Pricing method is the method followed in determining the price of a product. Pricing method must be appropriate in achieving the pricing objectives.

There are many methods of pricing and each one of them is appropriate for achieving a particular pricing objective or combination of pricing objectives.

The three major categories of methods used to establish product prices are cost-oriented pricing, competition-oriented pricing, and demand-oriented pricing. A retailer may use one or a combination of the methods. The most common is cost-oriented pricing.

The following are the methods used for pricing of products:-

ADVERTISEMENTS:

A. Cost Based Pricing Method –

1. Full Cost or Cost plus Method 2. Variable Cost or Marginal Cost Pricing 3. Target Return Pricing 3. Mark-up Pricing 4. Absorption Cost Pricing 5. Rate of Return Pricing 6. Marginal Cost Pricing 7. Break Even Concept

B. Rate Return Pricing Method –

1. Going Rate Pricing 2. Sealed Bid Pricing 3. What the Traffic can Bear Pricing 4. Skimming Pricing 5. Penetration Pricing

ADVERTISEMENTS:

C. Demand / Market Based Method –

1. Demand Modified Break-Even Analysis 2. Perceived Value Pricing 3. Modified Breakeven Pricing 4. Consumer Market Pricing 5. Industrial Market Pricing

Some of the other pricing methods are:-

1. Competition Oriented Pricing 2. Product Line Pricing 3. Tender Pricing 4. Affordability-Based Pricing 5. Differentiated Pricing 6. Initial Markup Percentage 7. Variables in the Initial Markup Percentage.

Pricing Methods: Cost Based Pricing Method, Rate Return Pricing Method, Demand / Market Based Method and Target Return Pricing Method

Pricing Methods – Cost Based Pricing Method, Rate Return Pricing Method and Demand / Market Based Method

Pricing method is the method followed in determining the price of a product. Pricing method must be appropriate in achieving the pricing objectives. There are many methods of pricing and each one of them is appropriate for achieving a particular pricing objective or combination of pricing objectives.

ADVERTISEMENTS:

The methods used for pricing are as follows:

Method # 1. Cost Based Pricing Method:

The cost based pricing methods are based on cost incurred in the production of the goods. Total costs include fixed and variable costs. The pricing may be based on total costs or only on variable costs. A reasonable profit is added to base cost to arrive at the pricing.

Thus cost based pricing methods are divided into following two types:

ADVERTISEMENTS:

i. Full Cost or Cost plus Method:

Most frequently used method is the cost-plus method. Under this mark-up pricing is done. Mark-up pricing refers the pricing method in which selling price is fixed by adding a margin to the cost price. Mark-ups vary depending on the nature of the product and the markets. Usually if the value of the product is higher the markup pricing will be larger or vice-versa.

Mark-up pricing assumes that demand cannot be known accurately but costs are known. A reasonable mark-up is added to the costs. Then the price as well as mark-up is adjusted by trial and error. The main objective is to maximize profits in short run without giving up on sales due to excessive prices. This method is adopted usually by distributive trade and marketing firms who do not have any manufacturing of their own.

ii. Variable Cost or Marginal Cost Pricing:

ADVERTISEMENTS:

Another common method of pricing is to determine the price on the basis of variable cost or direct cost. Fixed cost is totally ignored and the firm is only concerned with marginal or incremental cost of producing the products. Variable costs depend on the volume of production. Thus variable cost sets the price after a certain level of output is achieved. This method essentially aims at maximizing the total contribution of the firm towards fixed costs and profit. It does not seek to absorb the total cost in each unit of sale. This method takes in to account cost aspects as well as demand aspects.

Method # 2. Rate Return Pricing Method:

Rate of return means gain or loss on an investment over a specified period, expressed as a percentage increase over the initial investment cost. This method uses standard costing techniques and identifies the variable and fixed costs of manufacturing, selling and administration involved in producing and selling the product.

All The costs of the three operations are added. And to this total cost the required margin is added towards profit and the total becomes the selling price of the product. For this type of pricing, the company needs to specify the rate of return on its capital invested. Similar to cost plus pricing, the difference is that the mark-up will be based on the target rate of return.

The target rate of return varies with market norm or what management considers a fair return. Useful method to use when a business has invested too much on the project or the products. However difficult to use where a company has too many product lines or competes in markets.

