companies, which have previously entered the market, will be forced out early as the market goes through a shake-out period.

An example of a company which has had problems in relation to the life cycle is Woolworths. In an attempt to remain competitive its range was expanded to a point where the offer was undefined and it became a store of last resort. The group realised it was not adequately providing for the needs of the contemporary consumer and survived only because it recognised the value of adopting a focused strategy.

3. Conflict Theories:

Conflict theories propose that institutional retail change is an outcome of the relationships between, and competitive behaviour of, retailers. Competition between retailers causes changes in the nature of the retail environment. However, it is not so much the day-to-day competition between companies that causes institutional change, but rather the imbalance caused by innovations.

Brown (1987) states that a response to innovation follows a process of four stages. Initially, retailers are in shock at the innovation; secondly, they deny the threat by means of defensive retreat; thirdly, they then move into a stage of acknowledgement and assessment; finally, they develop a strategy of adaptation.

The question is the timescale and strategy requirements which may occur as a result of the call for adaptation. There is a need to understand the type of change needed the cost of any adaptation and the resultant profitability of a change.

An example of retail innovation as a catalyst for change is the introduction of self-service supermarkets. As the supermarket developed and increasingly took market share from the traditional specialist retailers a direct reaction by the independents was necessary; in order to remain competitive, they formed themselves into voluntary groups and buying alliances.

As part of their strategy companies such as Spar copied the trend by offering self-service. The buying alliances also helped the independents to remain in touch with the prices offered by the developing supermarket chains. A more recent example is multi-channel retailers.

Traditional bricks and mortar players felt threatened by this new channel of distribution and by the new pure-play e-tailers. They seized the opportunity to develop a competing offer, and one that would complement their existing offer, hence the bricks and clicks approach. Due to the heavy losses incurred by e-retailing specialists it is now the multi-channel operators that, on the whole, are more successful.

Retailing in India – Retail Industry in India

Organised and Unorganised Retailing:

The Retail industry is divided into the organised and the unorganised sector.

Organised retailing refers to trading activities undertaken by licensed retailers, that is, those who are registered for sales tax, income tax, etc. These include the corporate-backed hypermarkets and retail chains, and also the privately owned large retail businesses.

Unorganised retailing, on the other hand, refers to the traditional formats of low-cost retailing, for example, the local kirana shops, owner manned general stores, paan/beedi shops, convenience stores, hand cart and pavement vendors etc.

Unorganised retailing has dominated the Indian scenario for a number of centuries. It was only in the late 90’s that organised retailing dared to crop its head on the Indian scenario. It faced stiff and organised protests from the unorganised sector.

According to the Census report of 2001 nearly 3 crore people in India, worked in wholesale and retail trade 1.1 crores in urban India and 1.9 crores in the rural areas of India.

India had well over 5 million retail outlets of all sizes and styles (or non-styles). However we sorely lacked anything that could resemble a retailing industry in the modern sense of the term.

In 2001, as much as 96 per cent of the 5 million-plus outlets were smaller than 500 square feet in area. This meant that India per capita retailing space was about 2 square feet (compared to 16 square feet in the United States). India’s per capita retailing space was thus the lowest in the world (source – KSA Technopak (I) Pvt Ltd, the India operation of the US-based Kurt Salmon Associates).

In 2005, with over 12 million retail outlets, India had one of the highest densities of retail outlets in the world with one retail outlet for approx. 90 persons. India was the ninth largest retail market in the world with annual retail sales of approx. USD 215 Billion in 2005. However, the share of organised trade in India was very low, estimated at just Rs.35,000 Cr. in 2005 (Rs.28,000 Cr. in 2004). This accounted for less than 4 per cent of the total retail trade in the country.

Till date most Indian shopping takes place in open markets and millions of independent grocery shops called kirana stores. Organised retail such as supermarkets accounted for just 5 per cent of the market as of 2008.

However McKinsey and Company, in a report The Great Indian Bazaar – Organised Retail Comes of Age in India, 2008 stated that organised retail was expected to grow from the current five percent of the total market to 14 -18 per cent of total retail in 2015.

The report also states that of the 204 million households in the country, McKinsy expected only about 13 million households are comfortable and have the income to patronise organised retail. This relevant consumer segment would grow fivefold from 13 million to 65 million households in the next eight years.

India’s first true shopping mall, Crossroads – complete with food courts, recreation facilities and large car parking space, was inaugurated as late as in 1999 in Mumbai. Thereafter there was no looking back.