ADVERTISEMENTS:

For example, assume a firm invests $100 million in order to produce and market a cell phone brand and they estimate that they can sell 2 million units per year. Further they know that average total cost is $50 per unit of cell phone. So at 2 million units per year total annual cost is 100 million. Now the management wants 20% return on investment. That becomes @20 million. So profit margin is $10 per cell phone. So the price must be set at $60 per cell phone.

Method # 3. Demand / Market Based Method:

Both the above methods are based on cost consideration only. But the competitive prices should also be considered before fixing the price. Competitive prices mean the prices that are charged by the competition for the same product or for the substitute of the product in the target market. Once this price level is established, the base price should be determined.

Determination of Base Price:

Base price determination can be done by following three basic steps:

First, relevant demand schedules at various prices should be estimated over the planning period.

Secondly, relevant costs of production and market cost should ne estimated to achieve the target sales volume as per demand schedules prepared.

Lastly, the price that offers the highest profit contribution, i.e. sales revenue minus all fixed and variable cost.

The final determination of base price should be made after considering all other elements of marketing mix. Within these elements the nature and length of channel of distribution are the most important factors affecting the final cost of the product. Besides products adaptation costs should also be considered in fixing the base price. The most appropriate method to estimate the demand of the product shall be the judgmental analysis of company and trade executives.

Pricing Methods – Cost-Based Pricing Methods, Competition Based Pricing Methods and Demand Based Pricing Methods

Every company incorporates the vital factors such as costs, competition and demand factors in arriving at an ideal price for its offering in the market. Due to the existence of various influencing factors, many methods exist to determine the price of a product and service.

The important ones are described here:

1. Cost-Based Pricing Methods:

Costs define the minimum amount to be recovered from sales. Popularly, there are two commonly used cost oriented pricing methods.

They are:

(i) Cost-Plus Pricing Method:

This method suggests adding a percentage of cost (acting as profit) to the total cost to arrive at the selling price. It is also known as markup pricing. However, there is a difference. In cost plus pricing, profit is calculated as a percentage of cost. In markup pricing, profit is calculated as a percentage of sales value.

(ii) Target Return Pricing:

Here, a rate of return is set, for example, 15% of invested capital or 18% of sales revenue is set. This concept is based on break-even analysis. Prices are set at a desired percentage return over and above the breakeven point. Therefore, the costs of producing and selling goods are determined and a target percentage return is added to these costs at a standard level of output. In this concept, price may need repeated revisions to keep the rate of return constant, as and when demand level goes under changes.

(iii) Marginal or Incremental Cost Pricing:

This method aims at recovering only the marginal costs or the variable costs and not the total costs. Thus, fixed cost is ignored. However, this cannot happen for long as every cost incurred must be recovered. Ignoring fixed costs brings the price down. The market will witness price variations making some customers pay lower price while others may pay higher prices.

Merits of Cost Based Methods:

Important merits of cost based pricing methods can be discussed as follows:

1. Simplicity – Cost is an internal factor to a firm. Ascertaining total cost is imperative and price based on total cost is therefore simple enough to be understood and calculated. This approach is further simple, as it is not influenced by external factors.

2. Peaceful Competition – This approach establishes competitive stability as all firms adopt cost mark ups, which keep price wars at bay. This also ensures that no particular player adopts extremely low or high price.

3. Safe – Since total cost is the influencing or determining factor, this approach ensures that all costs are recovered. Thus, it will not let the management play with seasonal and cyclical shifts in the business.

4. Flexible – Cost based methods are flexible and reliable. This is because, whenever a new technology, prices are revised according to the changes occurring due to cost being the determining factor.

5. Justifiable – Compared to demand based or competition based methods, this method is fair as the rate of return remains the same regardless of changes in the demand level.

Demerits of Cost Based Methods:

This approach also poses certain disadvantages which are discussed as below:

1. Ignores demand and competition – This is the biggest drawback. Ignoring demand and competition makes a pricing method have very low practical value.

2. Challenges in cost allocation – To determine total cost, all kinds of costs need to be considered. Thus, variable, fixed and semi variable costs need to be identified for each product produced and grouped together to arrive at total cost. Allocation of fixed and semi variable costs is not free of hassles. This needs certain assumptions and therefore can make total cost arbitrary in nature. Pricing arrived at will therefore can be imperfect. This is particularly true when the company has a multi-product portfolio.

3. Irrelevance – Apart from product costs, certain other types of costs such as opportunity cost and incremental cost play an important role in business decisions. They need greater importance than full costs. During inflation, future costs make more sense than historical costs.