The increase in the purchasing power of the Indian middle classes, the influx of foreign investments, change in the taste and attitude of the Indians, and the effects of gloabalisation have been responsible for encouraging the growth of retail companies in India.

The retail companies are found to be rising in India at a remarkable speed with the years and this has brought a revolutionary change in the shopping attitude of the Indian customers.

The growth of retail companies in India is most pronounced in the metro cities of India, however the smaller towns are also not lagging behind in this. The retail companies are not only targeting the four metros in India but also the second graded upcoming cities like Ahmedabad, Baroda, Chandigarh, Coimbatore, Cochin, Ludhiana, Pune, Trivandrum, Simla, Gurgaon, and others. The South Indian Zone has adopted the process of shopping in the supermarkets for their daily requirements and this has also been influencing other cities as well where many hypermarkets are coming up day to day.

Retailing in India – Growth Drivers of the Indian Retail Sector

The drivers of growth of retail have given credit to many factors. The growth of retail has given credit to many factors including the change in the preference of the consumers, change in demographic profile and making policy decisions by the government. Organised retailing has already come across the initial and growth stage, and it is in the phase of consolidation, which is expected to make more adjustments in the coming years.

The following are the drivers of growth of the Indian retail sector:

Changes in Demographic Profile:

One of the biggest attractions of the Indian market is its young population and their number accounts for around more than 50% of the total population. The younger generation prefers to outlet in retail as they get all their things under one roof along with entertainment. With the advent of female population in business and industries in the Indian subcontinent, there is abrupt rise in the purchase and sales of products of female preference like cosmetics, etc.

This trend is attracting many national and international players to venture into this sector.

Increase in Disposable Income:

Indian economy is growing faster and competing with China because of its potential in terms of consumption capacity to consume. Currently, billions of people are getting out of poverty to form large middle class population which got accumulated in cities and towns of the Indian subcontinent. There is a gradual transfer of power (spending) to urban or towns from villages or rural areas and as a result, there is

consumption (private) in the hands of retail giants of main retail business.

Along with the shift from rural to urban consumption, India will witness the rapid growth of its middle class—households with disposable incomes from Rs.200,000 to Rs.1,000,000 a year. In addition to that, India has a population of more than 1.2 billion and a large fraction of this population is below the age of 40 (working population). There is improvement in perks and packages of workers which caused improvement in income in disposable form.

The rise in business process outsourcing causing rich and the other professionals’ demand for a new product and service as their income level is sky rocketing is one of the biggest drivers for many players to think about the Indian market.

Changes in Consumer Needs, Attitudes and Behaviours:

Increase in disposable income has enhanced demand for new product and services. The preference of the consumer for services has opened the market for organised retailing. Nowadays, the consumers are more consumption driven and desire comfort variety in offerings and good experience in shopping, as compared to the earlier generation. The level of change in attitude for new things forced many players to venture into the retail sector.

The following are the main features explaining behaviour of a consumer:

1. Higher degree of family orientation

2. No outlet loyalty

3. Priority given to fresh food items

4. Opting for convenience

5. Role of traditional products

6. Apparel purchase for special occasions

7. Brand flexibility

8. Growing individualism among Indian youth

Increased Credit Friendliness:

The boom in the financial sector has opened the credit facility as well personal credit option. The Indian consumers are gradually accepting plastic money, which boosts retail spend, as it enables impulse buying and big purchases. The easy availability of loans for any product and service also make the difference in credit worthiness of individual consumers. It has enhanced the ability in individual consumers to spend more which is driving consumption. This is one of the driving factors for the change in the retail sector in India.

Increasing Awareness of Indian Consumers:

The growth in literacy rate and exposure to television and IT has enhanced the awareness about price and quality of service. The customs, needs as well as occasions work as a measuring rod according to which the consumer of the Indian subcontinent value outlets and brand for lifestyle.

The levels of literacy and exposure to different media have increased the awareness of consumer towards the new product and services. They want to experiment with new brands over time. The substantial growth in print media and electronic media has led the foundation of awareness for the consumers about new brands and retailers. The customer of the Indian subcontinent has been logically shifting to organised retailing having separate legal entity background, that is, corporate existence, and this was possible due to the awareness that was created by electronic and print media. They are slowly believing and putting more reliance on organised retailing.