4. New products – Pricing new products poses a problem as the firm lacks past experience. Doing it for the first time is always a challenge and too many influencing factors are at play. Since sales volumes cannot be precisely estimated and market is not tested on the new product, pricing is a challenge in such situations.

5. Not logical – Sometimes, total costs increase due to operational inefficiency such as stoppage of work, lack of adequate raw materials etc. Even such cost is recovered in the price and therefore it is not logical.

2. Competition Based Pricing Methods:

Competition-based pricing policies focus on competition without neglecting cost and demand factors. Many companies pricing policy is influenced by competitors’ policies as they want to fit into the existing pricing bracket for the product in the consumer’s mind.

Competition-based pricing pushes the costs and revenues as secondary considerations and the main focus is on what are the competitors’ prices. This pricing acquires more importance when different competing brands are almost homogeneous and price is the major variable in marketing strategy, such as cement or steel.

Depending on the level of product differentiation a company can keep the price higher, lower, or the same as that of the nearest competitor. This approach may make it necessary to adjust prices frequently. However, this approach can help keep prices stable in the industry.

There are two commonly used competition based pricing methods:

i. Going Rate Pricing:

Here, the firm will take the competitor’s price as a benchmark and keep it at par or slightly below it or even slightly above it. This method works well in an oligopoly market such as steel, fertilizers, paper, aluminum, copper etc.

To adopt this method good many factors such as pricing objectives of the firm, customers’ perception, costs of production and industry spare capacity to accept new players influence need to be considered. In industries where costs are difficult to measure and competition response is uncertain, going rate pricing is the popular choice of pricing method.

ii. Sealed Bid Pricing:

This method is popular to win contracts form the government when there is more than one company trying to win the project. Among various considerations, keeping the price as low as possible is the most important one. This means, if a firm wants to win the contract, it has to keep it low. ‘Low’ here means keeping it less than that of competitors.

However, it must ensure such a low price also recovers cost. At the same time, it cannot keep it high as it reduces the chance of winning the contract. So, there should be balance between recovering cost and having a safe margin of profit and yet keeping the price low enough to gain the project.

Managers adopt competition based pricing when:

a) The existing competitors have a strong hold on the market and are able to select appropriate prices.

b) The product offered is not subject to wide price changes at the retail level and any change in the retail price can impact sales strongly.

c) Important factors such as cost, profit and sales volume are taken care of to adopt the standard price prevailing in the market.

Merits of Competition Based Methods of Pricing:

a) It can prove to be virtuous as it is based on experience of other firms.

b) New customers are willing to try the product as the price is competitive.

Demerits of Competition Based Methods of Pricing:

a) If the price set by other firms is wrong, the firm also suffers. If the competitors price is very low, then the firm is also compelled to keep it low.

b) This method lacks creativity and innovation from the firm side as it is depriving itself of what it can achieve with internal factors, by paying attention only to one factor -competition.

c) This method is not suitable for niche and unique products as competition does not play an important role in those products

d) All internal factors take a back seat and the biggest of those will be the cost factor. In other words, recovering cost is not given primary focus.

e) If a firm is not financially strong, it is not advisable to adopt this method.

3. Demand Based Pricing Methods:

Demand for a product or a service plays an important role in setting its price. Apart from competition and cost, demand will be one more factor to form a basis in determining the price of the product. Since demand determines the life curve of a product in the market, its importance cannot be understated.

Demand-based pricing is any pricing method that uses consumer demand-based on perceived value as the central element. These include- price skimming, price discrimination and yield management, price points, psychological pricing, bundle pricing, penetration pricing, price lining, value-based pricing, geo and premium pricing. Factors of pricing are many and they include manufacturing cost, market place, competition, market condition and quality of product.

The important demand based pricing methods are:

i. Demand Modified Break-Even Analysis:

This method intends to achieve highest profit, beyond the break-even point, in consideration of the amount demanded at alternate prices. To employ this method, market demand has to be estimated at each price break-even point. Based on these estimates, expected profit levels of the total sales revenue can be calculated.

ii. Perceived Value Pricing:

Here, price is arrived in accordance to the perception of the customer and not the costs of the company. This means non-price variables affect the price determination process. First, it is imperative to understand the factors that influence consumer perception. Then, understanding what is the value perceived by the consumer based on such factors. Now, this perceived value itself becomes the price of the product for the firm.