Retailing in India – Growth of Organized Retailing in India

Organized retailing in India initially began in the South. The availability of land at prime locations coupled with lower real estate prices (compared to Mumbai and Delhi) made multi-storied shopping complexes possible.

And now South India – notably Chennai and, to lesser extent Bangalore and Hyderabad – has emerged as a center of organized retailing. In fact, in Chennai, nearly 20% of food sales now is accounted is sold through specially chains such as Vivek’s.

It took two years of recession for this concept of shopping to take root in major cities like Mumbai and Delhi. Recession brought down property prices in these cities, and it was during this slump that big business houses took notice of the potential in retailing.

India is rapidly evolving in to an exciting and competitive marketplace with potential target consumers in both the niche and middle class segments. Manufacturer-owned and retail chain stores are springing up in urban areas to market consumers goods in a style similar to that of malls in more afflinet countries.

Even though big retail chains like Crossroads, Saga and Shoppers Stop are concentrating on the upper segment and selling products at higher prices, some like RPG’s Food world and Big Bazaar are tapping the huge middle class population.

During the past two years, there has been a tremendous amount of interest in the Indian retail trade from global majors as well. Over the years, international brands like McDonalds, Swarovski, Lacoste, Domino’s, Pepsi, and Benetton are among a host of others that have come in and thrived in India.

Retailing is one of the fastest growing industries in India, catering to the world’s second-largest consumers market. A Sunrise industry offers tremendous potential for growth and contributes 8-10 to overall employment. However, this is still low compared to 20% in USA.

As India moves towards being a service-oriented economy, a rise in this percentage at about 8.5% annually in the urban areas, and in towns with a population between 1,00,000 to 10,00,000, the growth rate is about 4.5% with the increasing assertiveness of the Indian as well as from other sector in India is poised for a significant change in the coming decade.

However, the boom in retailing has been confined primarily to the urban markets. There are two main reasons for this. Firstly, the modern retailer is yet to exhaust the opportunities in the urban market and has therefore probably not looked at other markets seriously.

Secondly, the modern retailing trend, despite its cost-effectiveness, has come to be identified with lifestyle. In order to appeal to all sections of the society, retail stores need to identify with lifestyle. In a sense, this trend is already visible with the emergence of stores with an essentially ‘value for money’ image.

The attractiveness of the other stores actually appeals to the existing affluent class as well as those who aspire to be a part of it. Hence, one can assume that the retailing revolution is emerging along the lines of the economics evolution of society.

A four-gear path for the organized retail trade suggested by KSA Technopak places India in the second gear and predicts that it will match global standards by 2010.

Gear one is the stage of infancy. The Super Bazaar, as a concept focusing on price control, started during the inflationary period of the 1960s. The development of the modern retail industry began when Indian shoppers upgraded from local shops to super bazaars.

The open layout and self-service concepts were new to the Indian consumers, who was used to being served while shopping. Gear I was driven by entrepreneurs like Vasanth & Co. and Vivek’s in the South, real estate-owners like the Rahejas (who started Shoppers’ Stop) and marketers who integrated forward from manufacturing to retailing (for instance, lifestyle brands like Zodiac, Park Avenue and Bombay Dyeing which opened exclusive stores).

This gave the new breed of retailers an opportunity to differentiate on the basis of good quality products, services and ambience. These retail formats raised the bar for consumers as far as retail formats raised the bar for consumers as far as retail interface was concerned. The first level also looks at retailers driving customer awareness.

The model primarily applies to apparel more than any other form of retailing. For instance, manufacturers in the food and grocery business hardly get into retailing. It is completely driven from the demand side and not on the supply side.

The second gear is about meeting customer expectations. It is consumers-driven, where buyers are exposed to new retail formats. This leads to first-driven, where buyers are exposed to new retail formats. This leads to first-generation retailers expanding to multiple locations (Shopper’s Stop, Food World and Subhiksha expand their networks as well as their locations).

Convenient timings, dial-n-order, free parking, provision for trial and taste. Prices below MRP (maximum retail price), free home delivery and ‘no-questions-asked’ return policies are some of the offer facilities like taking care of the kids while the mothers shop, vending machines and entertainment for those accompanying series shoppers and convenient floor levels for the physically handicapped and so on.

Gear II is a period of growth. India is currently in this stage. The apparel retail market in India is a little more evolved than the rest. While apparel retailing can be said to be in the second gear, other sectors like electronics, food etc. are still in the first gear.