Pricing Methods – 7 Major Methods: Cost Based Pricing, Demand/Market Based Pricing, Competition Oriented Pricing, Product Line Pricing and a Few Others

Pricing strategy, mean the route taken in fixing the price. Evidently, the method/strategy must be appropriate for achieving the desired pricing objectives. There are several methods of pricing. Each of them is appropriate for achieving a particular pricing objective or a combination of pricing objectives.

Method # 1. Cost Based Pricing:

Under this category, there are several approaches/methods like:

Mark-up pricing refers to the pricing method in which the selling price of the product is fixed by adding a margin to the cost price. The mark-ups vary depending on the nature of the products and markets. Usually, the higher the value of the product (unit cost of the product) the larger the mark-up and vice versa. Again, the faster the turn round of the product, the lesser is the mark-up and vice versa.

Mark-up pricing proceeds on the assumption that demand cannot be known accurately, but costs are known. A reasonable mark-up is added to the costs. And the price, as well as the mark-up, is adjusted by trial and error. The objective is to maximise profits in the short run without sacrificing sales due to excessive prices. This pricing method is adopted usually by distributive trade and marketing firms who do not have any manufacturing of their own.

Absorption cost pricing primarily rests on the estimated unit cost of the product at the normal level of production and sales. The method uses standard costing techniques and identifies the variable and fixed costs of manufacturing, selling and administration, involved in producing and selling the product. All the costs of the three operations are added. And to this total cost, the required margin is added towards profit and the total becomes the selling price of the product.

This method is also known as Full Cost pricing since the method envisages the realisation of the full costs from each unit sold. The method has a couple of merits and a number of limitations.

iii. Rate of Return Pricing:

The rate of return pricing is in a way similar to the absorption cost pricing, but is different from it in some respects. In the absorption cost pricing, after the costs of manufacturing, selling and administration are absorbed on a per unit basis, the firm adds its mark-up towards profits. This addition is often done on an arbitrary basis.

The rate of return pricing on the other hand, uses a scientific approach to arrive at the mark-up. It is arrived at in such a way that the return on investment criteria of the firm is met in the process.

iv. Marginal Cost Pricing:

The marginal cost pricing essentially aims at maximising the total contribution to the firm towards fixed costs and profits. It does not seek to absorb the total costs in each unit of sale. The marginal costs will include all the direct variable costs of the product. But marginal cost pricing does not mean that the realisation is limited to marginal costs, i.e., the direct variable costs.

A portion of the fixed costs also gets realised through marginal cost pricing. The main difference between absorption cost pricing and marginal cost pricing is that the latter gives the flexibility to leave out a portion of the fixed costs unrecovered depending on the market situation. It also gives the flexibility to recover a larger share of the fixed cost from certain customers or a certain segment of the business and a smaller share from the others.

v. Break-Even Concept:

As an idea of the break-even concept is essential for understanding correctly most of the cost-based methods of pricing, we shall touch upon this concept before proceeding with the discussion on the other methods of pricing.

In any business, costs, volume, price and profits are interrelated. For most products, different demand levels and sales volume may materialise at different price levels. And the different volume levels have different associated cost levels. A particular volume level and its associated cost level, generates a particular profit level, the price remaining the same.

When we consider different price levels, we have different profit levels, resulting through their associated levels of volume and costs. The firm can project profits at different price levels and choose the one that is particularly suited to it.

In producing and selling a certain volume of any product, certain fixed costs and certain variable costs are incurred. When the volume is increased or decreased, the variable costs go up or down. The fixed costs usually remain the same. The firm is essentially concerned with the total of variable and fixed costs incurred for the particular volume.

At that volume, and at the assumed level of price, a particular level of total revenue is generated. The break-even exercise is aimed at relating these two entities—the total costs and the total revenues at different levels of volume and consequently at different levels of prices.

At a level where the total costs exactly equal the total revenues, the breaking even of costs and revenues takes place. The result is zero profit. At a level where the revenues exceed the costs, profits are earned and at the other level losses are incurred.

The number of units that are required to be produced and sold in order to reach a no loss no profit position at the given level of unit price is indicated by the break-even point. Usually, when more units than the break-even level are produced and sold at the given price, the profits go up. And each additional unit made and sold brings in a loss.

Many business firms use the break-even concept in their pricing methods. They use the concept not only for price fixation but also for determining levels of production or levels of utilisation of the production capacity that is required for achieving the desires levels of profits. The concept is also used in the appraisal of new projects.

It is a tool for making volume-cost-profit analysis. The various methods listed under cost-based pricing utilise the break-even idea in one way or the other.

Method # 2. Demand/Market Based Pricing:

The following methods belong to the category of demand/market based pricing:

i. What the Traffic can Bear Pricing:

Pricing based on ‘what the traffic can bear’, is not a sophisticated method. It is used by retail traders as well as by some manufacturing firms. This method brings high profits in the short term. But ‘what the traffic can bear’ is not a safe concept. Chances of errors in judgement are very high. Also, it involves trial and error.

It can be used where monopoly/oligopoly conditions exist and demand is relatively inelastic to price. Buyer opposition or consumerism is bound to set in course of time when a firm sets its prices on the basis of what the traffic can bear.

Skimming pricing aim at high price and high profits in the early stage of marketing the product. As the word skimming indicates, this method literally skims at the market in the first instance through high price and subsequently settles down for a lower price. In other words, the method profitably taps the opportunity for selling at high prices to those segments of the market which do not bother much about the price.

The method is very useful in the pricing of new products, especially, the ones that have a luxury or speciality element. For example, when the new product is a luxury item, enjoying the patronage of an affluent and non-price sensitive segment of the market, the firm can go in for the skimming strategy.

The skimming strategy admirably suits such a product. It also brings in the best benefits to the firm. As the product has novelty and as it is aimed at the affluent sections, the quantity that can be sold is not affected by the price level. Skimming will also help the firm to feel the market/demand for the product and then make appropriate decisions on pricing.

Penetration pricing, as the name indicates, seeks to achieve greater market penetration through relatively low prices. This method too is quite useful in pricing of new products under certain circumstances.

For example, when the new product is not a luxury item and there is no affluent/non-price sensitive segment backing it, but is capable of bringing in large volume of sales, the firm can choose the penetration pricing and make large size sales at a reasonable price before competitors enter the market with a similar product.

The strategy suits this type of product and also brings many advantages to the firm. For, in such cases, the quantity that can be sold is highly sensitive to the price level even in the introductory stage. There is no segment willing to pay any price for the product. And soon after introduction, the product may encounter stiff price competition from other brands/ substitutes.

Penetration pricing in such cases will help the firm to have a good coverage of the market and to keep competition out for quite some time. Moreover, for products of this category, large sales may be necessary for break-even, even in the initial stages and penetration pricing alone can bring in the high volume of sales required for breaking even and making profits.

Method # 3. Competition Oriented Pricing:

In several industries, competition-oriented pricing methods are followed. The methods under this category rest on the principle of competitive parity in the matter of pricing. Competition-based pricing, or competitive parity pricing, does not, however, mean exactly matching competition.

Three policy alternatives are available to the firm under this pricing method:

(i) Premium pricing;

(ii) Discount pricing; and

(iii) Parity pricing/going rate pricing.

Where supply is more than adequate to meet demand and the market remains competitive in a stable manner, and where the channel and consumers are well aware of their choices, parity pricing may be the answer. Similarly, when a market leader has established a market price with the intention of stabilising the price, the smaller firms in the industry may have to go in for parity pricing.

Method # 4. Product Line Pricing:

As the products in a given product line are related to each other, sales of one influence the sales of other. They also have interrelated costs of manufacturing and distribution. In such a situation, the aim of the firm is not to fix optimal price for each product independently of the other products, but to fix the prices of each product in such a manner that the entire product line is priced optimally resulting in optimal sales of all the products in the line put together and optimum total profits from the line.

A set of mutually related prices to the various products in the line will be the outcome of such a policy. Total costs of the entire product line and the total desired profits from the entire line go into such pricing. A further refinement is that tentative prices for the various products in the line are worked out and adjusted later, based on competitor’s prices for these products, and the demand reactions at different prices.

Two important aspects however should be kept in mind while resorting to product line pricing. Firstly, the joint cost problems and the joint revenue problems could be quite complex and formidable. Secondly, a price change cannot be initiated in respect of a product, which is a member of a product line, without considering the line effect.

It cannot be treated as an independent product for pricing. The method is also sometimes referred to as the product line promotion method of pricing.

Method # 5. Tender Pricing:

Tender pricing is of a special type, though it is also a competition- oriented method of pricing. It is more applicable to industrial products and the products/services purchased and contracted by institutional customers. Such customers usually go by competitive bidding through sealed tenders or by quotations.

They seek the best (the lowest possible) price consistent with the minimum quality specifications. Obviously, the marketer cannot get his best price from such customers. His objective in tender pricing can only be to get the ‘best possible price under the circumstances’ and to bag the order.