Compound to the first two stages retailers exert more influence than manufactures and therefore have stronger bargaining power. Furthermore, the third gear involves efficient back-end management. Retailers exploit economies of scale and offer the best prices to their customers.

The focus is on customer acquisition and category management. Cost savings in terms of initiating vendor partnership and increasing stock turns take priority. Retailers expand into non-metros and look at various customers’ loyalty programmes. Many retailers in China and South Asia are in this place.

A distinctive mark of this phase is efficiency: Profitability through heavy investment in the back-end. Aldi, a grocery chain in Europe and the US, is a good example of retail efficiency and can be roughly placed in the third gear.

The fourth and last gear is a period of consolidation. The organized sector acquires a significant share of the retail price. It is the start of a cross-border movement, with mergers and acquisitions gaining an importance.

Retailers in North America and Europe like Wal-Mart, Tesco, M&S and Carrefour are in gear four, where they are looking for cross-border movement. Furthermore, companies start adding more stores and newer markets to their portfolio. There is a fair degree of domestic consolidation as well. Sourcing gets done globally.

Thus, retailing in India has a very long haul ahead. The process of getting into newer forms of purchasing has been gradual because of traditional buying habits and the manner in which traditional retailers manage relationships.

There is no specific international format or an existing role model that can be easily adapted and applied in the Indian context. India is going through that phase in retailing. In order to develop the right proposition one needs to go through the learning curve.

The growth and development or organized retailing in India will be driven mainly by two factors-low price and benefits—the consumers can’t resist. Economics of scale will drive down the cost of the supply chain and increase the benefits offered to the customer. From product-based shopping, the emphasis will shift to experience-based shopping.

Retailing in India – Development of Retail Sector in India

In the current period, retail is the primary emerging sector of the Indian subcontinent. According to the views of industry experts, there is a chance of becoming an independent industry with lot of prospects. In times of cut throat competition, retail in India is emerging as the largest industry. Modern retail would have 19.3% share of the total by the year 2016.

The trends that are driving the growth of the retail sector in India include the following:

1. Low share of organised retailing.

2. The improvement in income (disposable), an inspiration for consumers.

3. Reduction in the expenses in essential products.

Improvement in people of younger generation as a worker in India has also increased the prospects in various sectors of India including retail.

The opportunities in India in a sector like service sector, improvement in women employees’ population, the concept and practice of nuclear families in basically urban sector and very high pay and packages of employed people have all contributed to the emergence of retailing as a major industry in India. The development of organised retailing sector in the Indian subcontinent was due to the factors specified earlier; however, it put pressure on boasting of retail in every product and preference of life like leisure, travel, accessories, apparel, electronic, toiletries, and much more.

The markets which were traditional are making way in format which are new, and consequently the various sectors in India including retail sector is undergoing a transformation from traditional to specialty, hypermarket, outlets such as department outlet, supermarket, etc. There is much faster growth as well as development of malls like shopping malls, in very large to medium cities, and this resulted in the fast development of retailing in the Indian subcontinent.

The cities which come under the category of tier II are also lagging in the race of development of space of retail especially the malls. The Delhi government and the government of National Capital Region therefore are making good attempts of making land available for mall development in the region thereby rendering approximately 49.99% of the total malls in the Indian subcontinent.

Top research in retail has emphasised that India is the destination of retailer in top category all over the world as called goldmine for investors globally. The untouched industry of retail and vast population of middle-class people are the areas where the global retail giants aim at as a new market. In India, in the modern sense, retailing has not fully developed instead of having 60 lakh outlets of retail business.

There are huge opportunities for those who are engaged as specialists in the area of international retailing. The development of retailing in the Indian subcontinent is much greater than the development of GDP in the upcoming six years. This is due to changes in the lifestyle of Indians, hiked earnings and supporting outline of demography. The other factors are the government’s effort to allow 51% FDI in retail business in India in brand (single) retail outlets.

The Indian government has been preparing to introduce another reformation measure by initiating capital investment terms and norms. There would be an environment of friendly customer, which would favour the retailing industry for the development of concept in designing, quality control, and by modern support availability.

The destiny of retailing in India seems in good form, since the market of customers is much promising though the retailing business is not sufficiently developed. With the growth of market size, the policies of the government are changing in its favour; however, this would not be possible without the help of emerging technologies in the Indian subcontinent.