The problem faced by any firm in tender pricing is basically one of finding a price that is consistent with costs, profits and company objectives and will also be low enough to get the business. A related problem is one of avoiding regrets of having missed a better price and profits due to over- anxiety in securing the order and/or wrong estimation of competitors’ bids.

The marketer has to set his price lower than what he expects his competitors will set for their products. Or, he must try to sell his product in some distinctiveness which the competitors may not have. In some situations, he can make the buyer prescribe specifications/minimum standards for the products in a manner that would especially suit his own product.

He can thus score an advantage and keep himself out of price competition. Even in cases where price becomes the main factor, the seller cannot set his price below a certain level—the barest minimum price. So, he must work out his barest minimum price. It will depend on several factors including costs and how badly he needs the particular order.

The chance of winning the order and the value of the order can often be inversely proportional in tender pricing. The price has to be lower than, but as close as possible to, what the competitors have quoted. The seller has to thoroughly analyse the tender pricing policy of his competitors as well as the response behaviour of the particular customer. He should also work out alternate offers based on possible alternate actions of competitors and alternate decisions by buyers.

Method # 6. Affordability-Based Pricing:

This method is also referred to, sometimes, as social welfare-based pricing. The affordability-based pricing method is relevant in respect of essential commodities which meet the basic needs of all sections of people. The idea behind this method of pricing is to set prices in such a way that all sections of the population, especially the poorest sections, are in a position to buy and consume the products to the required extent.

The price in such cases is set independent of the costs involved. Often an element of state subsidy is involved in the distribution of such commodities. Also, most of such commodities are distributed by the public distribution system. Sometimes, the public utility services as well as economic infrastructure items are priced by the affordability method.

Method # 7. Differentiated Pricing:

Differentiated pricing on the basis of volume of purchase is more common than pricing differentiated on the basis of customer class or marketing territory. Some firms practise a method of pricing where different prices are charged for the same product or service in different zones/areas of the market.

Sometimes, the differentiation in pricing is made on the basis of customer class rather than territorial differentiation. Sometimes, the differentiation is on the basis of volume of purchase.

Pricing Methods – 5 Methods Used by Retailers

The three major categories of methods used to establish product prices are cost-oriented pricing, competition-oriented pricing, and demand-oriented pricing. A retailer may use one or a combination of the methods. The most common is cost-oriented pricing.

1. Cost-Oriented Pricing:

To generate a profit, product costs must be covered. Cost-oriented pricing (also called cost-plus pricing) has two approaches – mark-up pricing (the more common) and breakeven pricing. The retailer needs to determine its mark-up percentage; one way to do this is to look at traditional product mark-ups within the industry and at the manufacturer’s suggested retail price.

The retailer must also consider the product’s average turnover, the amount of competition for the product, the levels of service required, and the amount of sales time and effort involved in selling the product. All these factors, along with the inclusion of the expected or targeted profit margin, determine the mark-up.

i. Markup Pricing:

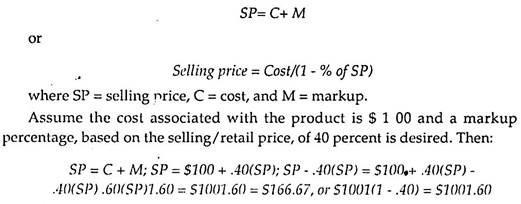

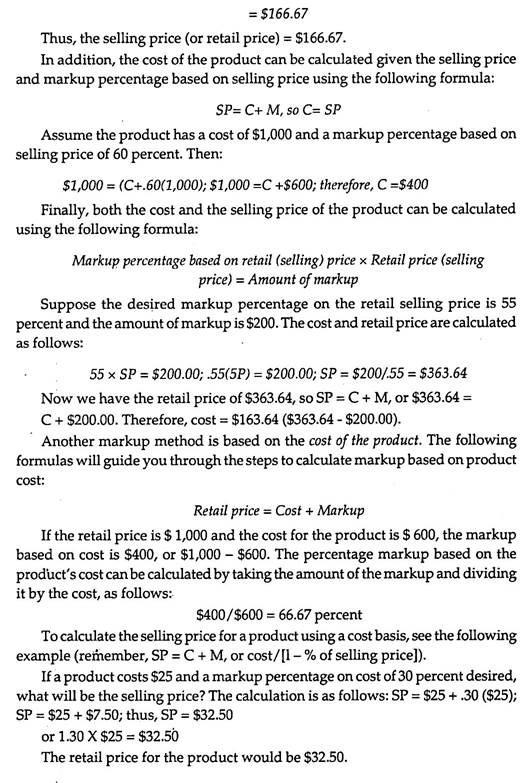

In markup pricing, two options exist for determining the markup percentage: markup based on the retail, or selling, price of the product, and markup based on the product’s cost. The chosen method is generally selected based on the accounting systems the retailer employs. The vast majority of retailers use markup based on selling price, because expenses and profits for the product’s sales are calculated as a percentage of sales.

In addition, this method keeps the markup percentage from exceeding 100 percent. Manufacturers and other suppliers most often quote discounts and price reductions from the retail selling prices they provide to the retailer. Finally, retail sales information is easier to acquire than cost information is; thus, it is easier to compare sales to those of competitors (and other stores) than it is to compare costs.

The general formula for developing a markup based on the retail price of the product is as follows:

Amount of markup = Selling price (retail price) – Cost If a product’s selling price is $ 100 and the cost is $40, the markup is calculated as $100 – $40 = $60. To calculate the markup percentage, use this formula –

Markup percentage = Amount of markup/Selling price Using the example above, the percentage markup at retail would be $60/ $100, or 60 percent.

To calculate the selling price rather than the cost, use the following formula:

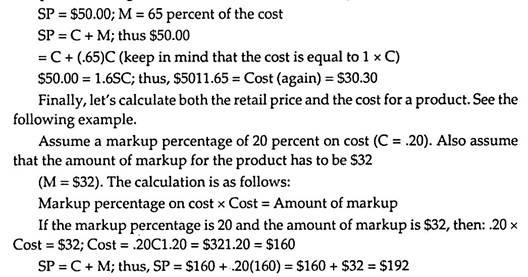

The product’s cost can also be calculated. Consider the following example. A product’s selling price is $50 and the markup percentage, based on cost, is 65 percent, if SP = C + M, then SPI (I + markup) will give the cost.

Let’s calculate this problem using both methods:

Keep in mind that the cost of goods equals the cost, per unit, of the merchandise (invoice price) plus the inbound freight costs associated with getting the merchandise. In addition, any discounts received from the trade as part of a purchase (including quantity discounts) are also taken out.

ii. Break-Even Pricing:

Breakeven pricing is the other method used in the creation of a cost-oriented pricing system. With breakeven pricing, the retailer determines the breakeven point (BEP), or the level of sales needed to cover all the costs associated with selling the product.

The breakeven point is calculated using the following formula:

BEP (in quantity) = Fixed cost/Unit price – Unit variable cost

This formula can be modified to calculate the BEP in dollars by multiplying the BEP (in quantity) by the selling price of the item.

2. Competition-Oriented Pricing:

In competition-oriented pricing, the retailer identifies the industry leader and then replicates the leader’s prices. In using this method, the retailer assumes that the industry leader is best equipped to select appropriate price levels for its products.

Retailers often ‘shop’ the corn petition to ascertain competitors’ price structures. A representative from the retailer’s organisation visits a competitor’s store to see what prices are set for the product mix. Shopping the competition is not always welcomed by retailing competitors, especially when done in person.

It is understood that environmental scanning should be an ongoing, not sporadic process, however, so many retailers see these actions as necessary. Particularly in service retailing, the same information often can be obtained from phone calls to competitors.

For example, a large hotel chain in southern Colorado regularly has disguised ‘shoppers’ call competing hotels and ask for list of prices for the various rooms. Different rates, such as state rates, government rates, AAA rates, and frequent-traveller rates, are checked. The chain then adjusts its prices based on the competitor’s rates.

If competitors raise or lower their prices, the retailer follows suit with price increases or decreases. Competition-oriented pricing assumes that costs, demand, competition, and other factors external to the retail firm remain fairly constant. Therefore, it is safe to follow the leader or follow the general trends within the industry.

3. Demand-Oriented Pricing:

Under the demand-oriented pricing method, prices are set based on consumer demand. In this approach, retailers often raise prices based on unusual environmental changes. These changes might include unusually-high customer demand (e.g., for fad products), events such as natural disasters, of conflicts in other countries that affect supplies of various products such as gas or oil.

In some instances, retailers raise their prices to exorbitantly high levels, a tactic called price gouging. Although this tactic may appear to be a sound business practice, it is an ethical gray area. Customers may pay the demanded price initially, but they may harbour negative feelings toward the retailer, thus decreasing long-term business and goodwill.

The three major types of demand-oriented pricing are:

i. Modified breakeven,

ii. Consumer market and

iii. Industrial market pricing.

i. Modified Breakeven Pricing:

Modified breakeven pricing assumes the retailer estimates the market demand for the product and then applies it to the breakeven point. In so doing, the retailer can estimate, or forecast, sales at different price points or levels.

ii. Consumer Market Pricing:

When using a consumer market approach to pricing, the retailer generates data about prices based on controlled store experimentation. Many techniques can be applied here, but the general idea is that consumers enter the store and are allowed to make product purchases. The prices on the various products are changed, and the retail researcher tracks the price points that are most popular with the consumers. The retailer then implements these price points throughout its locations.

iii. Industrial Markets Pricing:

A technique much like the consumer market approach is the industrial market approach. With this approach, the retailer sells its products to other businesses in addition to the final consumer. The retailer performs a wholesaling function aimed toward other businesses.

If the retailer is reselling products to intermediaries or industries (such as Home Depot, Office Depot, or Office Max may do), the retailer identifies the benefits of its products compared to competitors’ products and sets prices accordingly.

The assumption is that industrial buyers do not buy as much on emotion as ultimate consumers do. Rather, industrial buyers, or intermediary buyers, purchase more on a need basis. Consequently, by identifying the benefits these buyers are seeking, the retailer is better able to set price. This technique is also used when responding to government bids; in this situation, the government agency purchasing products is treated like another business.

Once product and service prices have been set, retailers need to prepare for the possibility that they will not sell all the products at the established prices.

Retailers must develop initial markups, maintained markups, and gross profit margin projections for the store inventory. In addition, retailers must consider creating markdowns for products, to move slower-selling items off the shelves. We will look at how an initial markup percentage is developed.

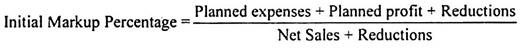

4. Initial Markup Percentage:

The initial markup percentage is a starting point for setting individual product prices. After calculating an initial markup percentage, the retailer can calculate the impact of markups, markdowns, and discounts. Initial markup percentages are usually calculated based on the retail selling price. Initial markups are calculated by taking the estimated retail expenses, adding them to the planned retail profit, and adding that figure to the planned reductions.

This figure is then divided by the planned net sales plus the retail reductions:

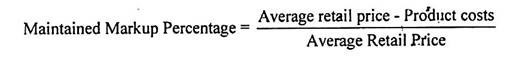

The markup is based on the original retail values placed on the merchandise after subtracting out the costs associated with the merchandise. By looking at the actual prices the retailer paid for the merchandise and again subtracting out the costs associated with that merchandise, the retailer can calculate its maintained mark-up percentage –

Another method is to take the average retail prices of products and then subtract out the costs associated with the merchandise and divide by the average retail price:

Finally, the retailer may want to know what its gross margin will look like. The gross margin is the total cost of goods sold (COGS) for the retailer subtracted from the retailer’s net sales:

Gross Margin in Dollars= Net Sales – COGS

Gross margin allows the retailer to adjust for cash discounts and other expenses associated with sales of goods and, services. The retailer may still have to adjust the prices on some merchandise. The process of changing prices is called price adjustment.

5. Variables in the Initial Markup Percentage:

Variables in the initial markup percentage can affect the initial price. One variable is the influence members of the retailer’s channel of distribution can have on the organisation. In distributor relationships, members of the channel of distribution have expectations of the other channel members. One expectation may be that the retailer adheres to the manufacturer’s suggested retail price.

The amount of influence a given channel member has is based on the type of supply chain used and the dominance of the channel member. For example, because Wal-Mart purchases in very large quantities, its suppliers give the discounter a smaller markup than they would give other retailers that purchase less. Wal-Mart then passes on those savings to its customers, thus creating a competitive advantage.

Related to the influence of channel members are the variables of quantity discounts and shipping arrangements. These variables are negotiated with suppliers and consequently have an impact on the price the retailer sets. In their infancy, e-tailers got into trouble by failing to factor in the shipping and handling costs associated with retailing products to end users. This was one of the significant factors that contributed to the failure of a number of dot-com companies.

Pricing for cyberspace sales can be a difficult task. Although e-tailers have an advantage over brick-and-mortar businesses in that they have lower physical location expenses and a less labour-intensive environment, in other ways they are at a disadvantage – customers can access the prices of competitors with the click of a button’s. Thus, e-tailers should avoid using price as a main tactic in attracting customers. They should also stay away from price wars with well- established retail outlets that have deeper pockets than they do.